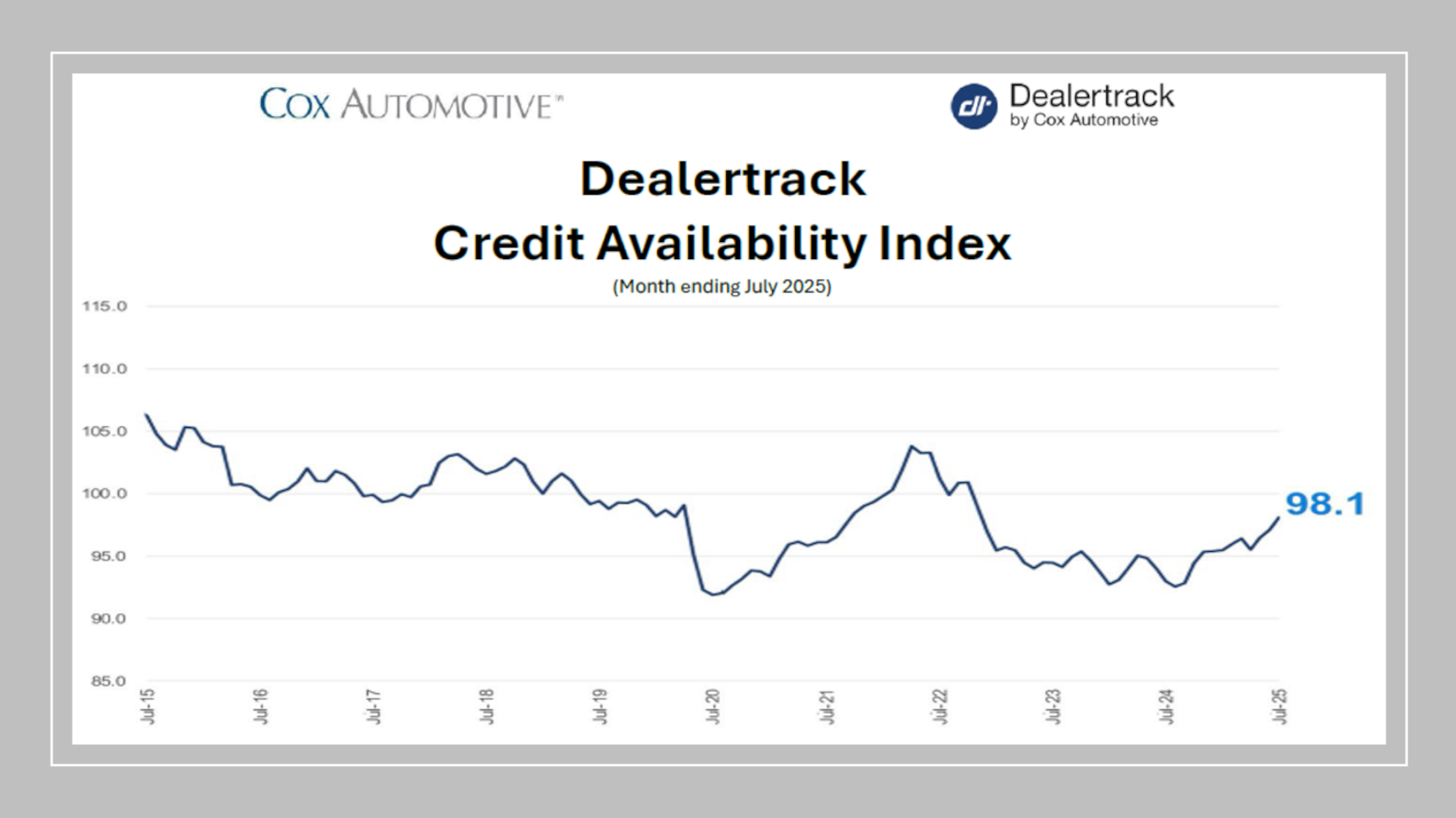

Only momentary tariff bump interrupts ongoing expansion of auto credit access

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It appears only talk about tariffs disrupted the upward trajectory of expanded auto credit access since last summer.

