Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Auto credit availability in November climbed to highest point in 3 years

Friday, Dec. 12, 2025, 10:16 AM

SubPrime Auto Finance News Staff

Perhaps dealers aren’t expecting an immediate lift from the Federal Reserve lowering interest rates for the third time this year. But overall credit availability already appears to be as good as it’s been in about three years. Cox Automotive reported ... [Read More]

FTC begins to send more than $9.6M to consumers impacted by CarShield

Friday, Dec. 12, 2025, 10:07 AM

SubPrime Auto Finance News Staff

The Federal Trade Commission said this week it is now sending checks totaling more than $9.6 million to eligible consumers impacted by CarShield’s misleading claims about its vehicle service contracts. The regulator recapped that last July, CarShield, a seller of ... [Read More]

Dealers not expecting immediate sales jolt from third interest-rate cut of the year

Thursday, Dec. 11, 2025, 10:58 AM

Nick Zulovich, Senior Editor

On Wednesday, the Federal Reserve lowered the federal funds rate for the third time this year, reducing the range to 3.5% to 3.75%. The latest Cox Automotive Dealer Sentiment Index showed the economy remains the top factor holding back business, ... [Read More]

PODCAST: Cutting keys & cutting costs during repossessions and recoveries

Wednesday, Dec. 10, 2025, 11:56 AM

SubPrime Auto Finance News Staff

Drawing standing-room-only attendance in the second-largest setting at Used Car Week 2025, Ryan Miller led a six-executive panel session that focused on one of the most complex challenges in all of repossessions and recoveries. Now available through this episode of ... [Read More]

PODCAST: 4 experts on automotive & the economy

Wednesday, Dec. 10, 2025, 11:53 AM

SubPrime Auto Finance News Staff

Used Car Week 2025 again brought together experts who can explain which parts of the economy impact automotive most. For example, this year’s event included views from Laura Wehunt of Black Book, Tim Gill of the American Financial Services Association, ... [Read More]

Connecting auto finance, risk management & interest rates ahead of Fed’s last policy meeting of year

Tuesday, Dec. 9, 2025, 10:23 AM

Nick Zulovich, Senior Editor

The Federal Reserve will make its final decision about interest rates this year on Wednesday. And at least one member of the Federal Open Market Committee (FOMC) appears to be looking at auto finance when considering another rate cut. At ... [Read More]

COMMENTARY: A dealer’s 2026 strategy guide for F&I in the new age of affordability

Monday, Dec. 8, 2025, 09:55 AM

Rick Kurtz, Protective Asset Protection

The automotive industry in 2025 was defined not by a single dominant trend, but by a complex interplay of affordability crises, global trade adjustments, and a bifurcated consumer market. For auto dealers, addressing this landscape means accepting that the traditional ... [Read More]

Ascent Dealer Services hires former Protective executive to be VP of acquisition

Friday, Dec. 5, 2025, 09:59 AM

SubPrime Auto Finance News Staff

Ascent Dealer Services, a provider of F&I performance, training, and profitability solutions, recently named Rob Johnson as its new vice president of acquisition. Johnson possesses more than eight years of specialized experience in the automotive and F&I sector. He began ... [Read More]

