New York Fed sees stability in auto-finance sector but turbulence involving student loans

Charts courtesy of the Federal Reserve Bank of New York.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While student-loan metrics are deteriorating because of changes in federal policies, auto-loan trends are staying stable.

That’s two of the primary findings from the Quarterly Report on Household Debt and Credit released on Tuesday by the Federal Reserve Bank of New York’s Center for Microeconomic Data.

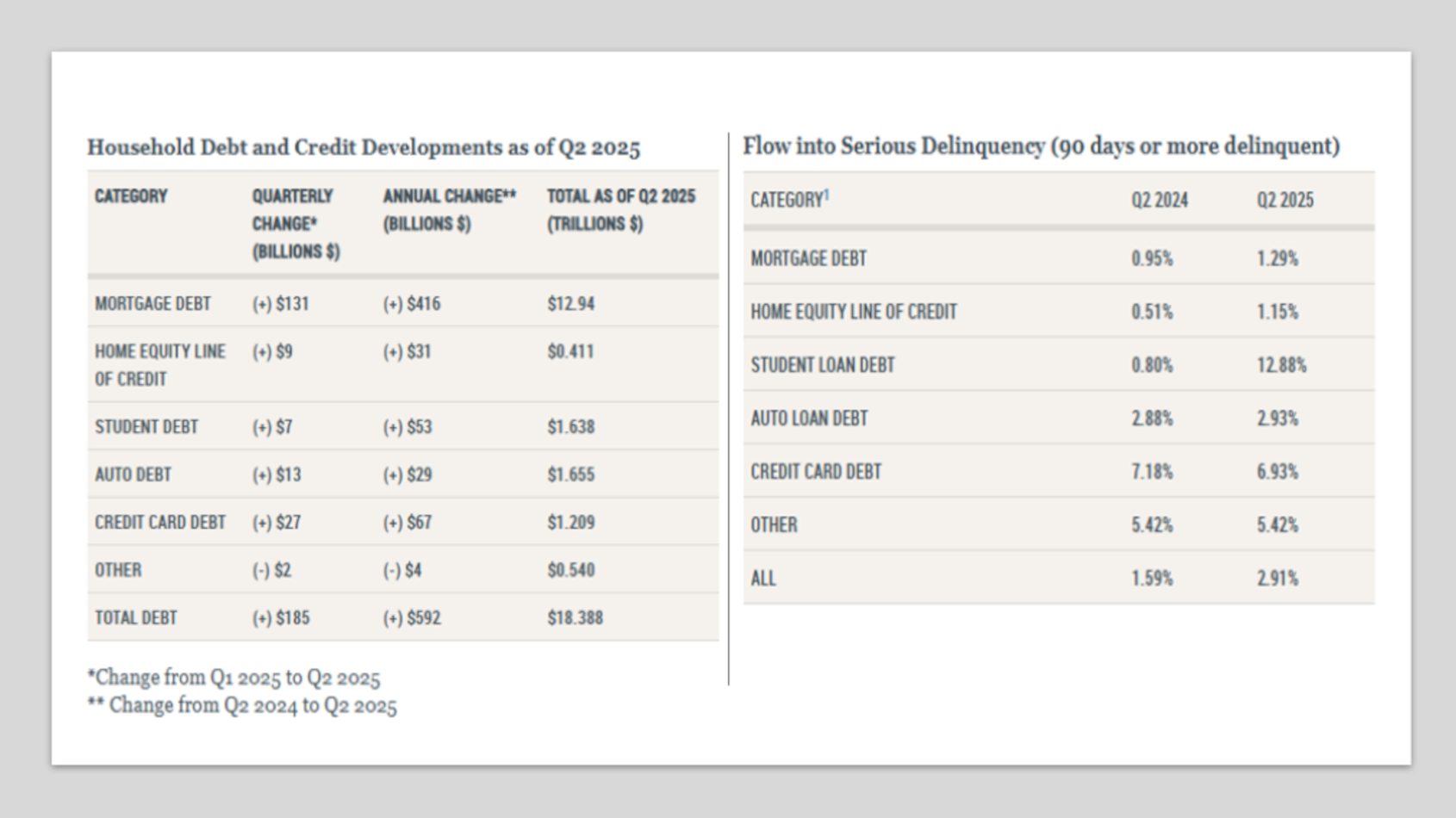

The report showed total household debt increased by $185 billion (1%) during the second quarter to $18.39 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

“This quarter’s flow of household debt into serious delinquency was mixed across debt types, with credit card and auto loans holding steady, student loans continuing to rise, and mortgages edging up slightly,” said Joelle Scally, economic policy advisor at the New York Fed. “Despite the recent uptick in mortgage delinquency, overall mortgage performance remains strong by historical standards.”

Analysts indicated outstanding student loan debt stood at $1.64 trillion in Q2.

The New York Fed recapped that missed federal student loan payments that were not previously reported to credit bureaus between Q2 2020 and Q4 2024 are now appearing in credit reports. Consequently, student loan delinquency rates continued to rise, according to the New York Fed.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In fact, analysts said 10.2% of aggregate student debt was reported 90 days or delinquent during the second quarter.

Meanwhile, the transition into early delinquency held steady for auto financing during Q2, as the New York Fed watched it edge up year-over-year from 2.88% to 2.93%.

Analysts added that auto loan balances also increased by $13 billion and totaled $1.66 trillion at the close of Q2.