Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

StoneEagle’s newest F&I solutions are being deployed at NADA 2026

Friday, Jan. 9, 2026, 11:17 AM

SubPrime Auto Finance News Staff

StoneEagle plans to unveil what it’s calling an enhanced interplay between StoneEagleMENU and StoneEagleMETRICS at the 2026 NADA Show in Las Vegas next month. The F&I solutions provider highlighted that its revamped tool generates a deeper connection of METRICS intelligence ... [Read More]

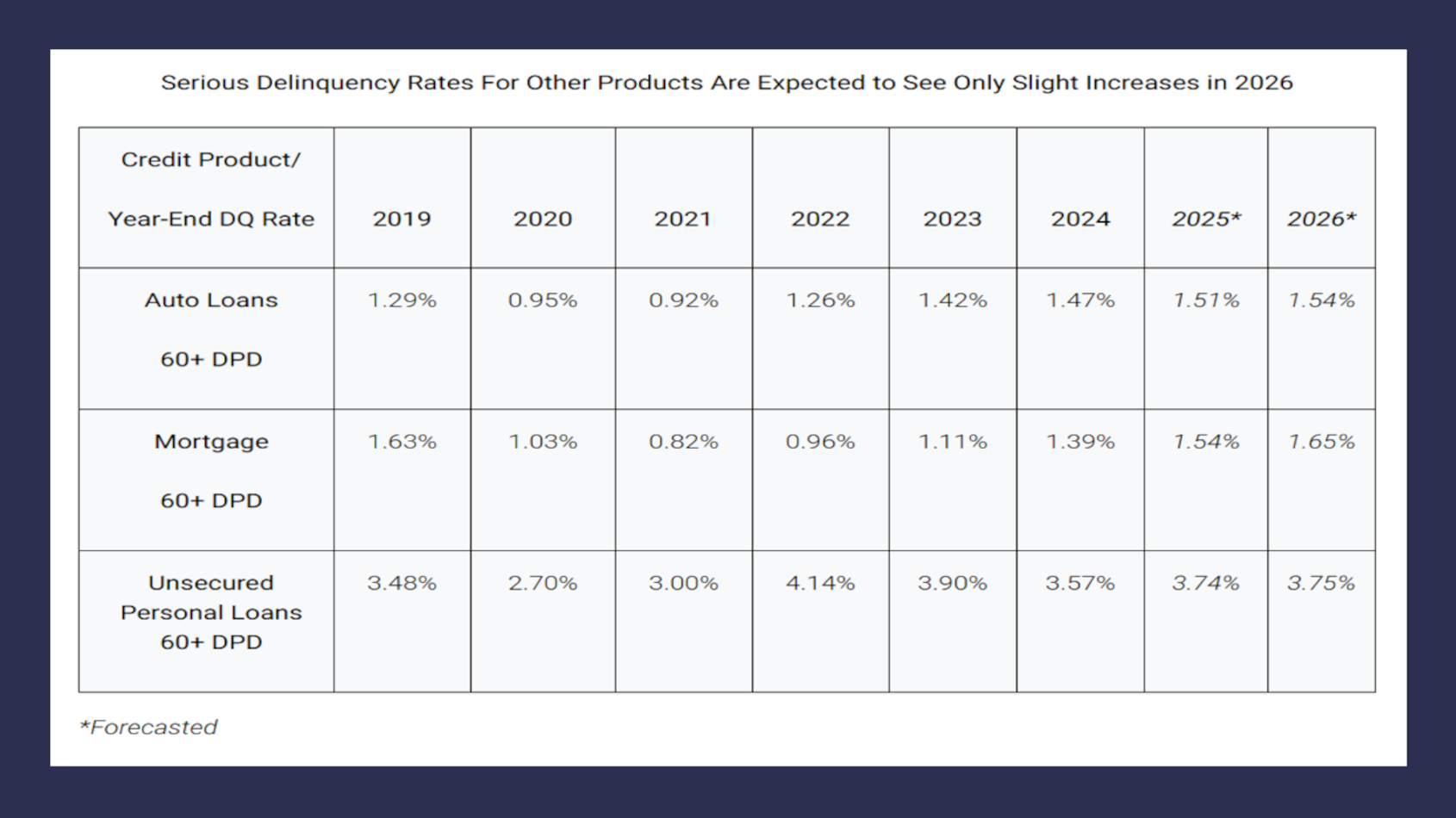

TransUnion sees auto delinquency rising for fifth straight year

Friday, Jan. 9, 2026, 11:16 AM

SubPrime Auto Finance News Staff

TransUnion acknowledged its 2026 Consumer Credit Forecast originated through a “complex backdrop,” with unemployment being one of the primary ingredients in analysts’ prediction of auto-finance delinquency rising for the fifth year in a row. And perhaps that “complex backdrop” got ... [Read More]

Primeritus Financial Services adds Hester to strategic sales team

Wednesday, Jan. 7, 2026, 01:21 PM

SubPrime Auto Finance News Staff

Primeritus Financial Services reinforced its human capital before 2025 closed. The provider of recovery, skip-tracing and remarketing services to the finance community hired Jeremy Hester to be part of its strategic sales team as senior national strategic sales executive. The ... [Read More]

PODCAST: How AI can improve repossessions with Geoff Weathersby of SVR Tracking

Wednesday, Jan. 7, 2026, 01:17 PM

SubPrime Auto Finance News Staff

