Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

3 repo organizations reiterate definitions of 8 key industry terms

Wednesday, Jun. 4, 2025, 02:26 PM

SubPrime Auto Finance News Staff

Earlier this year, a joint announcement from three of the largest repossession organizations — Allied Finance Adjusters, American Recovery Association and Eagle Group XX — reiterated their definitions of eight key terms associated with vehicle repossessions and recoveries. Especially considering ... [Read More]

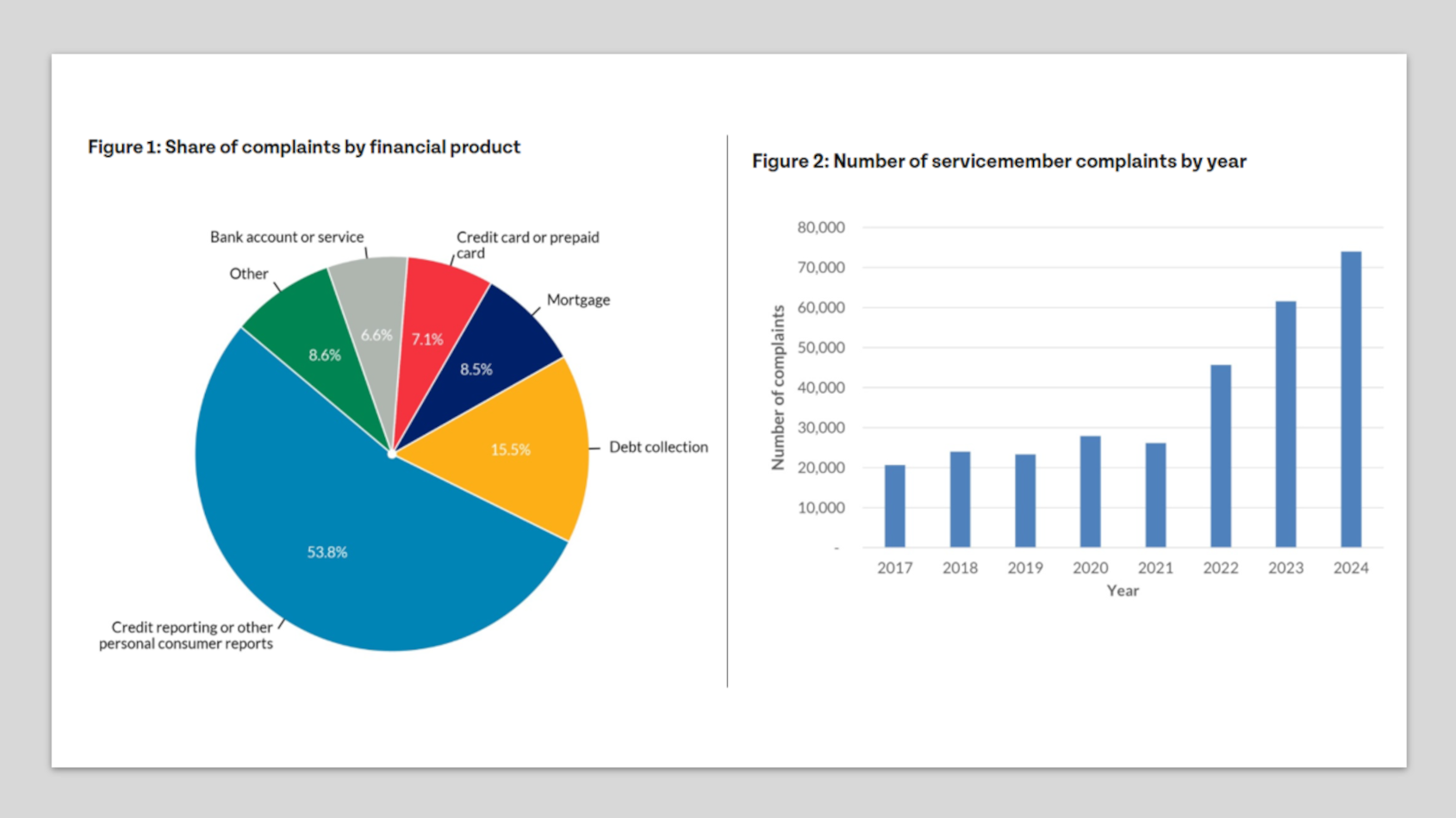

Report shows 165% increase in complaints to CFPB by servicemembers during a 4-year span

