Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Fed keeps interest rates unchanged even in ‘challenging environment’ for automotive

Thursday, Jan. 29, 2026, 10:29 AM

Nick Zulovich, Senior Editor

Two outspoken members of the Federal Open Market Committee (FOMC) — Stephen Miran and Christopher Waller — wanted their fellow Federal Reserve policymakers to lower the federal funds rate by 25 basis points. But the other 10 members chose to ... [Read More]

PODCAST: Lenders, forwarders & agents discuss repo bottlenecks

Wednesday, Jan. 28, 2026, 02:22 PM

SubPrime Auto Finance News Staff

In another of the Used Car Week 2025 panel discussions focused on repossessions and recoveries, AutoSquared.ai co-founder Bahador Rahimi led a conversation that included lenders, forwarders and agents. The group exchanged ideas about how industry firms can smooth the bottlenecks ... [Read More]

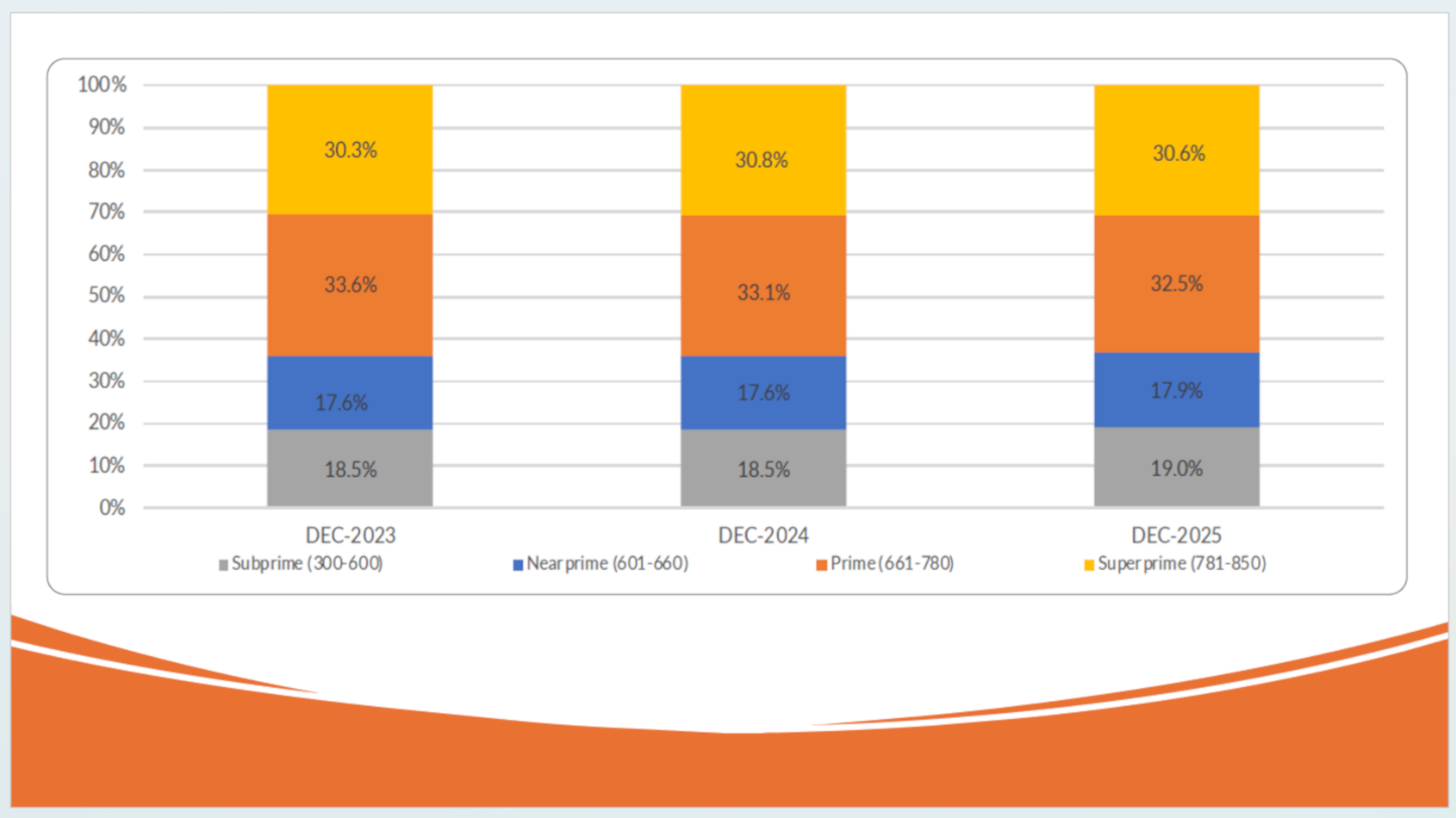

VantageScore pinpoints how much subprime credit market is growing

Wednesday, Jan. 28, 2026, 11:09 AM

SubPrime Auto Finance News Staff

Perhaps lenders that specialize in subprime auto finance can find a positive way to view the latest edition of CreditGauge from VantageScore. The data showed the pool of subprime consumers is getting noticeably deeper. From December 2023 to December of ... [Read More]

Two more Credit Acceptance executives set to retire

Tuesday, Jan. 27, 2026, 10:33 AM

SubPrime Auto Finance News Staff

The management transition at Credit Acceptance continued late on Monday, as the subprime auto finance company revealed the upcoming retirement of two c-suite executives. According to a filing with the Securities and Exchange Commission, chief analytics officer Arthur Smith and ... [Read More]

PODCAST: Looking at the possibility of 3 million repossessions annually through the recovery lens

Monday, Jan. 26, 2026, 10:08 AM

SubPrime Auto Finance News Staff

Cortney Osborne, who serves as chief operating officer of MVTRAC and chief revenue officer of DRN, and John Sibbitt, who is vice president of Recovery Database Network, hosted a conversation during Used Car Week 2025 about the potential for 3 ... [Read More]

