Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

DriveItAway partners with AllShifts to help on-demand nurses gain transportation

Friday, Sep. 6, 2024, 09:46 AM

SubPrime Auto Finance News Staff

DriveItAway Holdings has formed several partnerships and relationships this year to grow its “micro-lease to purchase” technology. But the partnership announced this week might be having the most impact on DriveItAway CEO John Possumato as the company has partnered with ... [Read More]

PODCAST: More details about ongoing squeeze in non-prime financing

Thursday, Sep. 5, 2024, 03:43 PM

SubPrime Auto Finance News Staff

Open Lending senior vice president of marketing Kevin Filan made another appearance on the Auto Remarketing Podcast. This time, Filan discussed Open Lending’s newest Consumer Update, which delved into the squeeze near- and non-prime consumers are facing when trying to ... [Read More]

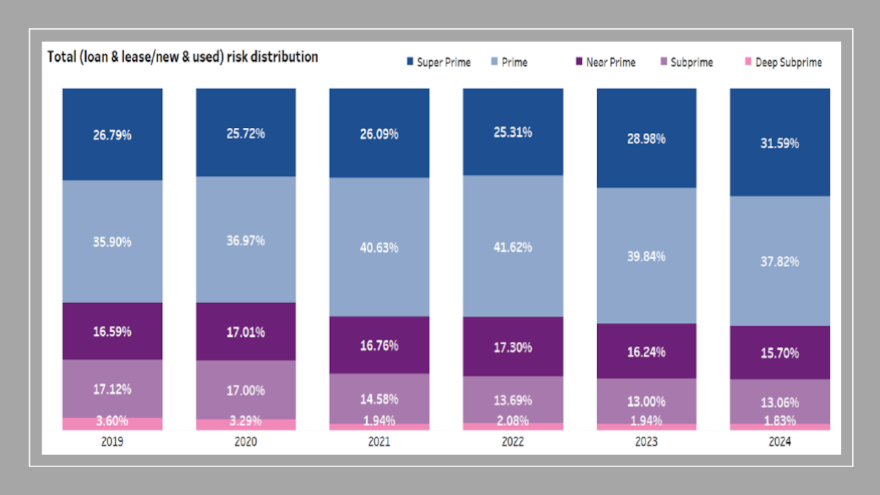

Experian Q2 data could illuminate ongoing movements involving affordability & risk

Thursday, Sep. 5, 2024, 10:30 AM

SubPrime Auto Finance News Staff

Is vehicle affordability improving for consumers? Or are finance companies not taking on as much risk? To help you decide, consider these metrics from Experian’s State of the Automotive Finance Market Report: Q2 2024 released on Thursday. Experian determined the ... [Read More]

3 questions about bankruptcy & repossessions with Weltman, Weinberg & Reis

Wednesday, Sep. 4, 2024, 01:59 PM

SubPrime Auto Finance News Staff

Shareholder Milos Gvozdenovic and attorney Garry Masterson of Weltman, Weinberg & Reis Co. recently addressed some of the most common questions finance companies have about bankruptcy and vehicle repossession. Gvozdenovic and Masterson began by touching on the question that might ... [Read More]

Auto refinancing companies optimistic about future growth

Wednesday, Sep. 4, 2024, 11:13 AM

SubPrime Auto Finance News Staff

A pair of firms that specialize in auto refinancing — iLending and Way.com — are optimistic about their prospects, especially if the Federal Reserve starts to lower interest rates this month. iLending president Nick Goraczkowski described what it’s been like ... [Read More]

Top 10 vehicles that end up being totaled following crashes

Wednesday, Sep. 4, 2024, 11:13 AM

SubPrime Auto Finance News Staff

A metric that finance companies often watch is the number of vehicles in their portfolio that become a total loss when involved in a crash. Levine and Wiss — a personal injury attorney law firm in New York — recently ... [Read More]

Rhode Island AG continues active pursuit of dealerships with $1M settlement

Tuesday, Sep. 3, 2024, 10:19 AM

SubPrime Auto Finance News Staff

Six more dealerships reached an agreement with the Rhode Island attorney general to settle allegations of deceptive sales practices in the finance office. The settlement announced in August has the dealerships paying more than $1 million in refunds and penalties. ... [Read More]

AFSA asks NH officials to delay major changes to auto financing processes

Friday, Aug. 30, 2024, 10:37 AM

SubPrime Auto Finance News Staff

This week, the American Financial Services Association followed up on its letter to New Hampshire Banking Commission with a petition to state officials asking for a delay of major restructuring of documents associated with the financing and retailing of vehicles ... [Read More]

Longtime Bank of America exec joins Millennium as COO

Wednesday, Aug. 28, 2024, 03:06 PM

SubPrime Auto Finance News Staff

Millennium Capital and Recovery Corp. named its new chief operating officer on Wednesday, selecting former Bank of America senior vice president Don Gordon for the role. The provider of nationwide asset recovery management, skip-tracing and remarketing said Gordon will lead ... [Read More]

Consumer advocates urge CFPB to keep digging with Auto Finance Data Pilot

Wednesday, Aug. 28, 2024, 11:18 AM

SubPrime Auto Finance News Staff

In June, the Consumer Financial Protection Bureau shared seven initial findings from its Auto Finance Data Pilot, deployed in February 2023. A trio of consumer advocates believe the CFPB’s work on this project is far from complete. Those organizations recently ... [Read More]

X