Cox Automotive reported the Dealertrack Credit Availability Index improved again in July, marking the third consecutive month of enhanced credit access. The index rose 1 point to 98.1.

Jonathan Gregory, a senior manager on Cox Automotive’s economic and industry insights team, explained the move extends the broader run of loosening credit conditions that began late last summer. Gregory said the only notable interruption surfaced in April that “likely driven by market uncertainty following tariff announcements, which temporarily tightened access.”

Gregory continued in his analysis that, “Overall, the July Dealertrack Credit Availability Index reflected a continued loosening in auto credit conditions, supported by broader lender participation and easing rate pressures. Credit access improved across all sales channels and most lender types, with finance companies and captives leading the expansion.

“Consumers benefited from slightly lower borrowing costs and increased approval rates, while lenders balanced growth with cautious adjustments to risk exposure. finance companies and captives leading the expansion,” he went on to say. “Consumers benefited from slightly lower borrowing costs and increased approval rates, while lenders balanced growth with cautious adjustments to risk exposure.”

When it comes to risk exposure, Gregory pointed out a robust rise in approval rates in July. Cox Automotive data showed the approval rate for auto loans climbed 210 basis points from the previous month to 74.4%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“This strong gain reflects lenders’ confidence in borrower profiles and heightened competition for volume,” Gregory said.

Perhaps mitigating some of that risk was the drop in the subprime share. Cox Automotive reported the share of loans issued to subprime borrowers decreased by 50 basis points to 13.6% from 14.1% in June.

Gregory said that’s, “indicating a move toward lower-risk lending practices despite a general easing of credit standards.”

Next, Gregory got deeper into the numbers when explaining the July yield spread, which narrowed by 35 basis points.

Gregory said the spread movement was driven by a 36-basis-point drop in the average contract rate, which fell from 11.23% to 10.87%. He added the five-year Treasury yield also declined slightly, from 3.96% to 3.95%.

“This suggests lenders are offering more competitive rates as rate pressure eases,” Gregory said.

Another interesting development in the July data was associated with contract terms.

Cox Automotive indicated that the share of loans with terms longer than 72 months decreased by 60 basis points, “potentially reflecting a shift toward shorter-term financing or tighter affordability constraints,” according to Gregory.

Negative equity has been in the news often recently, with Edmunds sharing its second-quarter data about it, and IAA noticing it in the salvage auction world, too.

Cox Automotive said the proportion of borrowers with negative equity fell by 70 basis points in July, but it remained at the second highest level recorded in the index.

“Those who previously relied on rolling negative equity into new loans may face tighter constraints,” Gregory said.

Cox Automotive said the average down payment percentage declined by 20 basis points in July, sliding to the lowest since November 2022.

“A decline in average down payment percentage reduces upfront costs, expanding access to credit for budget-conscious consumers,” Gregory said.

Looking again at the overall scene, Gregory highlighted lender performance was mixed in July.

“Auto-focused finance companies showed the most significant loosening, followed by captives and banks. In contrast, credit unions tightened slightly, possibly reflecting more conservative underwriting or portfolio adjustments,” he said.

With autumn signals approaching — like elementary and high schools to begin traditional academic calendars as well as colleges and universities nearing the fall semester — what might happen next in auto financing?

“The continued improvement in credit access, especially in used and non-captive new vehicle segments, offers more financing opportunities,” Gregory said about the potential for consumers. The drop in down payments and contract rates may enhance affordability. However, consumers should remain mindful of shorter loan terms and stable negative equity levels when evaluating loan offers.

“The mixed performance across lender types reflects varying risk appetites and strategic priorities,” he continued. “Finance companies, captives, and banks appear to be expanding access, while credit unions are slightly more conservative. As credit conditions evolve, lenders must balance growth with prudent risk management, especially amid shifting rate environments and consumer behavior.”