Tuesday, Jun. 3, 2025, 09:50 AM

SubPrime Auto Finance News Staff

Advocates are encouraged and concerned following the release of a new report on Tuesday from the U.S. PIRG Education Fund and Frontier Group that analyzed a portion of complaints published by the Consumer Financial Protection Bureau (CFPB). While not specifically ... [Read More]

Kashable lands $250M credit facility to expand

Monday, Jun. 2, 2025, 11:55 AM

SubPrime Auto Finance News Staff

Kashable, a fintech platform that provides access to “socially responsible credit” and financial wellness solutions for employees, got its own boost of financial resources last week, announcing the closing of a $250 million credit facility. According to a news release, ... [Read More]

Powell & Trump discuss growth, employment & inflation

Monday, Jun. 2, 2025, 11:54 AM

SubPrime Auto Finance News Staff

The Federal Reserve released a statement recapping chair Jerome Powell being invited to the White House for a meeting with President Trump on Thursday. The statement indicated Powell and Trump discussed economic developments including for growth, employment, and inflation. “Chair ... [Read More]

Ciocca Automotive highlights how Assurant has helped its stores in F&I and beyond

Friday, May. 30, 2025, 11:00 AM

SubPrime Auto Finance News Staff

Two top executives from Ciocca Automotive, a growing automotive group with 54 dealerships in New Jersey and Pennsylvania, recently described what the partnership with Assurant has done for their dealerships’ F&I performance and other parts of the retailer. “We’re already ... [Read More]

