5 components of Treasury Department’s National Strategy for Financial Inclusion

Wednesday, Nov. 6, 2024, 11:10 AM

Experts give auto-finance outlook after another Fed rate cut & Trump election victory

Friday, Nov. 8, 2024, 11:13 AM

Results & recommendations from federal audit of CFPB’s information security program

Thursday, Nov. 7, 2024, 10:49 AM

Agora Data finalizes $12M deal with Road Auto Finance

Wednesday, Oct. 16, 2024, 10:39 AM

SubPrime Auto Finance News Staff

Agora Data announced on Tuesday that it has closed a $12 million transaction for Road Auto Finance, an indirect auto finance company. The capital solutions and advanced performance analytics provider for the subprime to non-prime market called the development a ... [Read More]

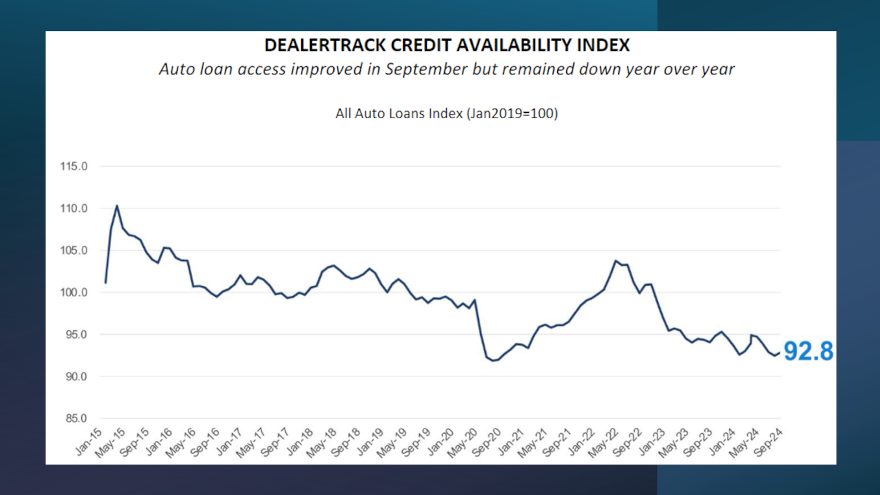

Five straight months of credit tightening for auto finance stops in September

Wednesday, Oct. 16, 2024, 10:36 AM

SubPrime Auto Finance News Staff

While Edmunds detailed the swelling of negative equity, Cox Automotive noticed credit access loosened to close the third quarter. The Dealertrack Credit Availability Index came in at 92.8 in September, representing a 0.4% improvement from August and stopping a streak ... [Read More]

Edmunds: Average negative equity surges in Q3 to all-time high

Tuesday, Oct. 15, 2024, 10:24 AM

SubPrime Auto Finance News Staff

In March, Edmunds said “negative equity is rearing its ugly head.” After looking at its third-quarter data that showed average negative equity hitting an all-time high, Edmunds acknowledged on Tuesday that the trend now is “nothing short of alarming.” Edmunds ... [Read More]

3 new executives reinforce management as Veros Credit eyes more market share

Monday, Oct. 14, 2024, 10:36 AM

SubPrime Auto Finance News Staff

Veros Credit on Monday recapped the addition of several key executives as part of its strategic initiative to expand operations and strengthen its presence across the United States. By leveraging cutting-edge systems and models to enhance the user experience of ... [Read More]

Open Lending partners with Point Predictive to boost underwriting in non-prime space

Monday, Oct. 14, 2024, 10:35 AM

SubPrime Auto Finance News Staff

Open Lending recently formed a partnership with Point Predictive Designed to bring enhanced speed, security and performance to auto finance companies that want to book near-prime and non-prime paper, the service providers highlighted that the partnership integrates the capabilities of ... [Read More]

Onbe releases survey about refund processes amid CFPB examinations

Thursday, Oct. 10, 2024, 11:11 AM

SubPrime Auto Finance News Staff

One of the processes to draw ire during examinations in the past year by the Consumer Financial Protection Bureau was refunds associated with voluntary protection products. This week, Onbe published its 2024 Auto Finance Payments Survey, exploring consumers’ refund preferences. ... [Read More]

Automotive Risk Management Partners tries to see potential positives from CARS Rule

Wednesday, Oct. 9, 2024, 11:00 AM

SubPrime Auto Finance News Staff

Oral arguments in the legal challenge to the Combating Auto Retail Scams (CARS) Rule were set to begin this week in New Orleans. Attorneys for the Federal Trade Commission, the National Automobile Dealers Association and the Texas Automobile Dealers Association ... [Read More]

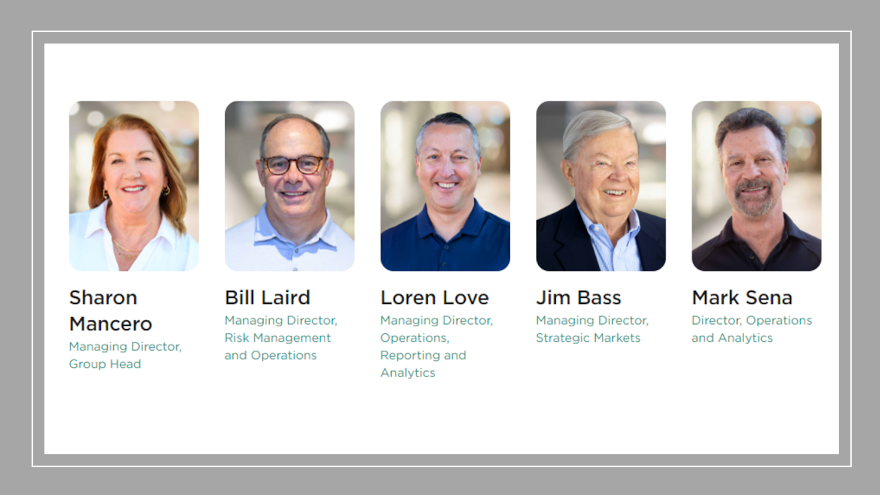

Agora Data reveals 5 members of new financial institutions group

Wednesday, Oct. 9, 2024, 10:59 AM

SubPrime Auto Finance News Staff

Agora Data on Tuesday announced the formation of its new financial institutions group, which is tailored to serve finance companies that specialize in addressing the needs of the subprime to non-prime market. Agora Data said the division supports independent consumer ... [Read More]

CFPB’s newest Supervisory Highlights detail numerous ‘illegal practices’ in auto finance

Tuesday, Oct. 8, 2024, 10:11 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau published a special edition of its Supervisory Highlights on Tuesday focused solely on auto finance. The regulator found numerous “illegal practices,” including vehicle repossessions even when the customers caught up on monthly payments or received ... [Read More]

CPS integrates with Informed.IQ’s Dealer Verify tool

Monday, Oct. 7, 2024, 11:41 AM

SubPrime Auto Finance News Staff

Consumer Portfolio Services on Monday announced the successful integration of Informed.IQ’s Dealer Verify tool into its origination process. The subprime auto finance company said this advanced solution driven by artificial intelligence can enhance the dealer experience by automatically verifying stipulations, ... [Read More]

View The Latest Edition

View The Latest Edition