Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

TransUnion trying to clean up credit washing with new fraud detection solution

Friday, Nov. 14, 2025, 10:16 AM

SubPrime Auto Finance News Staff

TransUnion is trying to help the financial services industry clean up the proliferation of credit washing that’s impacting auto finance and beyond. To combat credit washing — the practice of removing legitimate, accurate and non-obsolete credit data from credit profiles ... [Read More]

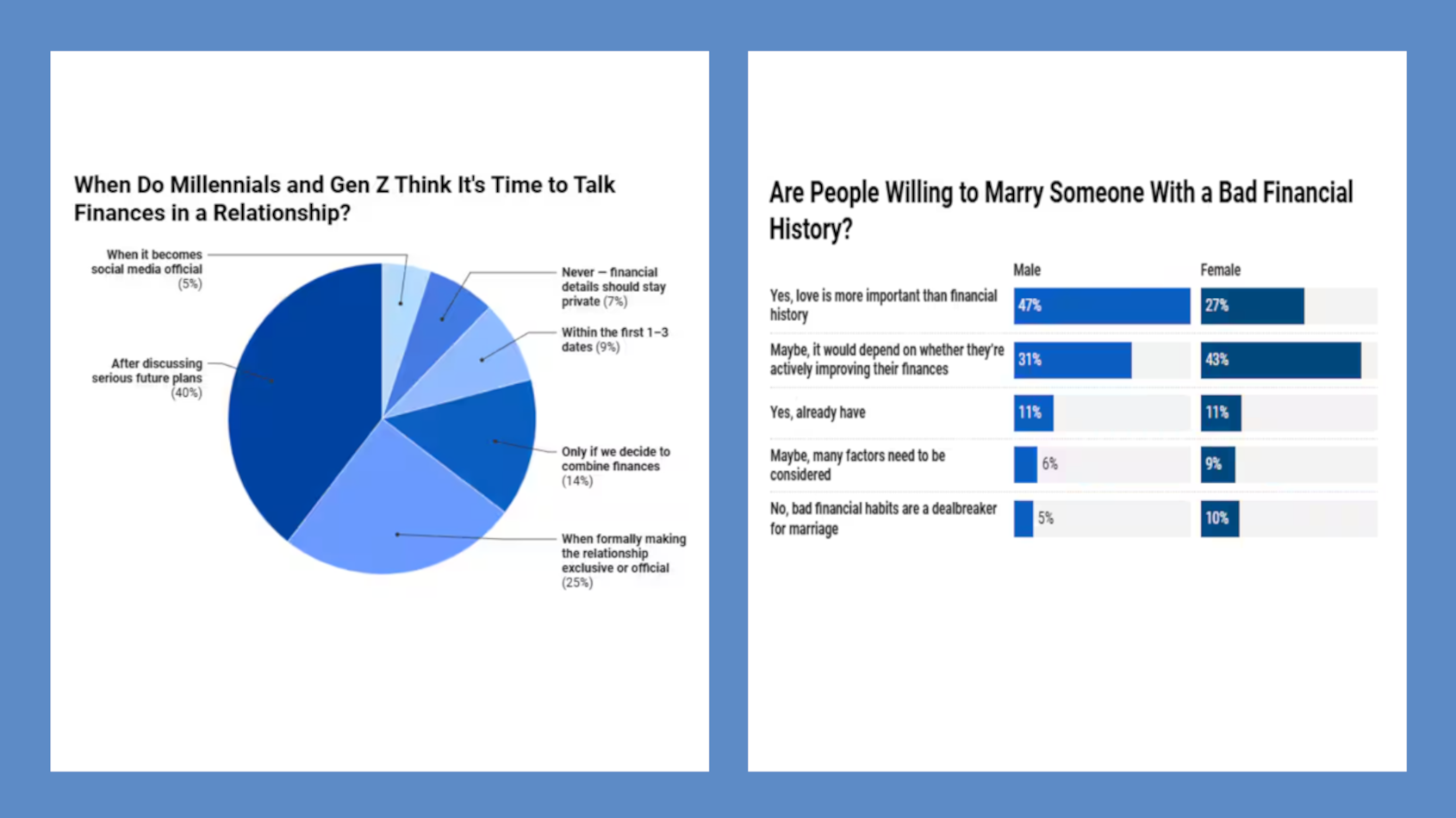

Credit One Bank survey asks, ‘Would you date someone with bad credit?’

