Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

2025 Loss Mitigation Executive of the Year: Craig Paterson of GM Financial

Wednesday, Nov. 5, 2025, 02:23 PM

Nick Zulovich, Senior Editor

Auto loans and retail installment contracts are often referred to by industry executives as paper. When Craig Paterson began his career in automotive, many of the tasks he had to complete were done on paper, too. Much has changed in ... [Read More]

Lender executives & industry experts distill current status of subprime auto finance

Wednesday, Nov. 5, 2025, 10:48 AM

Nick Zulovich, Senior Editor

Suspicions are intensifying about the current health of auto finance, especially within the subprime space stemming from the bankruptcy filings of Tricolor Holdings and PrimaLend. For example, the first question from an investment analyst during Carvana’s quarterly conference call last ... [Read More]

How Protective plans to leverage past F&I acquisitions to make most of upcoming Portfolio addition

Tuesday, Nov. 4, 2025, 10:39 AM

Nick Zulovich, Senior Editor

Rick Kurtz, senior vice president and chief distribution officer for Protective Asset Protection, spent a few minutes with Cherokee Media Group on Thursday after the company entered into an agreement to acquire Portfolio Holding and its subsidiaries from Abry Partners. ... [Read More]

White Label Holding acquires National Auto Lenders

Monday, Nov. 3, 2025, 04:08 PM

SubPrime Auto Finance News Staff

Another auto-finance company specializing in the subprime space now has new ownership. White Label Holding, a U.S.-based financial group specializing in integrated automotive lending solutions, on Monday announced the full acquisition of National Auto Lenders, which is a non-prime auto ... [Read More]

NextGear Capital hires 3 new execs, unveils redesigned website

Monday, Nov. 3, 2025, 12:27 PM

SubPrime Auto Finance News Staff

In an effort “bring fresh energy, diverse perspectives and deep expertise to the organization,” NextGear Capital recently added three new members to its senior leadership team along with rolling out a revamped website. Executives joining the inventory finance company for ... [Read More]