Artificial intelligence helps individuals and businesses in many ways nowadays. Can AI help to sharpen the repossession process, too? Geoff Weathersby thinks so. The chief operating officer of SVR Tracking explained how on the Live Stage presented by SYCN Auto ... [Read More]

DriveItAway & Free2move launch in 9 more markets ‘at the moment consumers need it most’

Wednesday, Jan. 7, 2026, 11:13 AM

SubPrime Auto Finance News Staff

Last July, DriveItAway Holdings joined forces with Free2move, the global mobility brand of Stellantis, to launch Free2move Powered by DriveItAway, a national initiative that aims to “transform dealerships into next-generation mobility hubs.” In December, the companies announced the expansion of ... [Read More]

Initial 2026 auto financing outlook still muted despite two positive trends

Wednesday, Jan. 7, 2026, 10:57 AM

Nick Zulovich, Senior Editor

In December, consumers’ pay rose and average rates on auto financing dropped. Sounds like wonderful ingredients to get vehicles delivered and contracts booked, huh? Well, Cox Automotive interim chief economist Jeremy Robb is among the cautious contingent not ready to ... [Read More]

Protective finalizes Portfolio acquisition, its eighth since 2015

Tuesday, Jan. 6, 2026, 09:28 AM

SubPrime Auto Finance News Staff

The unofficial first business day of 2026 marked the closing of an F&I product provider acquisition first announced the day before Halloween. Protective Life Corp., a U.S. subsidiary of Dai-ichi Life Holdings, said on Monday that it has completed the ... [Read More]

