A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Who to Watch: Why EY’s George wants to be part of transparency in financing

Monday, May. 5, 2025, 10:38 AM

Nick Zulovich, Senior Editor

EDITOR’S NOTE: This story is part of the May edition of Auto Remarketing, which will focus entirely on a new special feature: Who to Watch. This special feature will recognize auto industry executives and companies — selected by Cherokee Media ... [Read More]

Agora Data president & COO among Dallas Business Journal’s 2025 40 Under 40 for fintech innovation

Friday, May. 2, 2025, 09:46 AM

SubPrime Auto Finance News Staff

Matt Burke is one of the best among his peers in Dallas. The president and COO of Agora Data has been named to the Dallas Business Journal’s 2025 40 Under 40 list for his transformative leadership and contributions to the ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Proposed FTC order spells out what not to do in collections

Friday, May. 2, 2025, 09:46 AM

SubPrime Auto Finance News Staff

A proposed order detailed by the Federal Trade Commission this week gave auto finance companies clear bullet points of what not to do when it comes to their collections activities. In developments outside of automotive, the FTC alleged that Global ... [Read More]

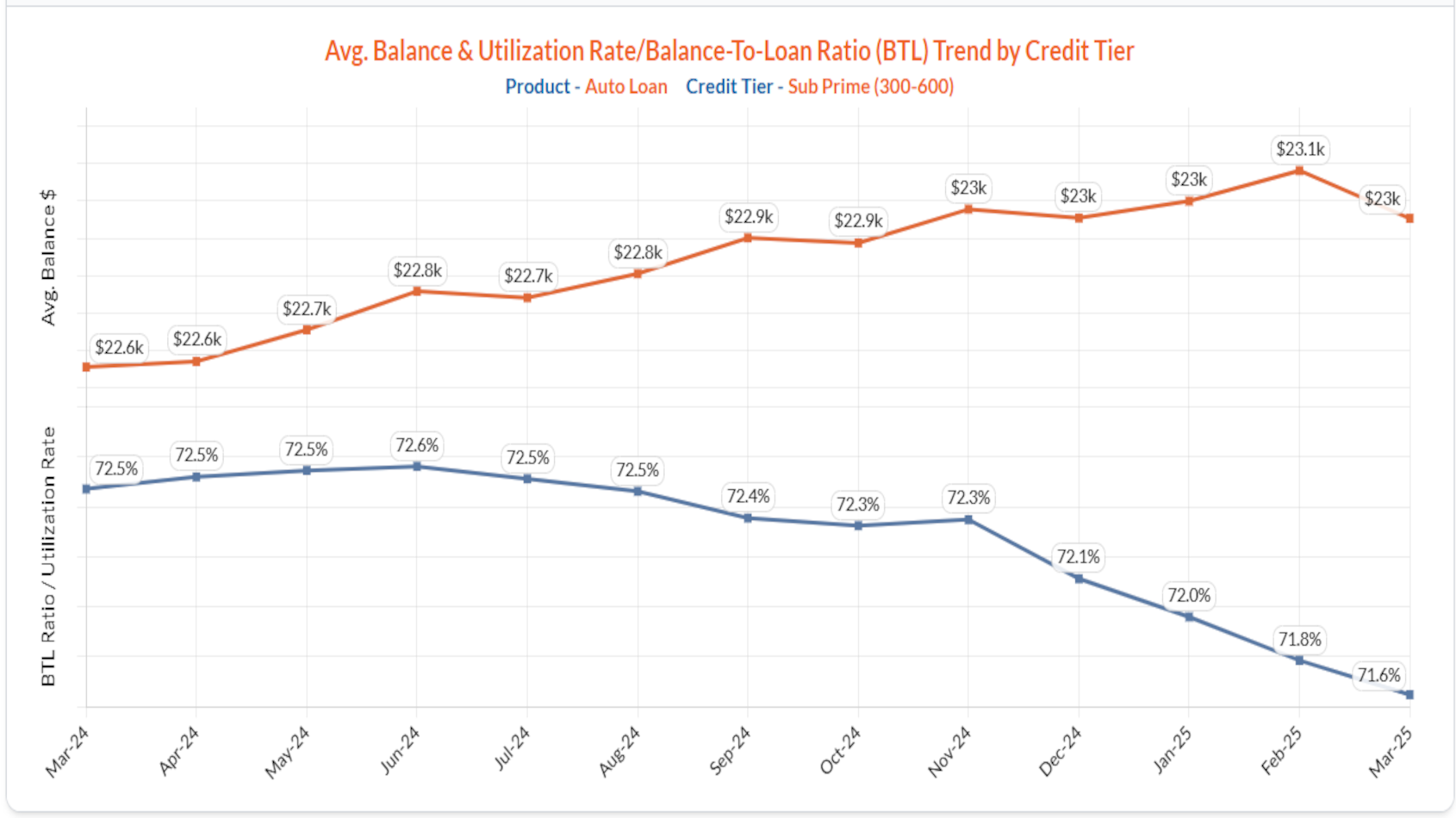

CreditGauge reveals some stability in subprime auto finance & overall credit market

Thursday, May. 1, 2025, 11:37 AM

SubPrime Auto Finance News Staff

While overall consumer credit balances remained largely stable, the March edition of CreditGauge from VantageScore offered deeper insight into the subprime credit tier and auto financing. When looking only at subprime consumers — what VantageScore pegs as individuals with scores ... [Read More]

11 awards given during NARS 2025

Wednesday, Apr. 30, 2025, 12:14 PM

SubPrime Auto Finance News Staff

The repossession community gathered in Orlando, Fla., last week for the annual North American Repossessors Summit (NARS). Along with organizing insightful panel discussions, crucial training workshops and demonstrations as well as productive meetings between finance companies and repossession agents, the ... [Read More]

