A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

AutoPayPlus continues workforce development with promotion of national sales director

Wednesday, Oct. 30, 2024, 10:40 AM

SubPrime Auto Finance News Staff

AutoPayPlus by US Equity Advantage made its fourth move so far this year connected with its workforce. On Tuesday, the automated financial concierge service provider announced the promotion of Damon Walker to national sales director. In this position, AutoPayPlus said ... [Read More]

S&P Global Ratings explains why impact on auto finance is more insulated compared to other sectors after natural disasters

Tuesday, Oct. 29, 2024, 11:37 AM

SubPrime Auto Finance News Staff

The National Centers for Environmental Information (NCEI) said the 24 confirmed weather disaster events so far this year — including hurricanes Helene and Milton, as well as other storms and a wildfire event — created losses exceeding $1 billion each ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

With trailer full of hurricane relief supplies & 1,200-mile journey, Corey Cox pays it forward

Friday, Oct. 25, 2024, 02:03 PM

Joe Overby, Senior Editor

“Now, I’m very familiar with what a war zone looks like,” Corey Cox said. “So, when I say that this was a war zone, it was exactly that.” Cox, who served 13 years in the U.S. military, wasn’t describing overseas ... [Read More]

Opportunity Finance Network & MassMutual Foundation unveil $25M partnership to scale CDFIs

Friday, Oct. 25, 2024, 10:41 AM

SubPrime Auto Finance News Staff

Opportunity Finance Network (OFN) this week announced a strategic, five-year partnership with the MassMutual Foundation to launch the CDFI Innovation Initiative, a new effort designed to drive innovation, scale impact and build new infrastructure for the Community Development Financial Institution ... [Read More]

KeyPoint Credit Union tailors new auto-finance program for ITIN holders

Friday, Oct. 25, 2024, 10:40 AM

SubPrime Auto Finance News Staff

This week, KeyPoint Credit Union — an institution based in Silicon Valley — launched an auto financing program specifically designed for individual taxpayer identification number (ITIN) holders. According to the Internal Revenue Service, an ITIN is a tax processing number ... [Read More]

CFPB finalizes Personal Financial Data Rights Rule

Wednesday, Oct. 23, 2024, 10:45 AM

SubPrime Auto Finance News Staff

On Tuesday, the Consumer Financial Protection Bureau (CFPB) finalized a rule the regulator said will give consumers greater rights, privacy, and security over their personal financial data. The bureau said the Personal Financial Data Rights Rule requires financial institutions, credit ... [Read More]

Where interest rates might be by the end of 2025

Tuesday, Oct. 22, 2024, 10:29 AM

SubPrime Auto Finance News Staff

The federal funds rate set by the Federal Reserve currently sits at 4.75% to 5.00% after policymakers reduced it by 50 basis points in September. Last week during a public appearance at Stanford University, Fed governor Christopher Waller said he ... [Read More]

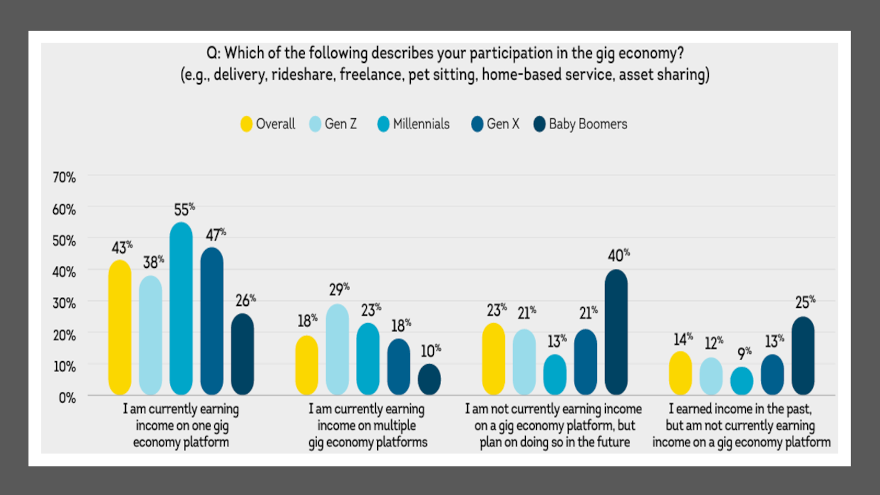

TransUnion: 62% of US adults earn money via gig economy

Monday, Oct. 21, 2024, 10:59 AM

SubPrime Auto Finance News Staff

Your underwriting department might be seeing more applicants who list their primary sources of income coming through services such as Uber or DoorDash. TransUnion wanted to get more clarity about these workers to help finance companies and other service providers. ... [Read More]

Chase sends $1M to On The Road Lending

Friday, Oct. 18, 2024, 10:11 AM

SubPrime Auto Finance News Staff

Chase is leveraging the power of transportation to help more people near Dallas and beyond. Last week, Chase announced a $1 million investment in Dallas-based On The Road Lending to get more people behind the wheel so they can earn ... [Read More]

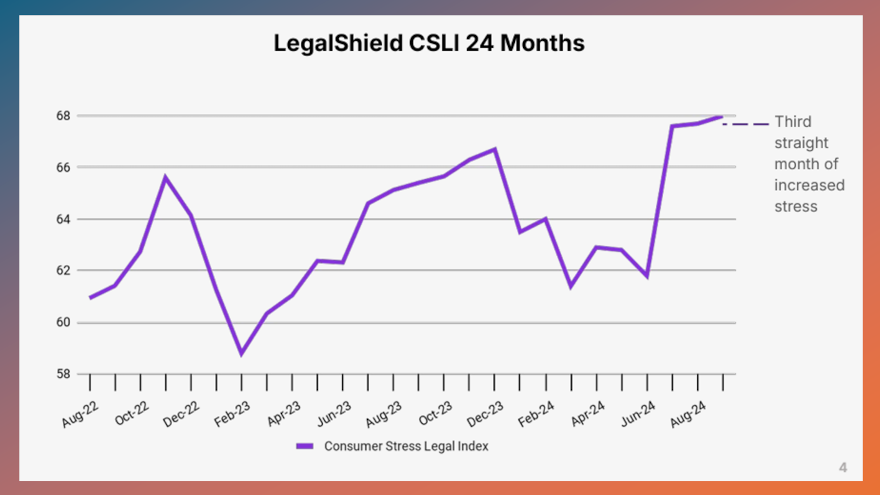

New York Fed & LegalShield notice more strain on consumer finances

Thursday, Oct. 17, 2024, 10:31 AM

SubPrime Auto Finance News Staff

The more researchers examine the current state of household finances, the more they’re uncovering plenty of negative trends. The two newest developments surfaced this week from The Federal Reserve Bank of New York’s Center for Microeconomic Data and the LegalShield ... [Read More]

X