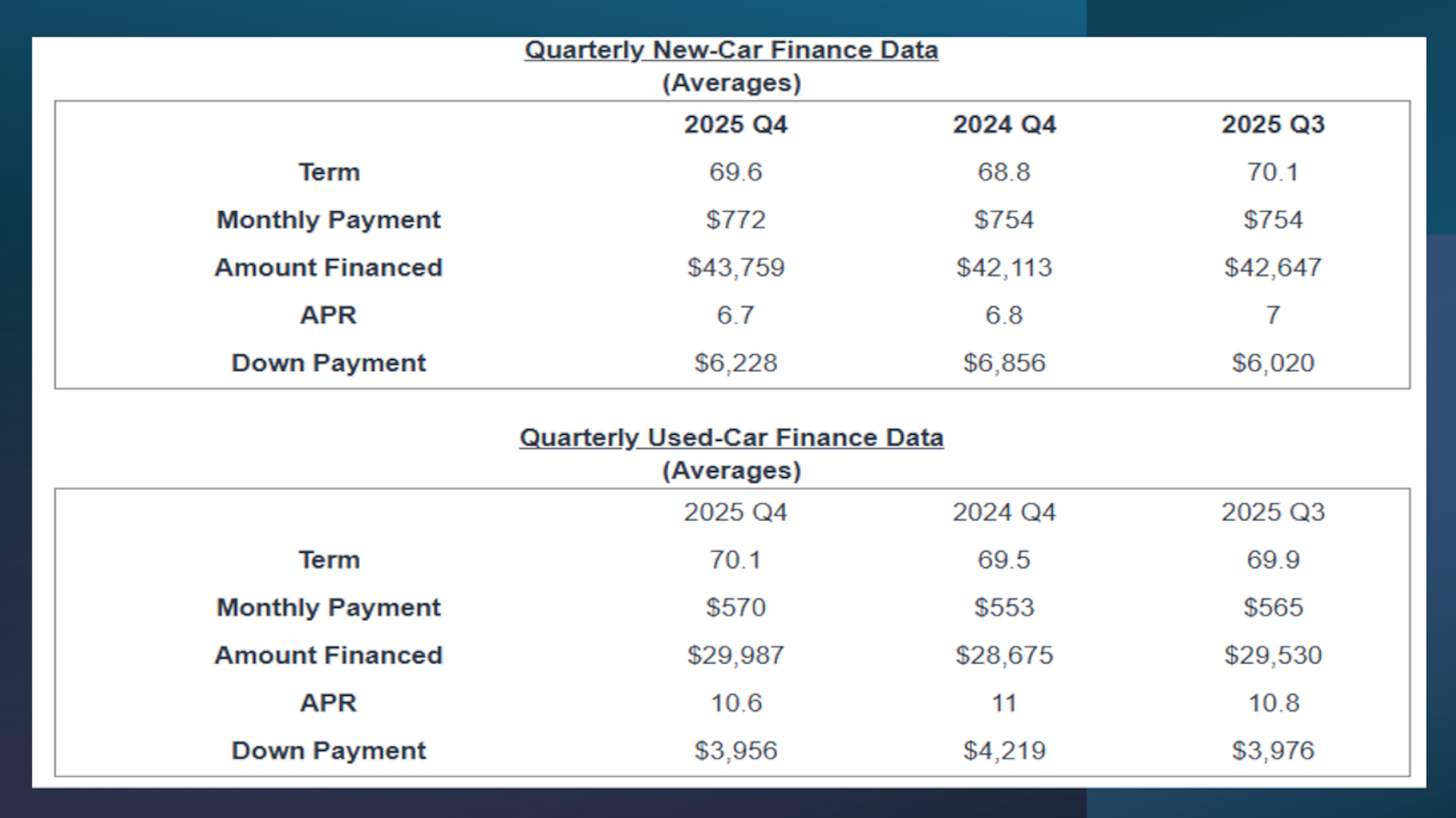

Edmunds: More than 26% of Q4 used- & new-car deliveries backed by monthly payments topping $1,000

Monday, Jan. 5, 2026, 11:29 AM

SubPrime Auto Finance News Staff

The first auto-finance number to know less than a week into 2026 might be $1,000. That’s because of the record number of consumers who took delivery of used and new cars during the fourth quarter with monthly payments of $1,000 ... [Read More]

Newest FlexPath DXP answers two affordability questions shoppers often immediately have

Monday, Jan. 5, 2026, 11:28 AM

SubPrime Auto Finance News Staff

The latest auto-finance data from Edmunds might make the newest tool from FlexPath DXP even more valuable for dealers. FlexPath DXP CEO Tarry Shebesta explained the launch of Personalized Shop-by-Payment (Personalized SBP) answers the two questions car shoppers have at ... [Read More]

Unsealed federal indictment details depth of Tricolor fraud with Chu facing multiple charges

Wednesday, Dec. 17, 2025, 03:07 PM

SubPrime Auto Finance News Staff

Explosive allegations and language surfaced on Tuesday via the unsealing of a Justice Department indictment charging Daniel Chu, the founder and former CEO of Tricolor Holdings with orchestrating a years-long financial crimes enterprise that defrauded multiple banks and other private ... [Read More]

X