A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

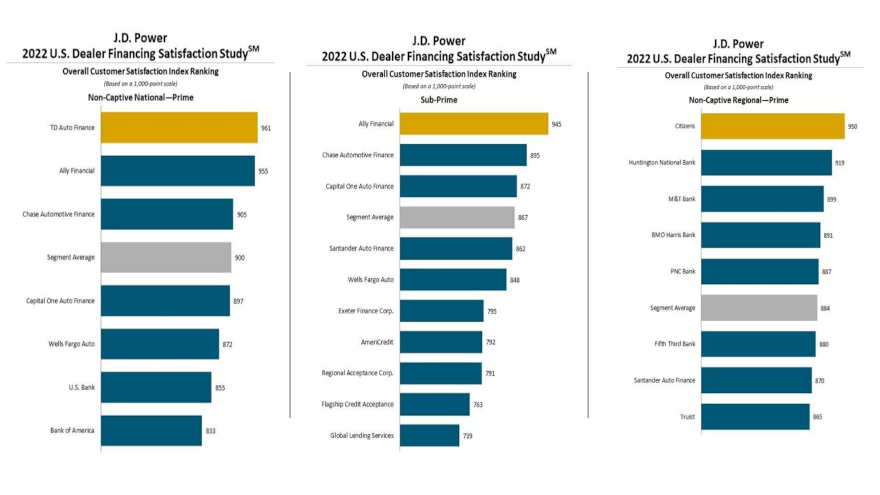

Ally tops J.D. Power dealer financing satisfaction charts in subprime for second straight year

Thursday, Aug. 11, 2022, 02:14 PM

SubPrime Auto Finance News Staff

Ally Financial topped the ranking among subprime auto finance companies for the second consecutive year, according to the J.D. Power 2022 U.S. Dealer Financing Satisfaction Study, which was released on Thursday. Ally Financial ranked highest in overall dealer satisfaction among ... [Read More]

2 alleged arson incidents concern ARA about insurance

Wednesday, Aug. 10, 2022, 07:14 PM

SubPrime Auto Finance News Staff

Two alleged arson incidents in a three-month span in the storage lots at repossession agents in Arizona and Illinois has the American Recovery Association quite concerned for a myriad of reasons. ARA recapped in a news release that 18 vehicles ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

AUL pinpoints 9 F&I tips & trends for remainder of 2022

Wednesday, Aug. 10, 2022, 03:48 PM

SubPrime Auto Finance News Staff

AUL Corp. senior vice president of sales and marketing Paul McCarthy identified nine F&I tips and trends he sees being in play for dealerships for remainder of the year. McCarthy touched on topics such as what’s on the dealership website ... [Read More]

Ga. woman sentenced to more than 18 years in federal prison for complex fraud scheme

Tuesday, Aug. 9, 2022, 01:54 PM

SubPrime Auto Finance News Staff

Federal authorities secured at least one conviction of an individual orchestrating a complex fraud scheme that could have impacted your dealership or finance company. According to a news release from the U.S. Attorney’s Office for district of South Carolina, Quinae ... [Read More]

PODCAST: New F&I series with leading consultant Becky Chernek

Sunday, Aug. 7, 2022, 08:52 PM

SubPrime Auto Finance News Staff

One of the leading F&I consultants agreed to begin a new monthly series as part of the Auto Remarketing Podcast. Becky Chernek opened the series by giving her perspectives on what’s changed in the finance office since the pandemic arrived ... [Read More]

Westlake gives largest donation in southern California to 2022 Ronald McDonald Walk for Kids

Sunday, Aug. 7, 2022, 08:47 PM

SubPrime Auto Finance News Staff

On Friday, Westlake Financial highlighted one of its latest philanthropy endeavors. The finance company said it partnered with Ronald McDonald’s 2022 Walk for Kids and donated $72,000, one of the largest donations in southern California thus far. Westlake indicated the ... [Read More]

Carvana rolls out co-signer option

Friday, Aug. 5, 2022, 03:18 PM

SubPrime Auto Finance News Staff

What’s often been done in special finance departments at physical dealerships now is being leveraged by Carvana — at least in South Carolina. The online used-vehicle retailer said this week that to make its vehicle financing qualification process easier for ... [Read More]

TransUnion: Delinquencies continue on normalization path

Thursday, Aug. 4, 2022, 02:45 PM

SubPrime Auto Finance News Staff

While TransUnion spotted noticeable rises of consumer debt levels in many credit segments, experts also are seeing normalization of delinquencies. That’s the main theme of TransUnion’s Q2 2022 Quarterly Credit Industry Insights Report (CIIR) released on Thursday. “Consumers are facing ... [Read More]

PODCAST: New leadership tandem at ARA

Wednesday, Aug. 3, 2022, 04:59 PM

SubPrime Auto Finance News Staff

The American Recovery Association’s new leadership tandem made time for this episode of the Auto Remarketing Podcast. Installed earlier this summer, president Vaughn Clemmons and executive director Joel Kennedy offered their perspective on taking these leadership roles for an industry ... [Read More]

F&I Sentinel makes 4th major move of year by hiring CFO

Wednesday, Aug. 3, 2022, 04:48 PM

SubPrime Auto Finance News Staff

Earlier this week, F&I Sentinel made its fourth major move so far this year, announcing its chief financial officer. After landing funding from Calera Capital in February and hiring two former F&I Express executives and adding former Hudson Cook partner ... [Read More]

X