Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Edmunds spots multiple new highs among Q1 financing data

Monday, Apr. 3, 2023, 10:51 AM

SubPrime Auto Finance News Staff

Financing a used-vehicle acquisition almost seems like a bargain when compared to new-car trends included in first-quarter data from Edmunds released on Monday. Edmunds reported the average amount financed for a used-vehicle delivery in Q1 came in at $28,610 for ... [Read More]

NAACP & TransUnion roll out credit education website

Friday, Mar. 31, 2023, 10:59 AM

SubPrime Auto Finance News Staff

Here’s an example of two large organizations recognizing a possible issue within financial services and taking action. On Thursday, the NAACP and TransUnion announced the launch of Connecting to Our Financial Future, a credit education website designed to promote financial ... [Read More]

2 new consumer surveys show mixed feelings about auto activity amid soft savings level

Thursday, Mar. 30, 2023, 11:27 AM

SubPrime Auto Finance News Staff

Two looks at consumer confidence released this week offered mixed views on individuals’ current views of their finances and whether they might purchase a vehicle during the next six months. Beginning first with the 2023 Consumer Spending Survey by Provident ... [Read More]

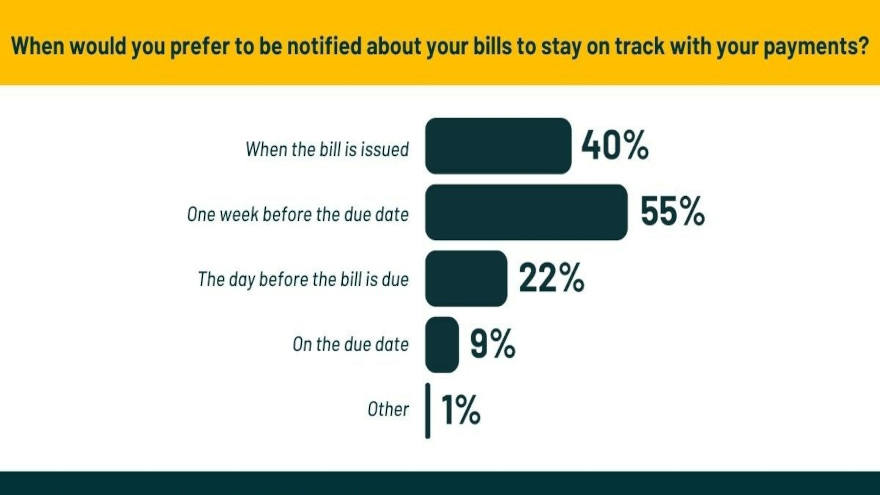

Survey: 55% of Americans want to be notified 1 week before bills are due

Wednesday, Mar. 29, 2023, 12:00 PM

SubPrime Auto Finance News Staff

Here’s more evidence that staying in communication with your customers could help keep payments coming and potentially keep your auto finance portfolio healthier. Lexop said a recent survey of more than 1,100 American consumers who were late in paying their ... [Read More]

Former MAX Digital exec joins AutoPayPlus as agency development manager

Wednesday, Mar. 29, 2023, 11:59 AM

SubPrime Auto Finance News Staff

In response to the continuing growth of its agency partners network, AutoPayPlus expanded its sales team this week with the addition of Damon Walker as agency development manager. Skilled in finance, sales, service and consulting, AutoPayPlus highlighted that Walker is ... [Read More]

Cox Automotive cautious of ‘doomsday’ thinking about defaults & repossessions

Wednesday, Mar. 29, 2023, 11:58 AM

Nick Zulovich, Senior Editor

You’re likely not the only one with significant interest in how auto defaults and vehicle repossessions are trending. It’s why Jeremy Robb, senior director of economic and industry insights at Cox Automotive, delved into the subjects during an episode of the Manheim Market Insights Series posted online last week.

“Due to economic volatility we’re seeing in today’s financial markets, we’re getting a lot of questions around auto loan default rates and repossessions. We want to make a few things clear for our audience,” Robb said.

Robb then went into four data points that might interest finance companies of all sizes ... [Read More]

3 trade associations & 4 lawmakers question CFPB & NY AG lawsuit against Credit Acceptance

Tuesday, Mar. 28, 2023, 10:03 AM

Nick Zulovich, Senior Editor

Credit Acceptance said in January that it would “vigorously defend itself” during a robust lawsuit brought by the Consumer Financial Protection Bureau and the New York attorney general. Last week, the finance company gained support for seeking to have a ... [Read More]

Equifax launches OneScore to help evaluate nearly 8.8M more consumers

Monday, Mar. 27, 2023, 11:08 AM

SubPrime Auto Finance News Staff

In an effort to support what the company called “financially inclusive lending,” Equifax on Monday launched OneScore. Equifax highlighted OneScore is a new consumer credit scoring model that combines the company’s alternative data insights with the power of the Equifax ... [Read More]

FTC lawsuit results in lifetime ban for operators of ‘extended vehicle warranty scam’

Monday, Mar. 27, 2023, 11:07 AM

SubPrime Auto Finance News Staff

The Federal Trade Commission said Friday that operators of a “telemarketing scam” that called hundreds of thousands of consumers nationwide to pitch them expensive “extended automobile warranties” will face a lifetime ban from the extended automobile warranty industry and from ... [Read More]

4 capabilities of SVR Tracking’s new wireless GPS device

Friday, Mar. 24, 2023, 10:23 AM

SubPrime Auto Finance News Staff

SVR Tracking, a leading provider of asset management solutions for the automotive industry, released its newest GPS tracking device this week. The company highlighted its SVR504 combines the convenience of a self-powered device with one of the longest-lasting batteries in ... [Read More]

X