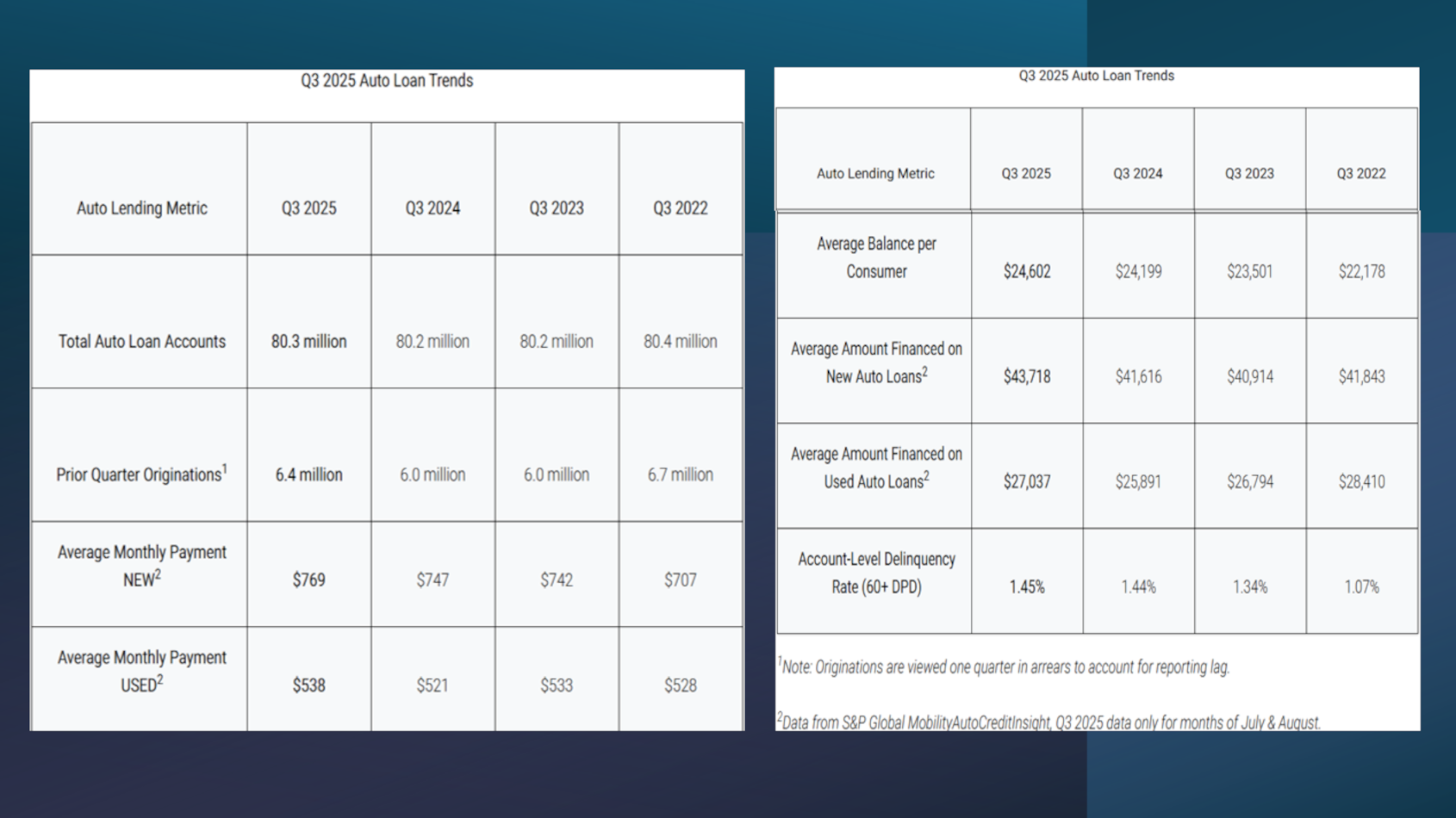

TransUnion spots ‘pre-pandemic norms’ in newest auto-finance analysis

Monday, Nov. 3, 2025, 12:26 PM

SubPrime Auto Finance News Staff

Experts are seeing auto financing “trending back toward pre-pandemic norms” based data contained in TransUnion’s Q3 2025 Credit Industry Insights Report (CIIR). TransUnion reported on Monday that originations rose 5.2% year-over-year to 6.7 million, supported by Federal Reserve rate cuts ... [Read More]

Experts explain auto-finance & general-economy implications after another rate cut comes during ‘challenging situation’

Thursday, Oct. 30, 2025, 12:24 PM

Nick Zulovich, Senior Editor

The primary result of this week’s meeting of the Federal Open Market Committee (FOMC) was the Federal Reserve reducing the federal funds rate below 4% for the first time since 2022. The reduction of the target rate to 3.75% to ... [Read More]

Protective to acquire Portfolio, enhancing dealer wealth and F&I solutions

Thursday, Oct. 30, 2025, 10:39 AM

SubPrime Auto Finance News Staff

Two well-known names in the F&I and reinsurance arenas — Protective Asset Protection and Portfolio — are now on track to be part of the same organization serving dealerships. On Thursday morning, Protective Life Corp., a U.S. subsidiary of Dai-ichi ... [Read More]

ARA elects new president, gives 6 awards during annual convention

Wednesday, Oct. 29, 2025, 02:38 PM

SubPrime Auto Finance News Staff

Along with handing out six industry awards, the American Recovery Association elected new board leadership during its annual convention last week in Reno, Nev. And there is a new president of the association, as the membership elected Todd Case of ... [Read More]