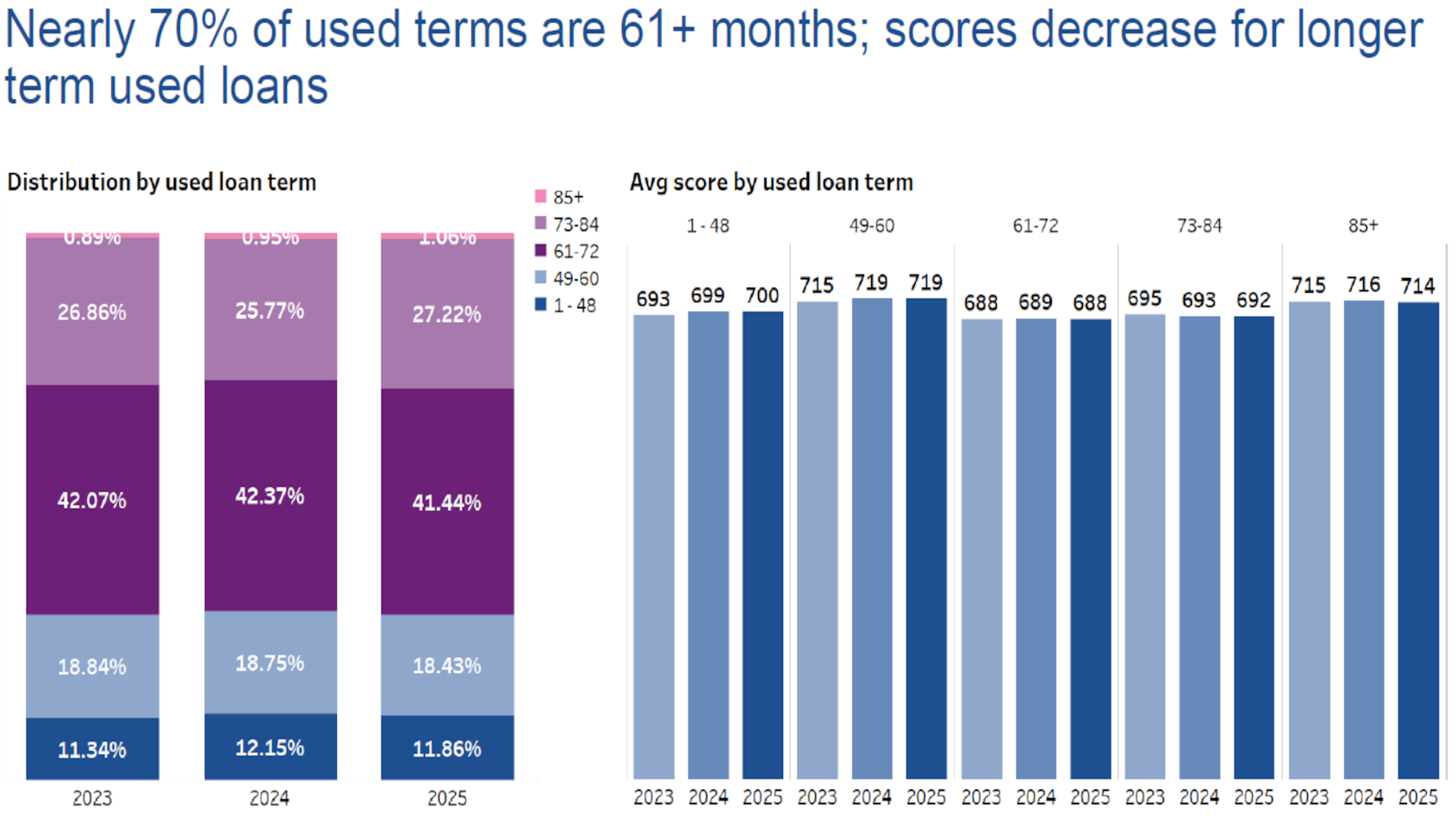

Growing volume of paper booked in Q3 has terms stretching toward 2033

Thursday, Dec. 4, 2025, 10:58 AM

Nick Zulovich

Imagine an excited individual who financed and took delivery of a used vehicle on Labor Day. Perhaps it was a gently used, older car or maybe even a certified pre-owned model. There’s a possibility that contract won’t reach its payoff ... [Read More]

GALR & MVTRAC share important dialogue at Used Car Week

Wednesday, Dec. 3, 2025, 03:11 PM

SubPrime Auto Finance News Staff

One of the purposes of Used Car Week is bringing various industry segments together for constructive conversations. An example of that outcome surfaced when the Georgia Association of Licensed Repossessors (GALR) announced that it had “productive and forward-looking industry dialogue” ... [Read More]

X