Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

RoadVantage hires experienced rental-car professional as new operations support manager

Wednesday, Feb. 26, 2020, 04:43 PM

SubPrime Auto Finance News Staff

RoadVantage named its new operations support manager this week, choosing a professional with extensive experience in the rental-car industry. The F&I product provider hired Mark Johnson, who RoadVantage described as an innovative operations professional and a visionary leader with a ... [Read More]

CFPB considering more rules involving time-barred debt disclosures

Wednesday, Feb. 26, 2020, 04:41 PM

SubPrime Auto Finance News Staff

Last week, the Consumer Financial Protection Bureau shared their latest action involving collections and time-barred debt disclosures. The bureau issued a supplemental notice of proposed rulemaking (supplemental NPRM) regarding the collection of time-barred debt. The bureau proposes to prohibit collectors ... [Read More]

TransUnion: Outstanding contracts top 83 million to close 2019

Tuesday, Feb. 25, 2020, 04:08 PM

Nick Zulovich, Senior Editor

The latest TransUnion data gives crystal clear evidence to show just how much the auto-finance market has grown during the past three years. Analysts reported 2016 closed with 75.8 million contracts in portfolios. By the close of this past year, ... [Read More]

AFIP gives annual scholarship during NADA Show 2020

Monday, Feb. 24, 2020, 04:18 PM

SubPrime Auto Finance News Staff

The Association of Finance & Insurance Professionals (AFIP) recently handed out its Jakob Murray Lange Memorial Scholarship. This year’s recipient honored during the annual Northwood University Dealer Education Awards breakfast at NADA Show 2020 in Las Vegas was Katie DeMarse, ... [Read More]

Assurant highlights capabilities of Virtual Coach for dealership F&I personnel

Monday, Feb. 24, 2020, 04:16 PM

SubPrime Auto Finance News Staff

Assurant is looking to help dealership employees in the finance department stay sharp. The company recently launched Virtual Coach, a simulated, interactive classroom experience as part of the Assurant Virtual Learning Platform. The new programs are from the Assurant Performance ... [Read More]

Nicholas acquires $19M of Platinum’s active portfolio

Friday, Feb. 21, 2020, 05:14 PM

SubPrime Auto Finance News Staff

One subprime auto finance company is absorbing much of the portfolio of another provider. On Thursday, Nicholas Financial announced today that it has entered into an agreement with Platinum Auto Finance to acquire approximately $19 million of Platinum’s active and ... [Read More]

California governor seeking to create CFPB-like agency

Thursday, Feb. 20, 2020, 04:01 PM

SubPrime Auto Finance News Staff

According to an online post by the California Department of Business Oversight, Gov. Gavin Newsom’s proposed 2020-21 state budget includes a component that would modify the state regulatory structure to “cement California’s consumer protection leadership amidst a retreat on that ... [Read More]

Resolvion outlines new client success department

Thursday, Feb. 20, 2020, 03:58 PM

SubPrime Auto Finance News Staff

This week, Resolvion announced the launch of its new client success team. The skip-trace and repossession management firm explained the objective of this new initiative is to provide a more holistic and seamless approach to ensuring that client specific requirements ... [Read More]

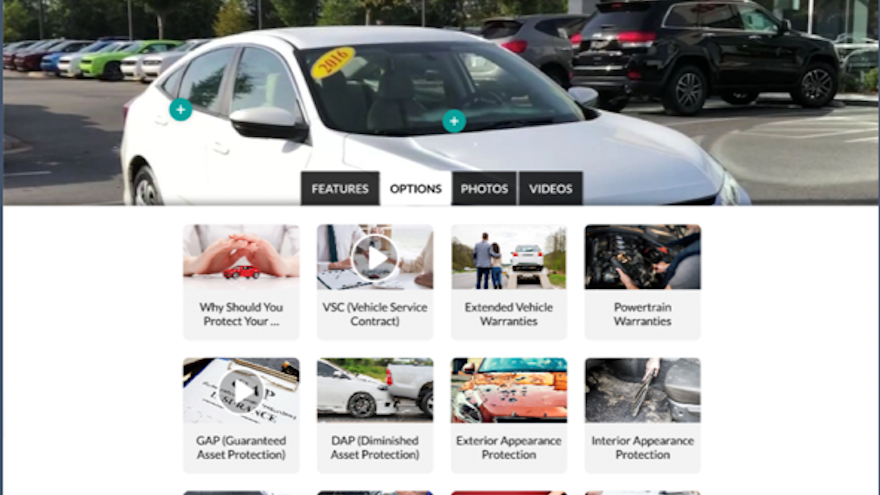

SpinCar details dealer website tool to educate buyers about F&I product benefits

Wednesday, Feb. 19, 2020, 07:44 PM

SubPrime Auto Finance News Staff

SpinCar is looking to give dealers another education tool to benefit their F&I sales strategies. During NADA Show 2020 in Las Vegas, the digital automotive merchandising software provider launched an F&I merchandising solution designed to integrate directly with dealer website ... [Read More]

iLendingDIRECT chief executive officer receives another accolade for women

Wednesday, Feb. 19, 2020, 07:26 PM

SubPrime Auto Finance News Staff

Nancy Fitzgerald, co-founder and chief executive officer of iLendingDIRECT Auto Refinancing, recently was named one of the 2020 Top 25 Most Powerful Women in Business by the Colorado Women’s Chamber of Commerce. The award, now in its eighth year, has ... [Read More]

X