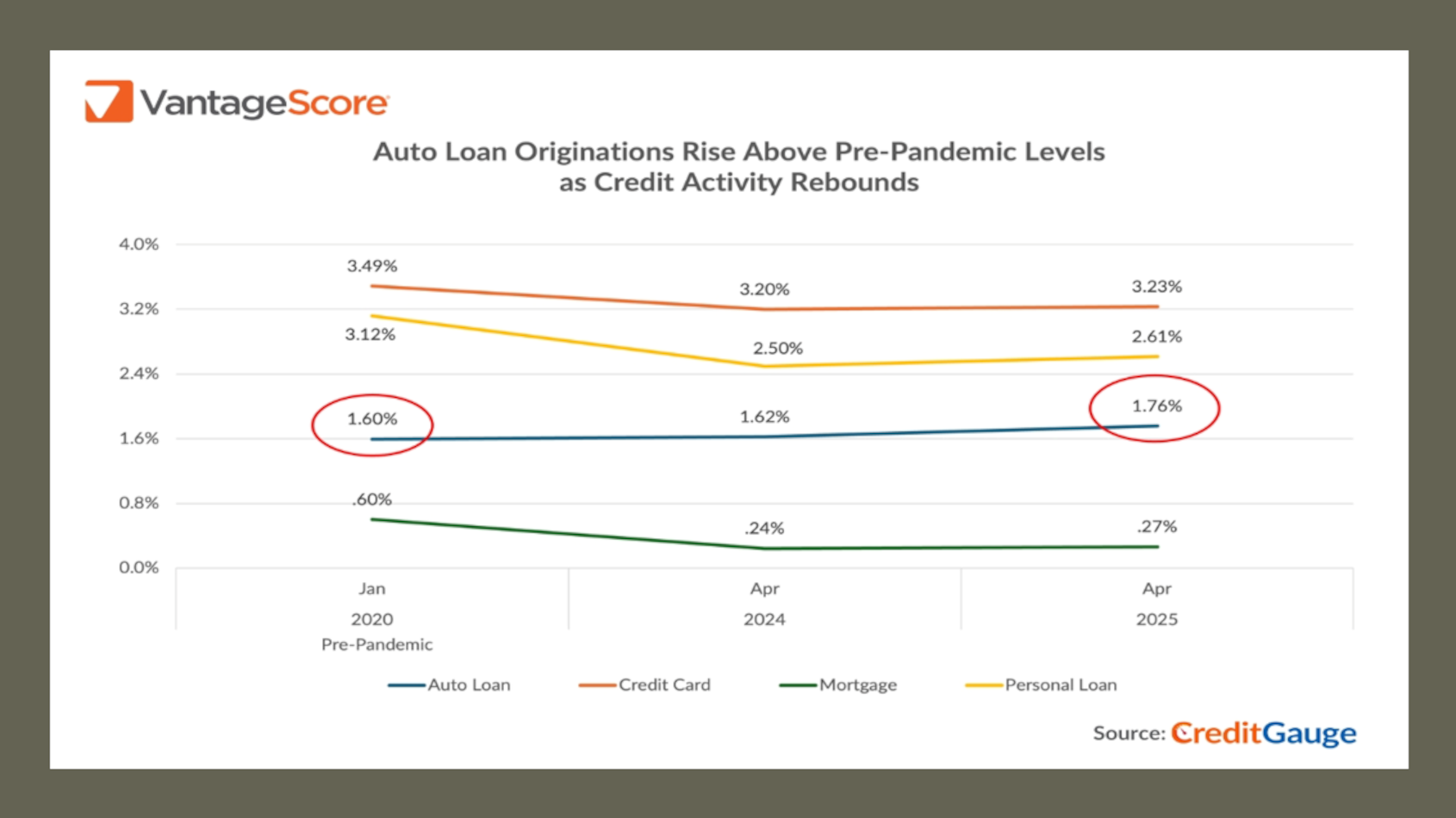

VantageScore delves deeper into April auto-finance surge

Friday, May. 30, 2025, 10:59 AM

SubPrime Auto Finance News Staff

The newest data from VantageScore released this week showed that if you want to ignite auto financing, just create a global pandemic or launch tariffs among some of the world’s leading economies. According to the latest edition of CreditGauge from ... [Read More]

EpicVIN finds Top 10 budget-friendly cars of 2025

Thursday, May. 29, 2025, 11:19 AM

SubPrime Auto Finance News Staff

Finding an affordable new car for someone with bruised credit is likely pretty difficult nowadays. Kelley Blue Book reported that tariffs pushed new-vehicle average transaction prices up by 2.5% month-over-month in April to $48,699. It was the second-highest increase in ... [Read More]

Consumer sentiment seems to be rebounding, but struggles to maintain payments remain

Wednesday, May. 28, 2025, 09:53 AM

SubPrime Auto Finance News Staff

Cox Automotive reported unique credit applications per dealer using Dealertrack ticked up 2% year-over-year last week. So, does that mean consumers feel more comfortable pushing forward with a financing commitment and taking vehicle delivery? It depends on which reading of ... [Read More]

