Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

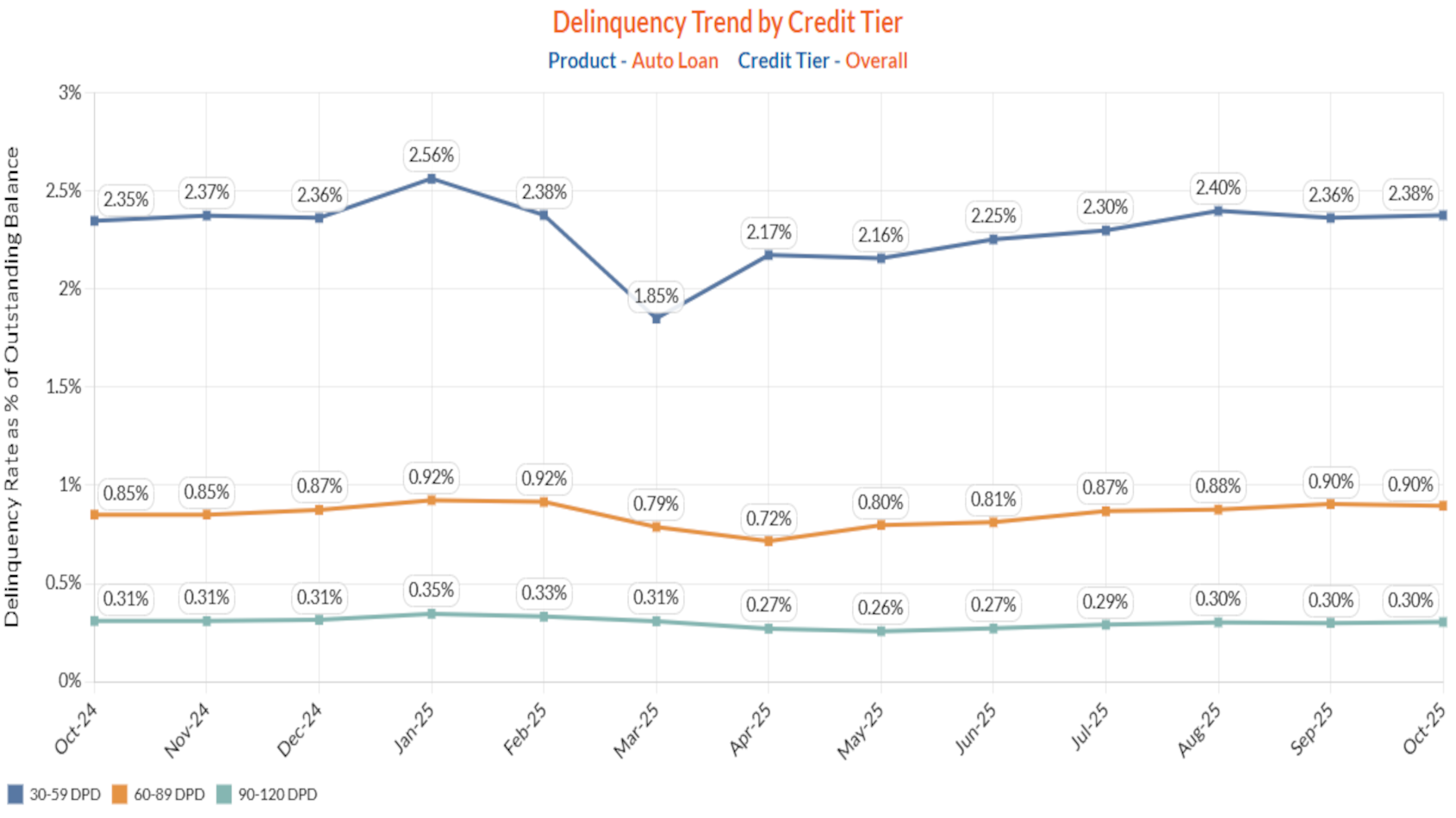

S&P Global Ratings: Extensions exceeding pre-pandemic level

Wednesday, Dec. 3, 2025, 10:56 AM

Nick Zulovich, Senior Editor

Evidently, finance companies are instructing their collections departments to work even harder with customers who are having trouble maintaining their monthly payments. According to S&P Global Ratings’ latest U.S. auto loan asset-backed securities data shared with Cherokee Media Group on ... [Read More]

