A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

AFSA expresses major concerns about changes involving FTC’s Holder Rule

Friday, Jun. 13, 2025, 11:27 AM

SubPrime Auto Finance News Staff

The American Financial Services Association recently responded to the Federal Trade Commission’s request for feedback about regulations that create impediments to competition. AFSA president-elect Celia Winslow sent a letter sharing concerns about how the FTC has shifted policy regarding the ... [Read More]

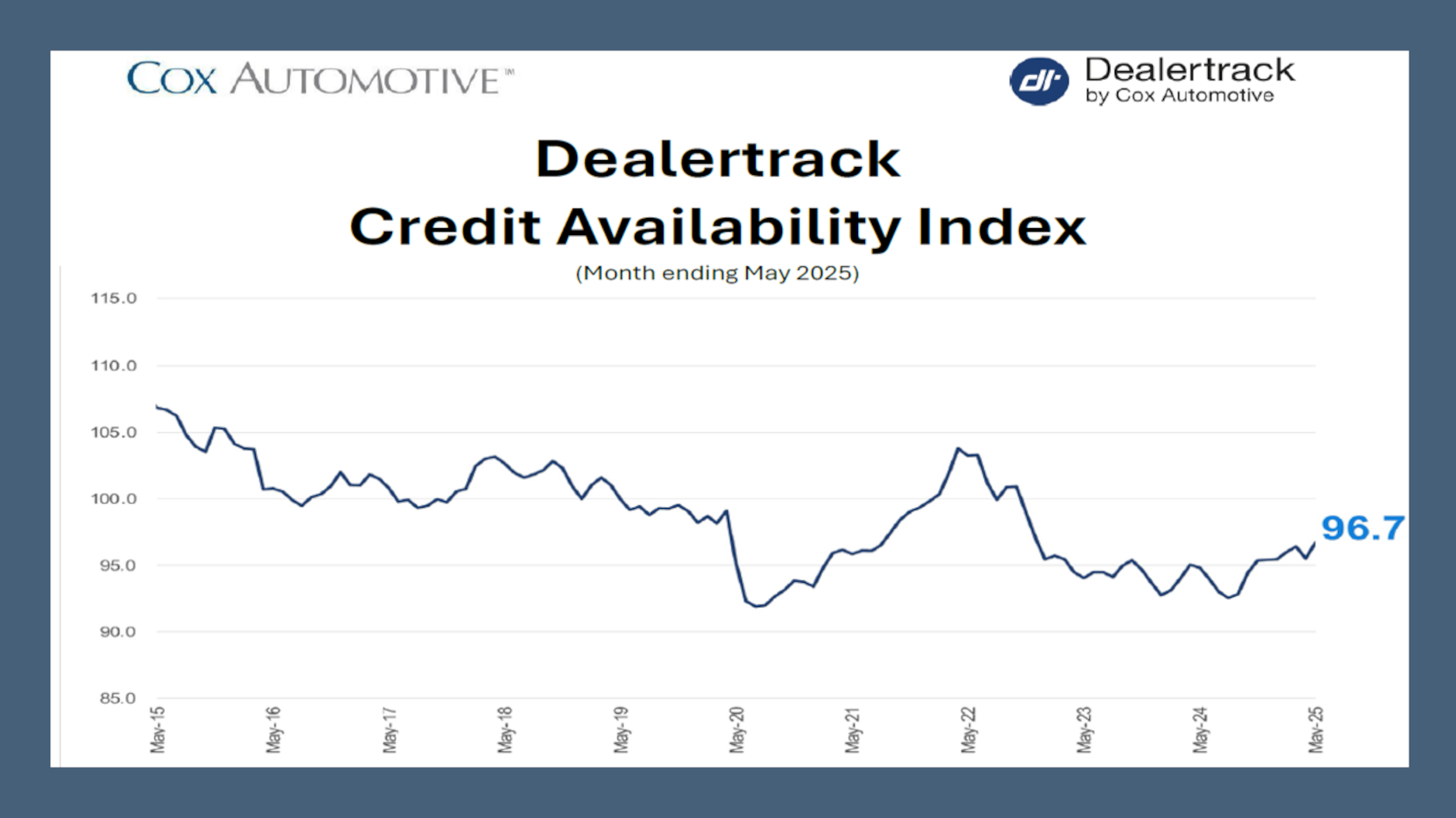

Cox Automotive spots more modest improvement in auto credit availability in May

Thursday, Jun. 12, 2025, 10:08 AM

SubPrime Auto Finance News Staff

Perhaps finance companies are acknowledging that they’re going to have to absorb a bit more risk to keep origination objectives within reach. Cox Automotive reported this week that the May Dealertrack Credit Availability Index showed a modest improvement in auto ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Arra Finance to acquire Crescent Bank’s auto-financing division

Wednesday, Jun. 11, 2025, 05:00 PM

Nick Zulovich, Senior Editor

The short history of Arra Finance already includes some of the most significant moments a new operation can have. The company specializing in subprime auto financing launched in spring 2022, then last summer gained new ownership with an asset management ... [Read More]

REPAY bolsters integration with MeridianLink to boost payment processing for banks & credit unions

Wednesday, Jun. 11, 2025, 01:49 PM

SubPrime Auto Finance News Staff

Quarterly updates have shown consumers are struggling to maintain their monthly payments for auto financing and other credit products. So, Repay Holdings Corp. is making sure that its vertically integrated payment solutions perform well, thus announcing new enhancements to the ... [Read More]

Agora claims ‘milestone accomplishment’ with rated asset-backed securitization

Wednesday, Jun. 11, 2025, 11:18 AM

SubPrime Auto Finance News Staff

Agora Data secured what it called a “milestone accomplishment” toward strengthening its position in the multi-billion-dollar public capital markets. The fintech innovator of advanced capital solutions in subprime and non-prime consumer finance on Tuesday announced the successful completion of its ... [Read More]