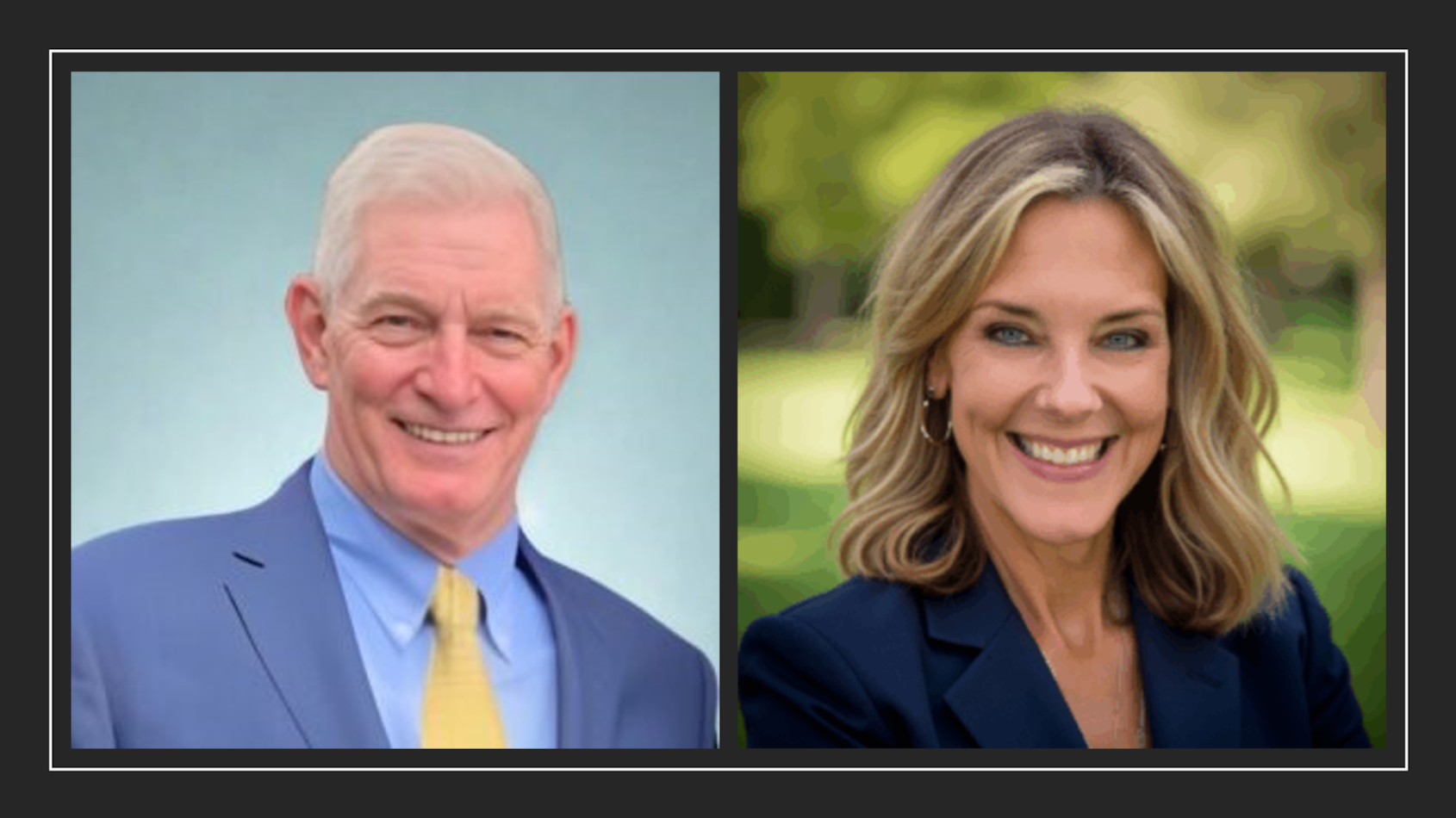

NAF Association reveals its 2025 award winners

Friday, May. 23, 2025, 09:37 AM

SubPrime Auto Finance News Staff

Gary Perdue and Suzi Straffon each have something extra special to celebrate this holiday weekend. On Friday morning, the National Automotive Finance Association announced Perdue, who is president of Peritus Portfolio Services, has been selected as the 2025 recipient of ... [Read More]