Thursday, Nov. 13, 2025, 10:15 AM

SubPrime Auto Finance News Staff

Being in the subprime credit tier not only can make it more difficult to secure auto financing, but it might make it more challenging to have a personal relationship, too. In a new nationwide survey of 1,000 young adults, Credit ... [Read More]

Multiple discussions about repossessions & recoveries on deck for Used Car Week

Wednesday, Nov. 12, 2025, 12:54 PM

SubPrime Auto Finance News Staff

Repossessions and recoveries will be one of the main topics covered during Used Car Week, which begins on Monday at the Red Rock Resort in Las Vegas. In fact, the first session of the entire event is a discussion with ... [Read More]

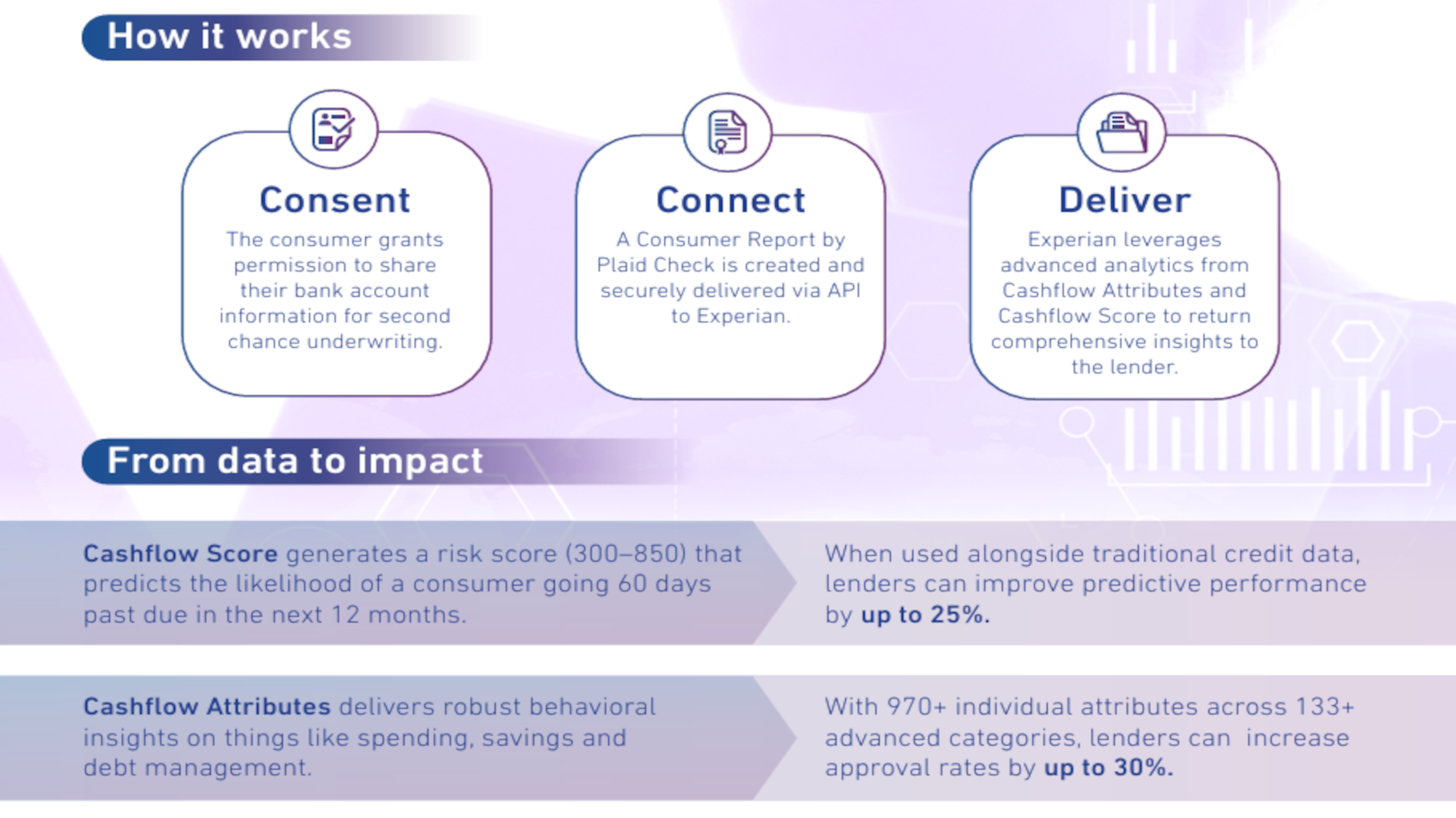

Experian launches new tool to combine credit, cash flow & alternative data into single score

Wednesday, Nov. 12, 2025, 11:48 AM

SubPrime Auto Finance News Staff

This week, Experian rolled out what the company said is the most advanced credit decisioning model it has ever released, marking a “positive milestone in Experian’s mission to help increase fair access to credit.” The company highlighted the Experian Credit ... [Read More]

PODCAST: Used Car Week Hall of Famer Becky Igo of Allied Solutions

Tuesday, Nov. 11, 2025, 10:48 AM

SubPrime Auto Finance News Staff

Becky Igo remembers the first few business trips she made going to industry conferences at a time when things like pay phones and fax machines were critical business-development tools. Now more than four decades later, the regional vice president for ... [Read More]

AutoPayPlus highlights series of technology, compliance & organizational advancements

Monday, Nov. 10, 2025, 11:42 AM

SubPrime Auto Finance News Staff

AutoPayPlus by US Equity Advantage, an automated financial concierge service, announced that it has achieved a series of technology, compliance, and organizational advancements designed to deliver greater efficiency, accuracy and security for its dealer partners. First, the company said it ... [Read More]

