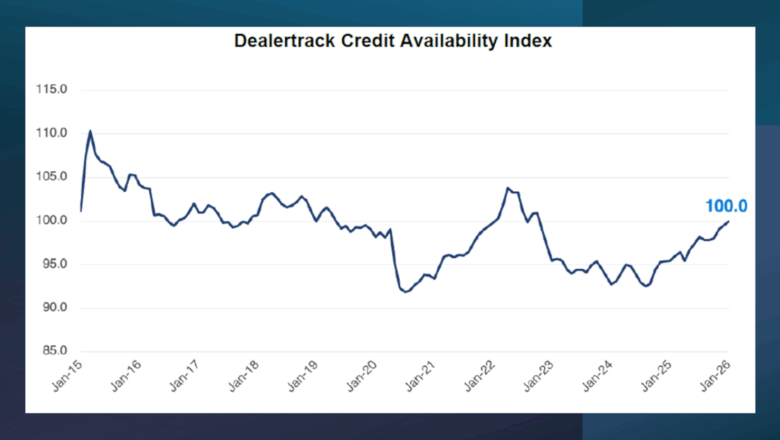

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

Voting closes on President’s Day for 10 industry awards to be given at NARS 2026

Wednesday, Feb. 11, 2026, 01:00 PM

Labor scene still murky, creating potential headwind for automotive

Wednesday, Feb. 11, 2026, 10:38 AM

Cox Automotive on the vanishing divide between wholesale & retail

Used Car Week 2025 extended the ongoing conversation about how the wholesale and retail portions of the used-car market aren’t quite as distinct as they used to be. Cherokee Media Group’s Bill Zadeits hosted a fireside chat about the subject ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

2025 Women in Remarketing honorees describe their careers, industry changes & more

One of the foundational parts of Used Car Week each year is the lively conversation among the Women in Remarketing honorees. Moderated again by Brenda Rios of award program sponsor, Ally, hear the valuable perspectives and wisdom from some of ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

Alistair Weaver on Edmunds Top Rated Awards

Edmunds editor-in-chief Alistair Weaver joins the Auto Remarketing Podcast from the NADA Show 2026 expo hall, where he talks with Cherokee Media Group senior editor Joe Overby about the Edmunds Top Rated finalists at the convention, how dealers can use ... Listen Here

Thursday, Feb. 12, 2026, 05:41 PM

Equifax Rolls Out Tool for Improved Targeting of Pre-approved Loan Offers

Friday, Oct. 19, 2012, 12:00 AM

Nick Zulovich

ATLANTA — Equifax contends that automotive lenders can now receive unprecedented levels of marketing intelligence to more effectively prescreen and target prospective consumers for pre-approved offers with its newest tool rolled out this week — True In-Market Propensity (TIP) Scores. ... [Read More]

Edmunds: Subprime Borrowing Pushes Rebound of Dealer-Financed Sales

Friday, Oct. 19, 2012, 12:00 AM

Nick Zulovich

SANTA MONICA, Calif. — Edmunds.com said this week that dealer financing is back to pre-recession levels after bottoming out in 2009. Analysts contend a key driver of this resurgence is the revival of the subprime market, which accounted for a ... [Read More]

S&P/Experian: Auto Loans Tick Higher Again as Most Consumer Credit Default Rates Hit New Lows

Wednesday, Oct. 17, 2012, 12:00 AM

Nick Zulovich

NEW YORK — The upward bounce from the reading's historic low continued in September as the S&P/Experian Consumer Credit Default Indices showed auto loan defaults climbed for the second month in a row. Analsyts from S&P Dow Jones Indices and ... [Read More]

FinCo Management Expands Deep Subprime Loans and Leases into 31 States

Wednesday, Oct. 17, 2012, 12:00 AM

Nick Zulovich

MARBLEHEAD, Mass. — FinCo Management, a provider of deep subprime dealer financing, is expanding its Financing Alternatives and Servicing Today program into 31 states, covering nearly 75 percent of the U.S. population. The company said the program should be operating ... [Read More]

Dealers United Chooses DealerTrack as Preferred DMS Provider

Wednesday, Oct. 17, 2012, 12:00 AM

Nick Zulovich

LAKE SUCCESS, N.Y. — DealerTrack announced today the company has been selected as the recommended DMS provider for Dealers United, a national purchasing network for privately owned dealers. As part of the agreement, officials said Dealers United will market DealerTrack ... [Read More]

CU Xpress Lease’s September Volume Establishes Year-High

Wednesday, Oct. 17, 2012, 12:00 AM

Nick Zulovich

HAUPPAUGE, N.Y. — CU Xpress Lease said its September activity reached a one-year high showing growth of 64.88 percent in lease volume year-over-year and 36 percent year to date. Officials said the vehicle leasing program available to current credit union ... [Read More]

Q3 Auto Originations Climb at Both Chase, Wells Fargo

Monday, Oct. 15, 2012, 12:00 AM

Nick Zulovich

NEW YORK and SAN FRANCISCO — Both Chase and Wells Fargo enjoyed positive developments in connection with their third-quarter auto loan origination volume performances. Starting with Chase, the company indicated its Q3 originations totaled $6.3 billion, a figure 7 percent ... [Read More]

CLCalc.com Offers Loan Widget for Dealer Websites

Monday, Oct. 15, 2012, 12:00 AM

Nick Zulovich

SEATTLE — Positioned as a tool dealers can embed into their websites, officials from CLCalc.com recently launched a versatile tool with five different calculators aimed at making vehicle loan amounts more understandable. The site contends its tool can help dealers ... [Read More]

Ally Financial Declares Dividends on Preferred Stock

Monday, Oct. 15, 2012, 12:00 AM

Nick Zulovich

DETROIT — Ally Financial's board of directors recently declared quarterly dividend payments for certain outstanding preferred stock, continuing a stream heading to the U.S. Department of the Treasury. Officials indicated these dividends are payable on Nov. 15. The company explained ... [Read More]

RDN: August Recovery Volume Up From July, Still Off Year-Over-Year

Monday, Oct. 15, 2012, 12:00 AM

Nick Zulovich

REDWOOD CITY, Calif. — The most recent RDN Monthly Analytics Update showed August recovery volumes increased 3 percentage points from July levels. However, the reading also ended up 17 points below year-ago levels. RDN indicated August recovery orders rose 4 ... [Read More]

X