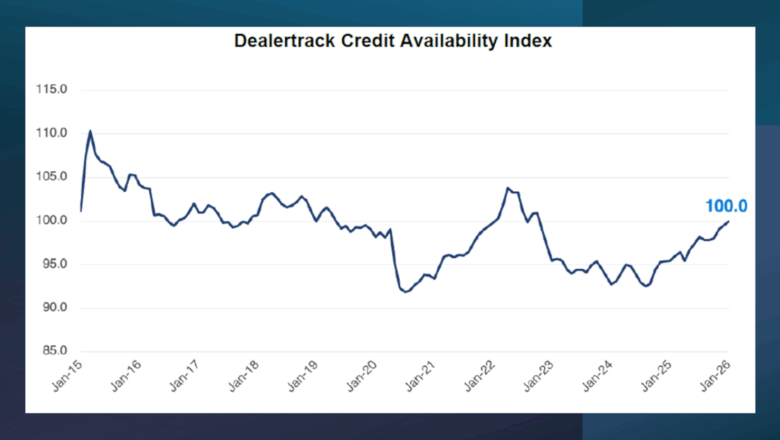

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

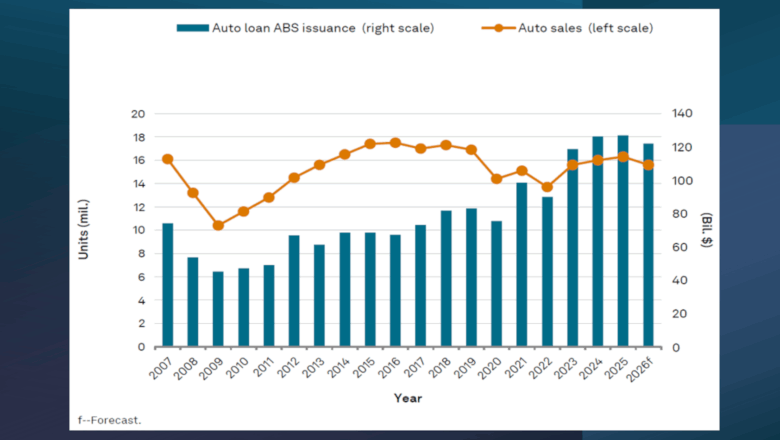

Despite ‘mixed year’ for subprime, S&P Global Ratings watches auto ABS volume generate another record in 2025

Monday, Feb. 16, 2026, 10:59 AM

Debt Awareness Week meant to be ‘wake-up call’

Tuesday, Feb. 17, 2026, 10:21 AM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Cox Automotive on the vanishing divide between wholesale & retail

Used Car Week 2025 extended the ongoing conversation about how the wholesale and retail portions of the used-car market aren’t quite as distinct as they used to be. Cherokee Media Group’s Bill Zadeits hosted a fireside chat about the subject ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

Westlake acquires Credit Union Leasing of America

Thursday, Jun. 15, 2017, 07:05 PM

SubPrime Auto Finance News Staff

Westlake Financial Services now possesses a significantly larger investment footprint, as on Thursday the company announced the acquisition of Credit Union Leasing of America (CULA), headquartered in San Diego. The company highlighted the purchase of CULA raised Westlake’s total managed ... [Read More]

Fed raises rates while watching subprime auto financing

Thursday, Jun. 15, 2017, 03:06 PM

Nick Zulovich, Senior Editor

As was widely anticipated, members of the Federal Open Market Committee at the Federal Reserve chose to raise the target range for the federal funds rate from 1 percent to 1.25 percent on Wednesday. While the vote to raise the ... [Read More]

How debt collection industry scored rare ‘victory’

Wednesday, Jun. 14, 2017, 03:37 PM

SubPrime Auto Finance News Staff

A debt collection expert explained the importance of the rule-making pivot the Consumer Financial Protection Bureau evidently is making when it comes to finance companies and other credit providers looking to collect from consumers who defaulted. CFPB director Richard Cordray ... [Read More]

Nicholas Financial president & CEO to retire as company modifies static pools & underwriting

Wednesday, Jun. 14, 2017, 03:17 PM

SubPrime Auto Finance News Staff

Coming off of a fiscal year where its net earnings dropped but still surpassed $5 million, Nicholas Financial this week announced the retirement of Ralph Finkenbrink as the subprime auto finance company’s president and chief executive officer for personal reasons. Nicholas ... [Read More]

7 findings in Treasury’s regulatory reform report

Tuesday, Jun. 13, 2017, 02:37 PM

SubPrime Auto Finance News Staff

Coming on the heels of the U.S. House of Representatives passing H.R. 10, the Financial CHOICE Act, in an effort to modify the Consumer Financial Protection Bureau among other objectives, the U.S. Department of the Treasury late on Monday issued its ... [Read More]

April ABS movements hint at possible future losses

Tuesday, Jun. 13, 2017, 02:31 PM

SubPrime Auto Finance News Staff

S&P Global Ratings reported that collateral performance in the U.S. prime and subprime auto loan asset-backed securities (ABS) sectors was mixed in April relative to March. Analysts indicated that while losses and recoveries continued to show seasonal improvement on a ... [Read More]

FactorTrust & GOLDPoint Systems partner to boost originations & more

Monday, Jun. 12, 2017, 03:12 PM

SubPrime Auto Finance News Staff

FactorTrust recently finalized an innovative partnership with GOLDPoint Systems to integrate alternative credit data and scores into the online finance company’s originating, servicing and reporting processes, thereby enabling GOLDPoint’s lending clients to get a complete overview of creditworthy borrowers. GOLDPoint ... [Read More]

Send your nominations for top industry Movers & Shakers

Friday, Jun. 9, 2017, 07:33 PM

SubPrime Auto Finance News Staff

Change seems to be always in the air in the auto finance space. Finance companies are adjusting underwriting to mitigate risk, maintain origination growth and watch for delinquency rises. Service providers are looking to improve their solutions while sustaining high ... [Read More]

Industry cheers as CFPB reform measure passes House

Friday, Jun. 9, 2017, 01:24 PM

Nick Zulovich, Senior Editor

While lawmakers from opposing parties either cheered or jeered the vote tally, industry advocates from the banking, financial services and dealership communities on Thursday all applauded the U.S. House of Representatives for passing H.R. 10, the Financial CHOICE Act. The ... [Read More]

3 reasons why RouteOne hit 7.5M booked eContracts

Friday, Jun. 9, 2017, 01:19 PM

SubPrime Auto Finance News Staff

This week, RouteOne highlighted that its eContracting platform reached a new milestone with 7.5 million booked eContracts. The threshold resulted in more than $200 billion in funded deals. RouteOne indicated the growth can be attributed to the rising adoption by: ... [Read More]

X