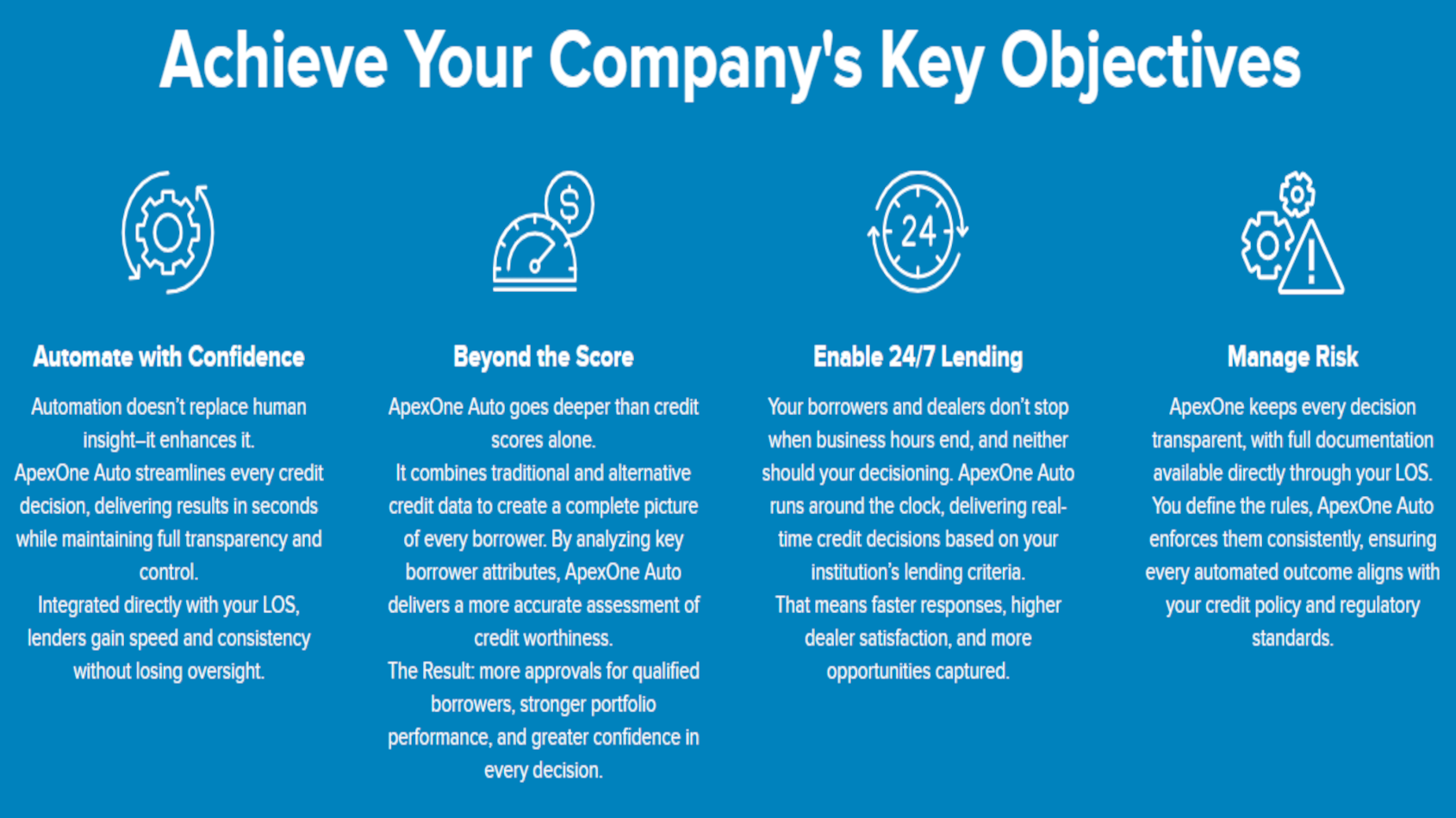

Open Lending unveils ApexOne Auto so lenders can review deeper pool of potential customers

Monday, Nov. 10, 2025, 11:34 AM

SubPrime Auto Finance News Staff

Last week, Open Lending Corp. announced the launch of ApexOne Auto, an advanced decisioning platform that expands the company’s capabilities to serve the full spectrum of auto-finance customers. The provider of automotive lending enablement and risk analytics solutions for financial ... [Read More]

Vitu bookends 2025 with acquisitions; this time of DDI Technology

Friday, Nov. 7, 2025, 09:59 AM

SubPrime Auto Finance News Staff

Vitu began the year by successfully closing its acquisition of the Dealertrack registration and titling businesses from Cox Automotive. And the innovator in vehicle-to-government (V2Gov) technology is rounding out the year with another acquisition. Vitu announced on Friday that it ... [Read More]

LCT’s Refund Control now aligns with new industry standards set by 3 associations

Friday, Nov. 7, 2025, 09:58 AM

SubPrime Auto Finance News Staff

Lender Compliance Technologies (LCT) said Thursday it secured “an important milestone for the industry” in connection with its Refund Control platform. The provider of a tool for managing voluntary protection product (VPP) cancellations and refunds announced that its platform fully ... [Read More]

2025 Repossession Agent of the Year: Phil Hanks of Connect 1 Recovery

Thursday, Nov. 6, 2025, 10:34 AM

Nick Zulovich, Senior Editor

Phil Hanks spent more than 17 years in corporate positions associated with the recovery industry. Much of that time was with Manheim, but Hanks also held leadership positions with Primeritus Financial Services and MBSi. Then in April 2013, Hanks established ... [Read More]

X