Zest AI integrates credit decisioning & fraud detection into Temenos loan origination solution

Wednesday, Apr. 30, 2025, 10:51 AM

SubPrime Auto Finance News Staff

In a move geared toward more credit access, Zest AI on Tuesday announced the native integration of its automated underwriting and fraud detection with the Temenos loan origination solution. The companies highlighted this seamless integration provides traditional financial institutions in ... [Read More]

Organizations upbeat about auto refinancing outlook

Wednesday, Apr. 30, 2025, 10:37 AM

SubPrime Auto Finance News Staff

While the Federal Reserve hasn’t lowered interest rates yet this year, institutions that participate in auto refinancing are upbeat about the volume they could generate in the coming months. Two examples of the bullish perspective recently came from iLending and ... [Read More]

Consumer sentiment continues to sag as even prime auto ABS experiences turbulence

Tuesday, Apr. 29, 2025, 10:19 AM

Nick Zulovich, Senior Editor

Federal Reserve chair Jerome Powell quipped during an appearance at the Economic Club of Chicago earlier this month, saying, “As that great Chicagoan Ferris Bueller once noted, ‘Life moves pretty fast.’” Nowadays, many consumers don’t appear to be liking how ... [Read More]

VantageScore generates record 41.7 billion credit scores in 2024

Monday, Apr. 28, 2025, 10:18 AM

SubPrime Auto Finance News Staff

The latest Charles River Associates analysis released on Monday showed that VantageScore credit score usage is up sharply by 55% year-over-year to a record 41.7 billion credit scores delivered in 2024. That’s up from 26.9 billion in 2023, as lenders ... [Read More]

CFPB withdraws from lawsuit against Credit Acceptance

Thursday, Apr. 24, 2025, 10:52 PM

Nick Zulovich, Senior Editor

Immediately drawing applause from the American Financial Services Association, Credit Acceptance announced late on Thursday that a lawsuit involving the Consumer Financial Protection Bureau (CFPB) took a positive turn for the subprime auto finance company. According to a news release ... [Read More]

X