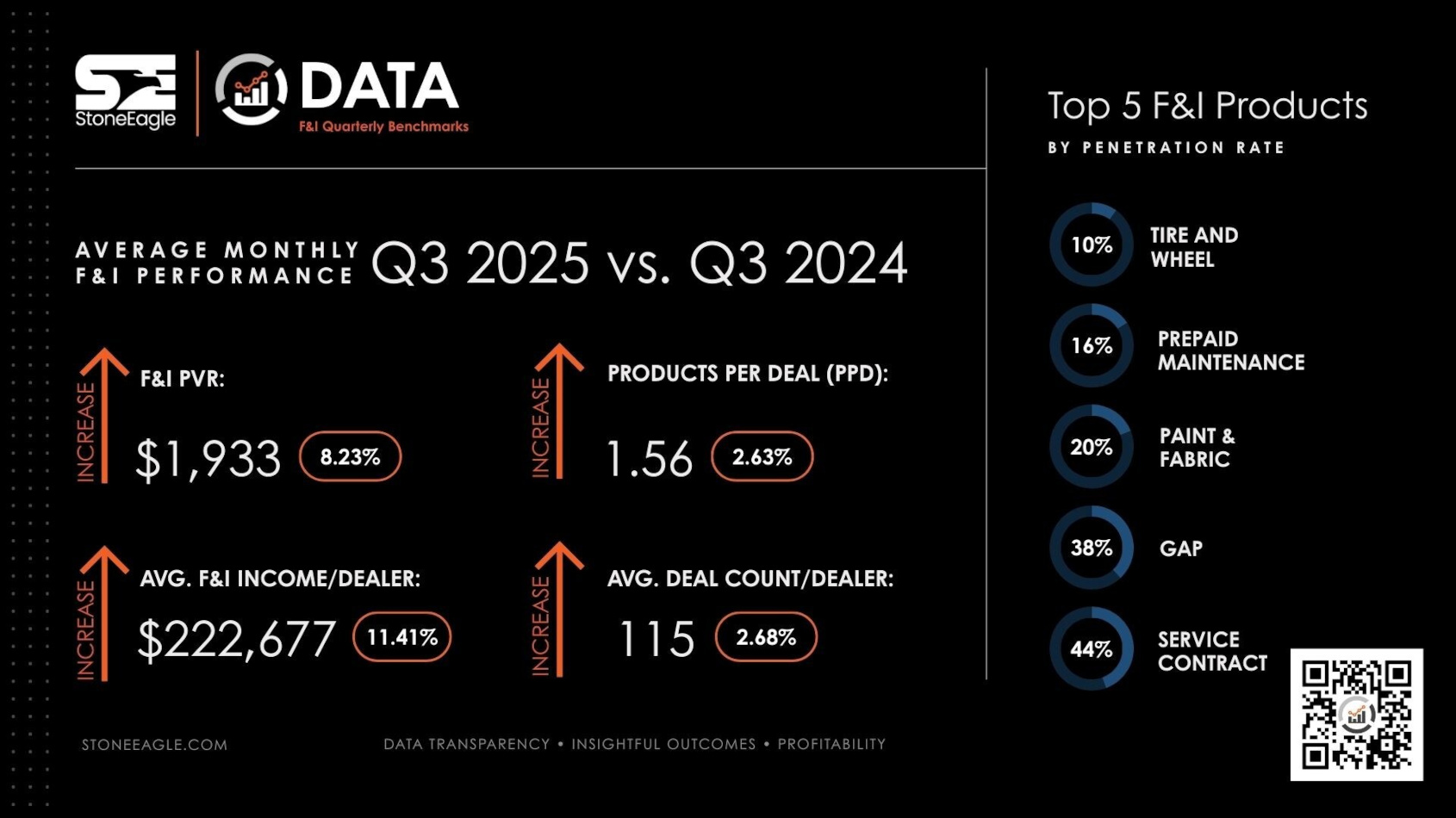

StoneEagle Q3 data shows steady times in dealer F&I departments

Tuesday, Dec. 2, 2025, 10:21 AM

SubPrime Auto Finance News Staff

StoneEagle on Tuesday highlighted how it was a steady quarter in dealership F&I departments amid some gross-profit turbulence seen in July, August and September. Third-quarter information included in the StoneEagleDATA F&I Benchmark Report showed stable F&I performance across key metrics. ... [Read More]

CFPB unveils ‘humility pledge’ for supervision division

Monday, Dec. 1, 2025, 11:48 AM

SubPrime Auto Finance News Staff

Perhaps compliance departments at auto lenders and other companies involved in financial services had something extra to be thankful for last week. Just ahead of Thanksgiving, the Consumer Financial Protection Bureau made significant changes to how its supervision division conducts ... [Read More]

AutoPayPlus welcomes new agency development manager

Monday, Dec. 1, 2025, 11:47 AM

SubPrime Auto Finance News Staff

AutoPayPlus by US Equity Advantage continued its recent string of moves by announcing the appointment of Steven Weir as agency development manager. In this role, the automated financial concierge service said Weir will be responsible for building and supporting strong ... [Read More]

Weltman, Weinberg & Reis adds 5 attorneys to Chicago office, donates to Feeding America network

Wednesday, Nov. 26, 2025, 01:48 PM

SubPrime Auto Finance News Staff

Along with making donations to local food banks and pantries in the Feeding America network, Weltman, Weinberg & Reis Co., added to its stable of legal professionals at its Chicago office. This month, the firm welcomed five new attorneys: Tresina ... [Read More]