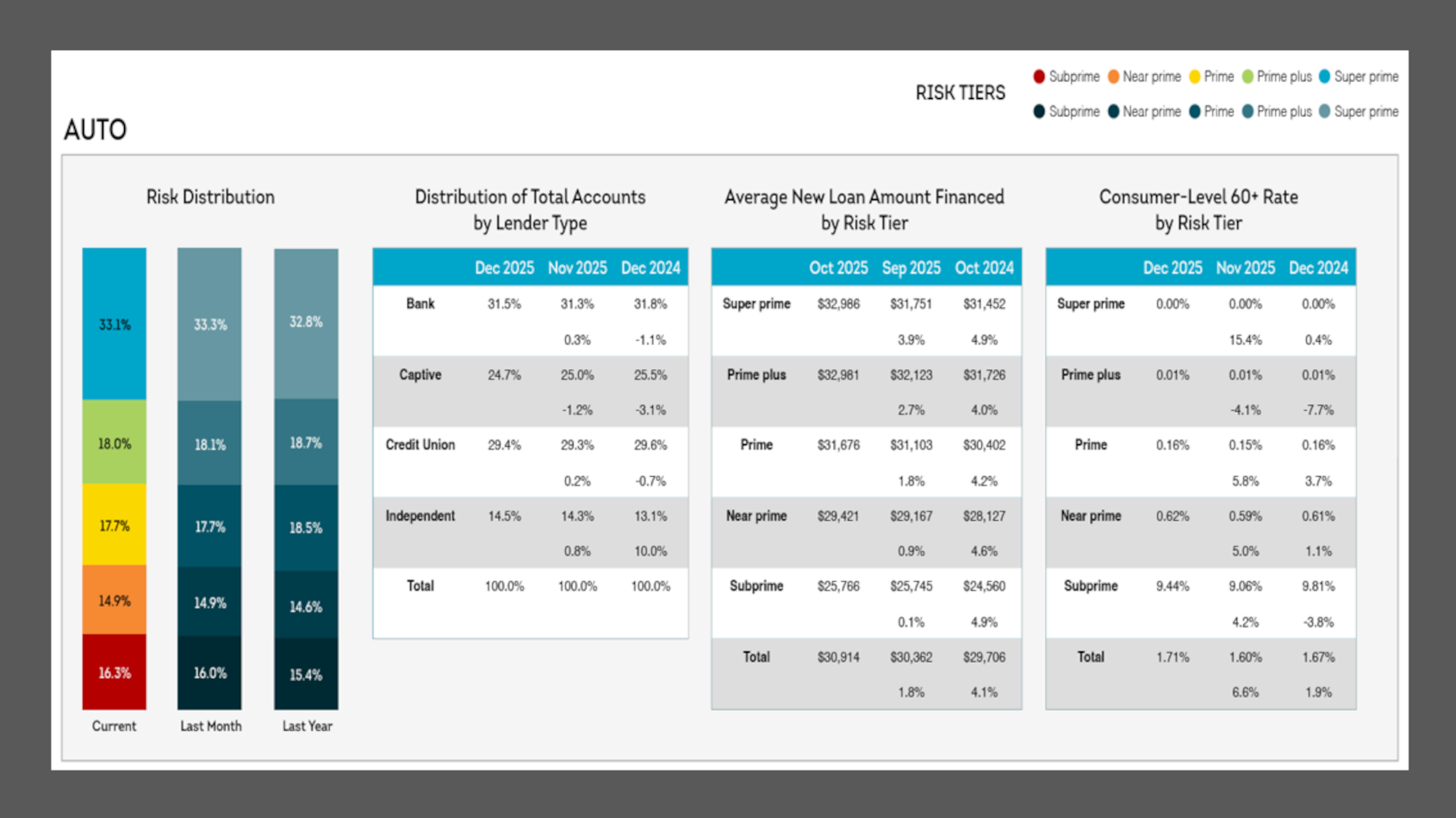

New info from TransUnion & LendingTree again shows how auto-finance risk rose to close 2025

Friday, Jan. 23, 2026, 10:26 AM

SubPrime Auto Finance News Staff

New information released this week from TransUnion and LendingTree showed the growing risk auto-finance providers are absorbing. According to TransUnion’s Credit Industry Snapshot for December, the average contract amount financed in October increased to $30,914 from $30,362 in September and ... [Read More]

PODCAST: A blueprint for auto lenders to maximize collateral recovery

Thursday, Jan. 22, 2026, 10:08 AM

SubPrime Auto Finance News Staff

There’s a growing possibility the vehicle serving as the collateral for the contract you just booked might have to be repossessed and remarketed before the consumer fully pays the balance. At Used Car Week 2025, Anne Holtzman of Allied Solutions ... [Read More]

PODCAST: Repo Roundtable gives agents opportunity to educate lenders

Wednesday, Jan. 21, 2026, 12:50 PM

SubPrime Auto Finance News Staff

In another session during Used Car Week 2025 that filled a room to near capacity, the Repo Roundtable is now available through this episode of the Auto Remarketing Podcast. Led by Lauren Kimbrell of Advanced Collateral Recovery, five other repossession ... [Read More]

Lender Compliance Technologies passes 1 million processed VPP cancellations

Wednesday, Jan. 21, 2026, 11:14 AM

SubPrime Auto Finance News Staff

Lender Compliance Technologies (LCT) highlighted a major operational achievement on Wednesday. The provider of compliance solutions for managing F&I product refunds announced it has now successfully processed more than 1 million voluntary protection product (VPP) cancellations through its cloud-based platform, ... [Read More]

Dealertrack & RouteOne integrate with F&I Sentinel to streamline compliance & validation

Wednesday, Jan. 21, 2026, 11:14 AM

SubPrime Auto Finance News Staff

F&I Sentinel made it a double. The provider of tech-enabled solutions for F&I products announced simultaneous strategic integrations on Wednesday with two digital contract platforms — RouteOne and Cox Automotive’s Dealertrack. F&I Sentinel said Dealertrack and RouteOne are helping to ... [Read More]

X