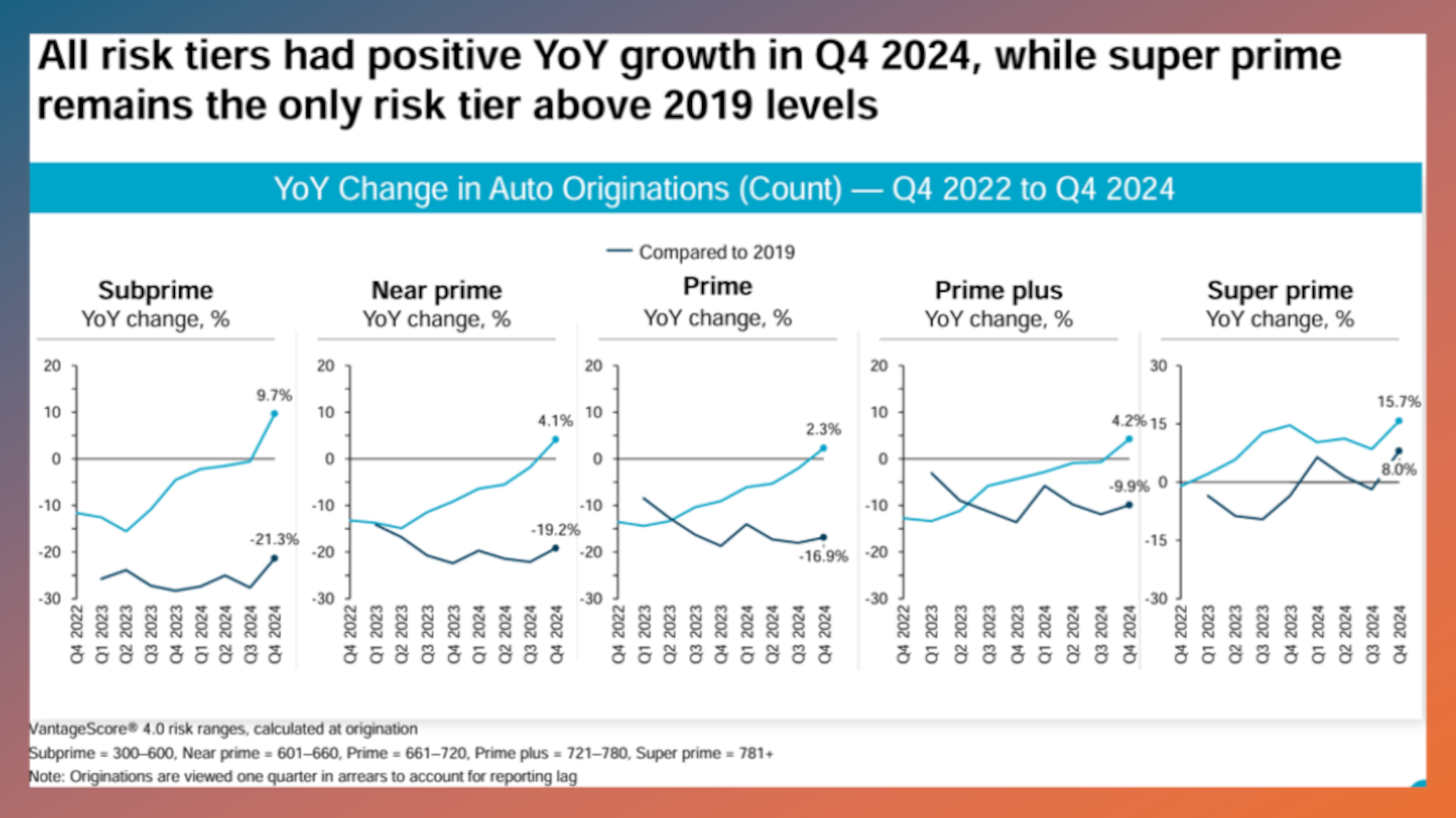

Fed can look at newest TransUnion auto-finance data to see interest-rate impact

Thursday, May. 22, 2025, 12:07 PM

SubPrime Auto Finance News Staff

The Federal Reserve says at almost every opportunity that policymakers watch all sorts of data and trends before adjusting interest rates. If the Fed wants more information about what a rate cut can do, it can examine the auto-finance portion ... [Read More]

X