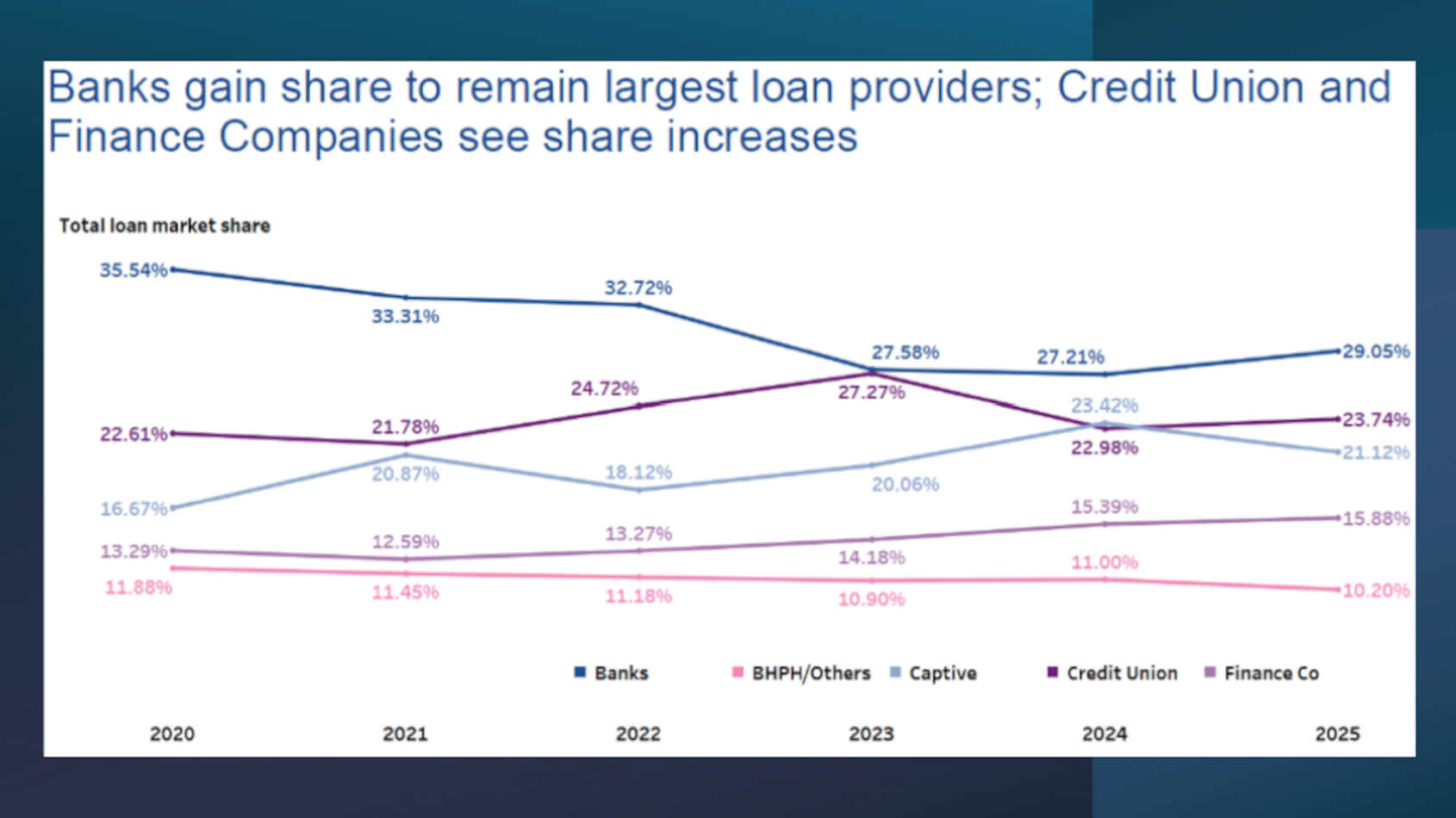

PODCAST: Putting Q1 auto-finance data into historical perspective with Experian’s Melinda Zabritski

Wednesday, Jun. 11, 2025, 11:18 AM

SubPrime Auto Finance News Staff

Melinda Zabritski, Experian’s head of automotive financial insights and one of the analysts among this year’s Automotive Intelligence Award recipients, returned for another appearance on the Auto Remarketing Podcast. Zabritski described what elements were in place to help banks gain ... [Read More]

NAF Association welcomes newly elected directors and 2025 executive officers

Tuesday, Jun. 10, 2025, 10:00 AM

SubPrime Auto Finance News Staff

Along with giving its annual awards, the National Automotive Finance Association elected five new members to its board of directors during last week’s Non-Prime Auto Financing Conference in Plano, Texas. Beginning a two-year term following a vote held during the ... [Read More]

GM’s former top marketing executive joins Safe-Guard board

Friday, Jun. 6, 2025, 10:12 AM

SubPrime Auto Finance News Staff

The former global chief marketing officer of General Motors is now helping Safe-Guard Products International. This week, the platform provider of private label protection products for the automotive, RV, marine, and powersports industries announced the appointment of Deborah Wahl to ... [Read More]

F&I Sentinel adds Ewing to board ‘at a pivotal moment’

Friday, Jun. 6, 2025, 10:07 AM

SubPrime Auto Finance News Staff

In a move happening “at a pivotal moment” for the company, F&I Sentinel appointed fintech leader and compliance expert Frank Ewing to its board of directors this week. The provider of tech-enabled solutions for F&I products highlighted that Ewing has ... [Read More]

Experian: Banks post auto-finance market rebound in Q1

Thursday, Jun. 5, 2025, 10:13 AM

SubPrime Auto Finance News Staff

There’s a new way to revisit that old phrase, “You can take it to the bank.” That’s because dealership finance managers might have been saying those words since Experian highlighted banks reclaimed ground across the automotive finance industry market during ... [Read More]

X