Open Lending unveils ApexOne Auto so lenders can review deeper pool of potential customers

Screenshot courtesy of Open Lending.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

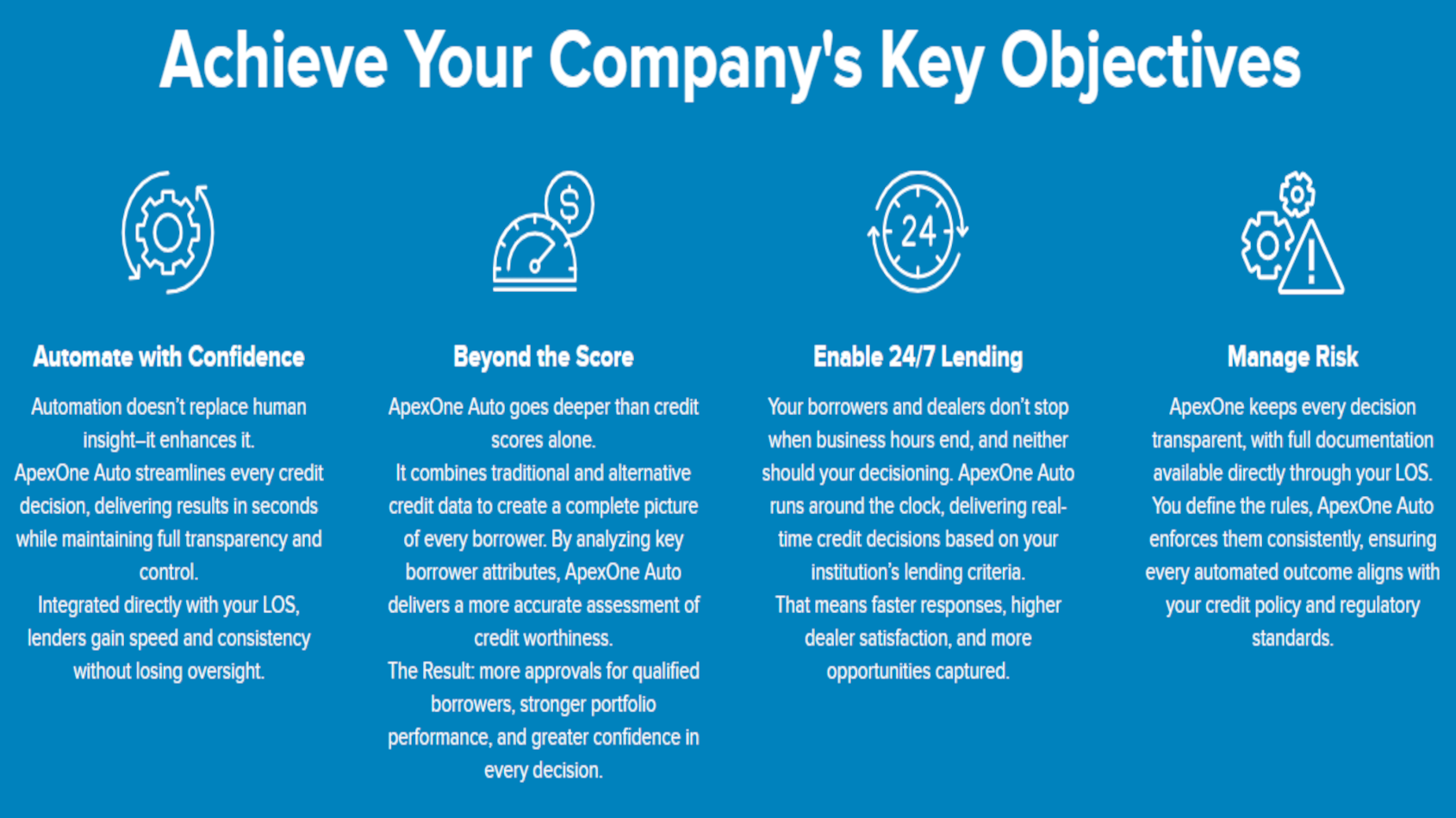

Last week, Open Lending Corp. announced the launch of ApexOne Auto, an advanced decisioning platform that expands the company’s capabilities to serve the full spectrum of auto-finance customers.

The provider of automotive lending enablement and risk analytics solutions for financial institutions highlighted ApexOne Auto combines automation, data, and explainable intelligence to help lenders make faster, more consistent, and transparent credit decisions while maintaining effective risk management practices.

Built on Open Lending’s expertise in scoring, pricing, and risk modeling, the company said the platform can deliver real-time decisioning and enhanced portfolio confidence around the clock.

“As the auto lending market continues to evolve, lenders need more than just partial solutions; they need a platform that can handle every borrower’s profile with consistency, speed, and confidence,” Open Lending CEO Jessica Buss said in a news release. “With ApexOne Auto we are breaking through credit spectrum silos and giving our partners a true one-stop decisioning engine that drives growth while mitigating risk.”

Open Lending mentioned early adopters of ApexOne Auto are already seeing the benefits of the platform’s automation and integration capabilities.

“Launching ApexOne Auto has been a smooth and seamless experience,” Lookout Credit Union consumer lending manager Jordan Hill said through the Open Lending’s website. “I expected the process to go smoothly, but the ease of the setup in Lenders Protection and our LOS exceeded my expectations. One of my favorite features is the dynamic pricing and how the contract rate accounts for pricing of loan structure like LTV.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The integration with DL4 and the automated communication back to the dealer have also been smooth sailing. Our indirect lenders can easily distinguish between ApexOne and LP deals, with no extra training needed. The funders know exactly which deals require certification and which don’t,” Hill went on to say.

Designed to integrate seamlessly with existing loan origination systems, the company pointed out ApexOne Auto complements Open Lending’s broader suite of solutions, offering financial institutions a more comprehensive, data-driven approach to credit evaluation and performance management.

For more information, visit openlending.com/apexone.