Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

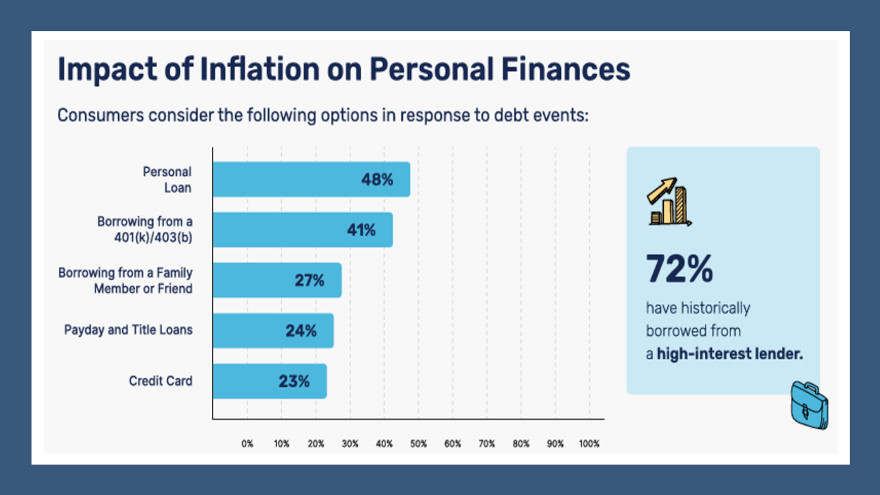

Survey: Despite notable lack of emergency funds, majority of Americans feel confident about handling unexpected expenses

Tuesday, Sep. 24, 2024, 10:28 AM

SubPrime Auto Finance News Staff

More evidence surfaced last week about how stretched family budgets are nowadays, with a survey by Kashable indicating more than 80% of Americans do not have an emergency fund. But the fintech platform that provides “socially responsible credit” and financial ... [Read More]

Launcher & OTTOMOTO partner to streamline auto-finance originations

Monday, Sep. 23, 2024, 11:33 AM

SubPrime Auto Finance News Staff

Launcher, a technology provider specializing in automotive financing originations, announced a strategic integration partnership last week with OTTOMOTO, a dealer auto retail finance platform offering a full suite of desking tools. The companies highlighted the partnership allows finance companies using ... [Read More]

StoneEagle rolls out compliance offering for product refunds, hires Apicella as VP

Monday, Sep. 23, 2024, 11:32 AM

SubPrime Auto Finance News Staff

StoneEagle recently revamped its leadership team, and last week, the F&I solutions provider ventured into the compliance business to offer cost-effective solutions for the benefit of the industry and consumers. As a part of StoneEagle’s enterprise solutions, the company that’s ... [Read More]

Safe-Guard’s leadership transition continues with new COO

Friday, Sep. 20, 2024, 10:20 AM

SubPrime Auto Finance News Staff

Less than a week after promoting two of its executives to be the company’s chief financial officer and chief risk officer, Safe-Guard Products International appointed its new chief operating officer on Thursday. Taking on the role for the provider of ... [Read More]

NAF Association highlights success of first C-Suite Retreat

Friday, Sep. 20, 2024, 10:18 AM

SubPrime Auto Finance News Staff

The National Automotive Finance Association celebrated the success of its newest in-person event — the C-Suite Retreat in San Antonio. The association highlighted its private gathering offered a rare opportunity for CEOs and senior leaders to collaborate on addressing the ... [Read More]

Experts project potential impact in auto after Fed’s 50-basis-point rate cut

Thursday, Sep. 19, 2024, 10:24 AM

Nick Zulovich, Senior Editor

The interest-rate cut by the Federal Reserve finally came on Wednesday afternoon, and it was more than what many experts anticipated. Policymakers trimmed the federal funds rate by 50 basis points. But, unfortunately, don’t expect an avalanche of car buyers ... [Read More]

ARA reveals new executive director & director of commercial operations

Wednesday, Sep. 18, 2024, 02:08 PM

SubPrime Auto Finance News Staff

American Recovery Association (ARA) now has more professionals in place to serve its membership of recovery and remarketing professionals. Cherokee Media Group previously learned ARA promoted Todd Squires to be its new executive director. And then the association announced on ... [Read More]

SAFCO makes another move, hiring new SVP of account services

Wednesday, Sep. 18, 2024, 10:58 AM

SubPrime Auto Finance News Staff

Southern Auto Finance Co. (SAFCO) continued its string of notable personnel and strategic moves on Tuesday. The latest action is hiring Noel Ortega as its new senior vice president of account services. Prior to joining SAFCO, Ortega served as senior ... [Read More]

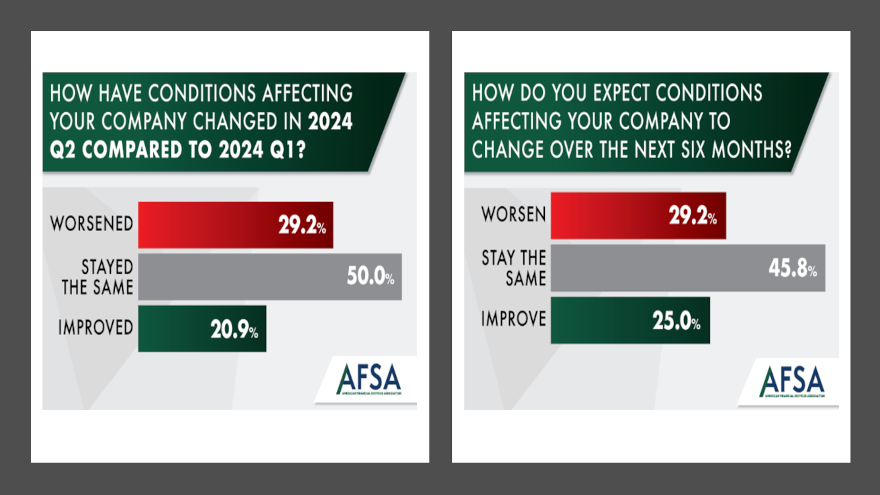

Likely interest-rate cut arriving in soft economic environment revealed in AFSA credit index

Tuesday, Sep. 17, 2024, 11:38 AM

Nick Zulovich, Senior Editor

An interest-rate cut is widely expected to arrive when the Federal Reserve announces its decision on Wednesday. But the current environment described by economic experts and research projects from the American Financial Services Association and KeyBank illustrated the significant headwinds ... [Read More]

Santander unveils expanded auto finance program to support ‘backbone of the US economy’

Monday, Sep. 16, 2024, 10:56 AM

SubPrime Auto Finance News Staff

At a time when many auto finance companies are pulling back on credit availability, Santander Consumer USA rolled out an expanded program on Monday that’s tailored specifically to applicants who can have a great impact on the entire economy. Santander ... [Read More]

X