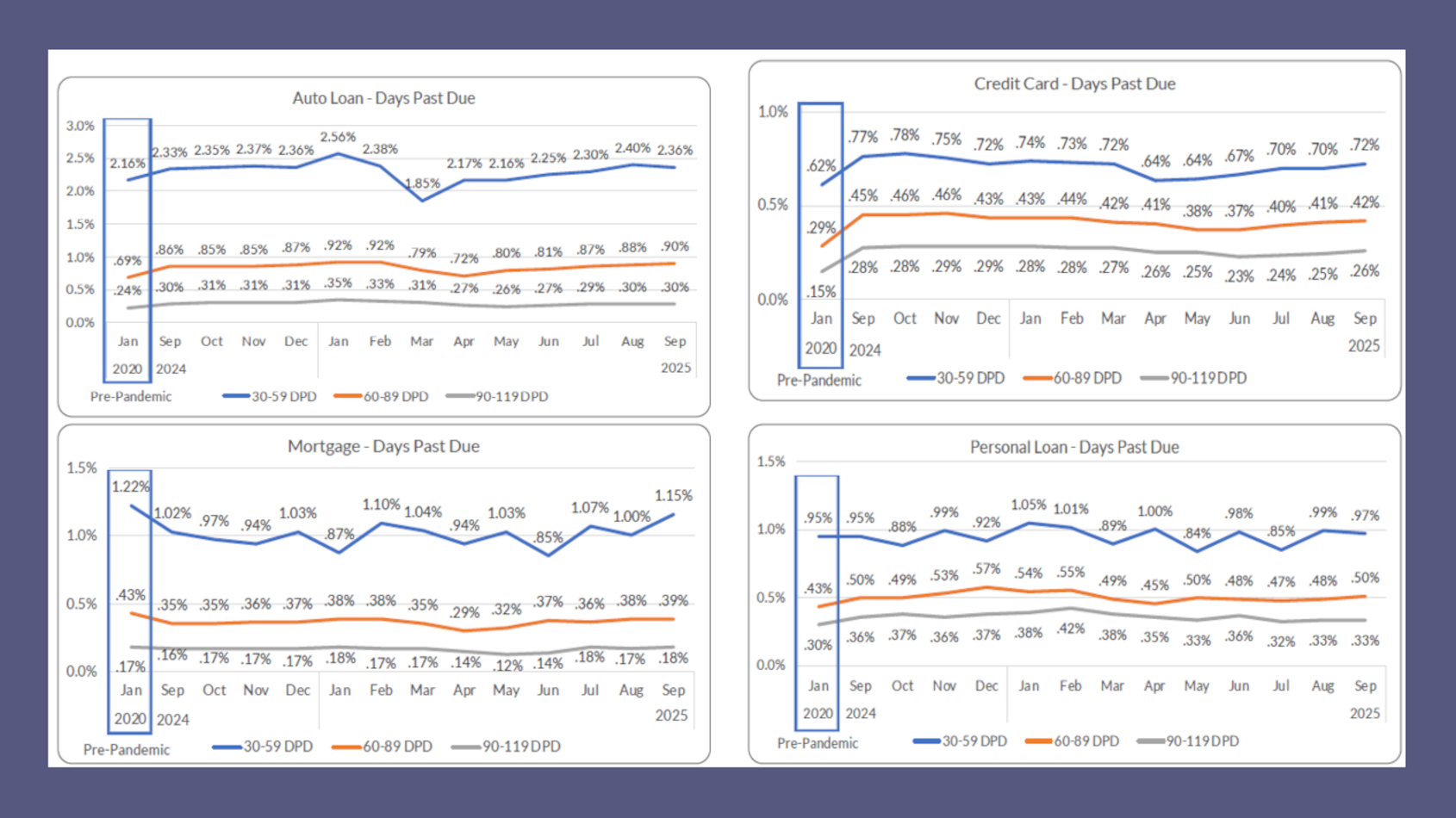

VantageScore: Early-stage delinquencies at highest point in 5 years

Wednesday, Oct. 29, 2025, 11:56 AM

SubPrime Auto Finance News Staff

Along with slowing originations, the latest edition of CreditGauge by VantageScore showed delinquencies throughout the credit market are on the rise. Analysts reported on Tuesday that overall credit delinquencies edged higher in September, with delinquencies 30 to 59 days past ... [Read More]

X