Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

700Credit reinforces QuickQualify Xpress tool with Equifax data

Friday, Feb. 1, 2019, 03:23 PM

SubPrime Auto Finance News Staff

In light of the ongoing dialogue involving affordability, 700 Credit recently announced a collaboration with Equifax for its QuickQualify web-based platform. The provider of credit reports, compliance solutions and consumer pre-qualification products explained that QuickQualify Xpress utilizes Equifax identity data ... [Read More]

As expected, Fed opens 2019 by keeping interest rates stable

Thursday, Jan. 31, 2019, 03:13 PM

SubPrime Auto Finance News Staff

What Comerica Bank chief economist Robert Dye projected to unfold this week came to fruition as the Federal Reserve had its first opportunity of 2019 to make an interest rate adjustment. The Federal Open Market Committee decided to maintain the ... [Read More]

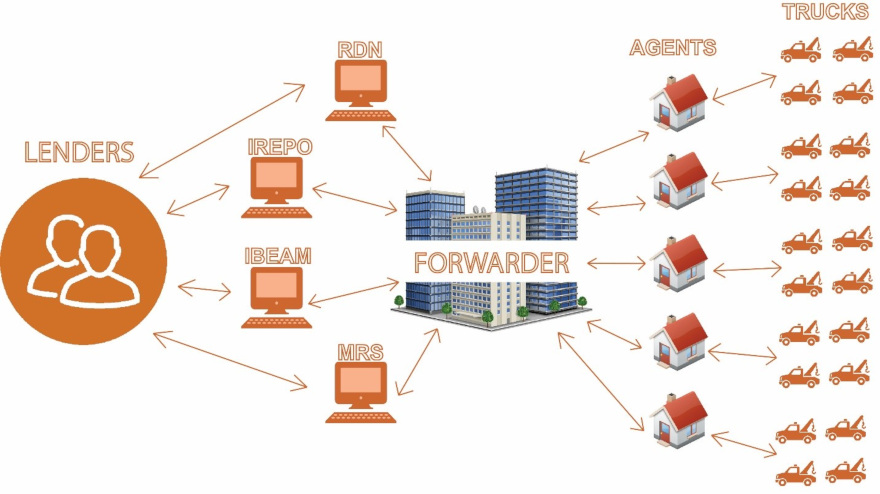

Levison on repossession compliance: Mobile platforms put the goal line in sight

Wednesday, Jan. 30, 2019, 08:21 PM

Mike Levison, ALS Resolvion

Anyone who has been involved with the repossession industry over the past several years knows that the world looks very different today than before the Consumer Financial Protection Bureau arrived. Most of the focus during this period has been on ... [Read More]

November subprime ABS readings land within likely expectations

Wednesday, Jan. 30, 2019, 02:58 PM

SubPrime Auto Finance News Staff

The newest S&P Global Ratings report indicated the U.S. auto loan asset-backed securities (ABS) market in November performed where finance companies likely expected, especially for participants within the subprime space. And when analysts extracted a trio of companies that securitize ... [Read More]

CFPB report notes continued servicemember frustration over GAP and other products

Tuesday, Jan. 29, 2019, 03:33 PM

SubPrime Auto Finance News Staff

Additional products sold to buyers during the financing process along with their terms and conditions continue to create issues for servicemembers, according to the newest report from the Consumer Financial Protection Bureau. The agency’s Office of Servicemember Affairs (OSA) monitors ... [Read More]

Darwin Automotive launches ‘Amazon-like’ checkout for F&I products

Monday, Jan. 28, 2019, 04:16 PM

SubPrime Auto Finance News Staff

Darwin Automotive wants finance office products to be as easy for used-vehicle buyers to purchase as their favorite items on Amazon. The F&I software provider recently announced the release of “Buy it Now” functionality as an addition to its Darwin ... [Read More]

National Auto Care expands board to 5 members

Monday, Jan. 28, 2019, 04:14 PM

SubPrime Auto Finance News Staff

National Auto Care (NAC) grew its board of directors to five by adding another member. The provider of F&I products nationwide recently announced the appointment of Michael Boyle to its board of directors. Boyle is the fifth member to join ... [Read More]

The negative impact of title release inefficiencies on finance company profits

Thursday, Jan. 24, 2019, 05:40 PM

SubPrime Auto Finance News Staff

Interest rates continue to increase the cost of buying a vehicle. Dealers and finance companies are well aware of concerns about affordability, consumer access to credit and softening new-vehicle sales. Because of that, dealers and finance companies are exploring new ... [Read More]

DriveItAway lands partnership to get free credit repair for Lyft and Uber drivers

Wednesday, Jan. 23, 2019, 01:00 PM

SubPrime Auto Finance News Staff

Lyft and Uber drivers not only might have a path to generate funds for a down payment when acquiring a vehicle at certain dealerships, they also could take advantage of a solution to help their credit situation. DriveItAway, a company ... [Read More]

Allied Solutions revamps tool for recovery and insurance tracking

Monday, Jan. 21, 2019, 03:39 PM

SubPrime Auto Finance News Staff

Just ahead of the American Financial Services Association’s Vehicle Finance Conference, Allied Solutions announced the restructuring of its claims and recovery product, REPOPlus & Track. The provider of insurance, lending and marketing products to financial institutions in the U.S. for more ... [Read More]

X