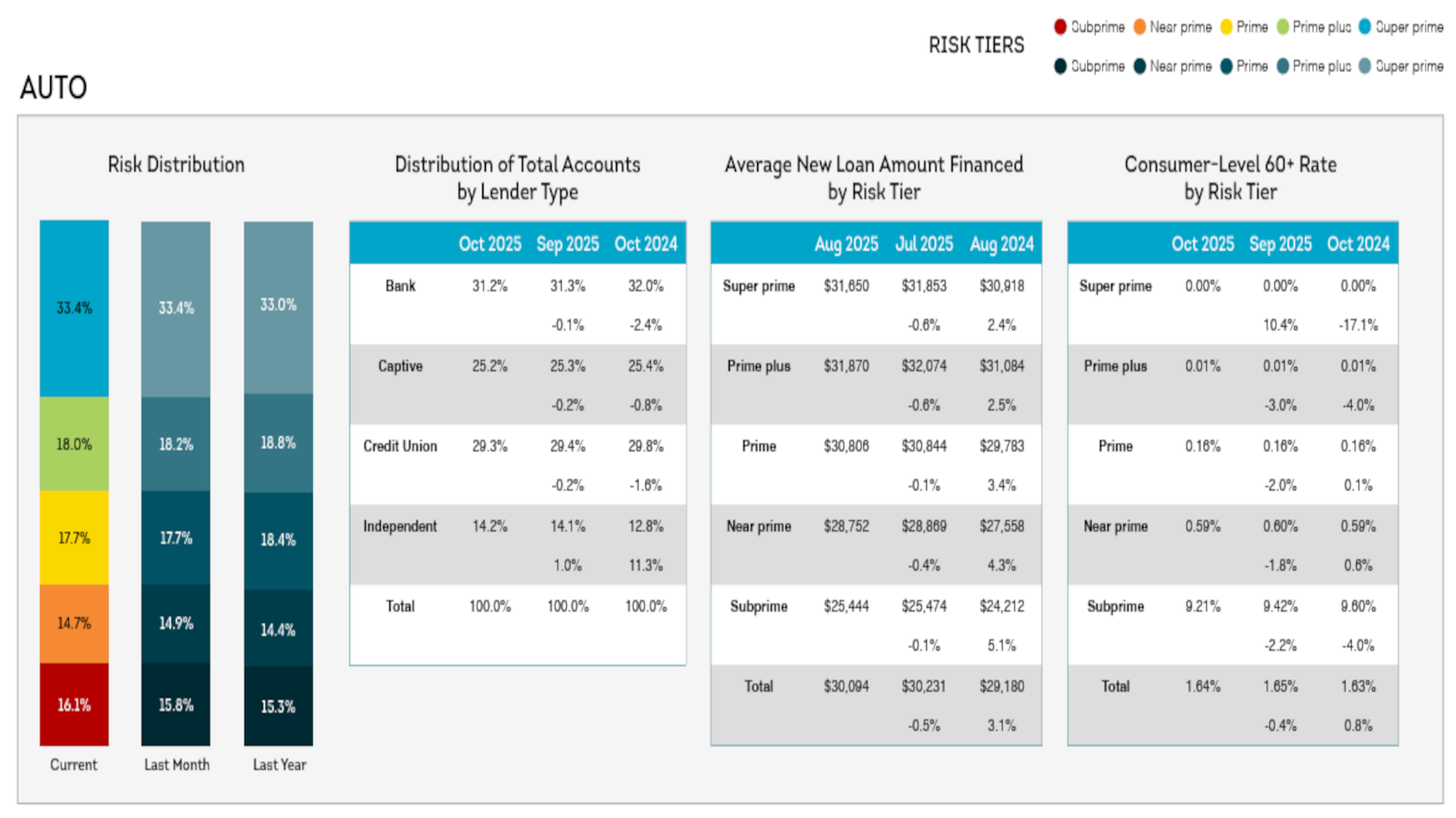

Auto snippets from TransUnion’s October 2025 Credit Industry Snapshot

Wednesday, Nov. 26, 2025, 10:07 AM

SubPrime Auto Finance News Staff

Are auto-finance providers taking on more risk or are there simply more consumers who fall into the subprime credit tier? Here some more data to consider. As Cox Automotive’s information showed credit access improved a bit in October, TransUnion’s October ... [Read More]

October data from Cox Automotive & VantageScore shows expanded credit access but growing delinquency

Tuesday, Nov. 25, 2025, 10:21 AM

SubPrime Auto Finance News Staff

You can make your own judgements about the state of the credit market based on October data from Cox Automotive and VantageScore. In October, Cox Automotive reported, the Dealertrack Credit Availability Index resumed its upward trend of improved credit access ... [Read More]

InterVest to acquire Flagship Credit Acceptance with Landy set to be CEO

Monday, Nov. 24, 2025, 10:40 AM

SubPrime Auto Finance News Staff

The next chapter in Jim Landy’s career in auto finance will arrive through another acquisition involving a lender and an investment firm. Last week, Flagship Credit Acceptance announced that affiliates of InterVest Capital Partners, a New York-based specialty finance investment ... [Read More]

PAR hires Dave Baker as vice president

Friday, Nov. 14, 2025, 01:26 PM

SubPrime Auto Finance News Staff

OPENLANE subsidiary PAR has a new vice president — someone familiar to the repossession and recovery industries. Coming aboard with three decades of experience spanning corporate operations, law enforcement, and compliance management is Dave Baker, who will serve as the ... [Read More]

Equifax launches new anti-money laundering solutions to help banks, credit unions & financial services companies

Friday, Nov. 14, 2025, 10:16 AM

Nick Zulovich

Equifax doesn’t want financial services firms and related industries to land in trouble for not meeting anti-money laundering (AML) mandates. So on Friday, Equifax introduced new AML compliance solutions designed to ease the burden of regulatory compliance by flagging potential ... [Read More]

X