Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

AutoAlert & 700Credit boost alliance for improved dealer experience

Wednesday, Mar. 1, 2023, 03:38 PM

SubPrime Auto Finance News Staff

AutoAlert and 700Credit announced an expanded integration alliance on Tuesday. With this new alliance, AutoAlert has incorporated 700Credit’s credit reports, compliance, and prescreen platforms into its CRM platform, AutoAlert CXM, to provide a “seamless” dealer experience. AutoAlert CXM is an ... [Read More]

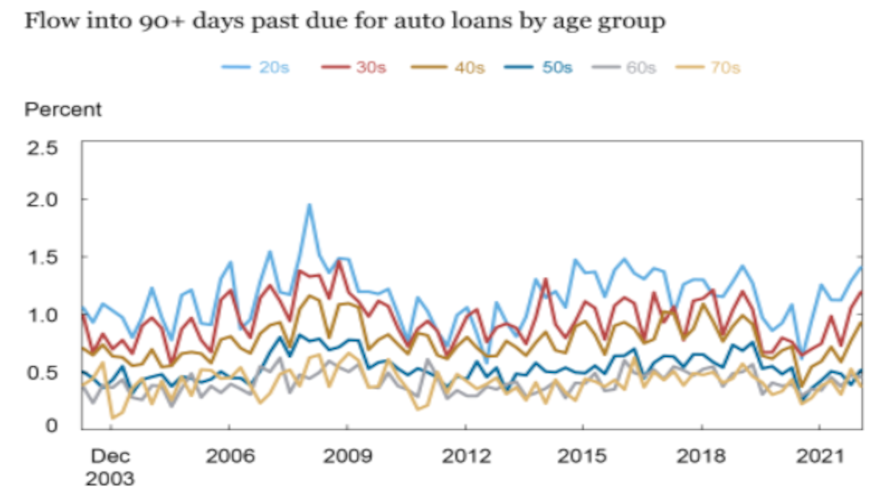

4 potential reasons why younger consumers are delinquent

Tuesday, Feb. 28, 2023, 03:46 PM

SubPrime Auto Finance News Staff

An analysis by five experts at the Federal Reserve Bank of New York showed consumers in their 20s and 30s represent the age groups with the most auto finance contracts 90 days or more past due. Those fourth-quarter findings are ... [Read More]

FTC sees annual fraud figure jump by more than 30%

Monday, Feb. 27, 2023, 04:48 PM

SubPrime Auto Finance News Staff

Newly released Federal Trade Commission data showed that consumers reported losing nearly $8.8 billion to fraud in 2022, an increase of more than 30% year-over-year. The FTC said consumers reported losing more money to investment scams — more than $3.8 ... [Read More]

9 finance companies asked to share info for CFPB auto finance data pilot

Friday, Feb. 24, 2023, 02:44 PM

SubPrime Auto Finance News Staff

The next step in building what the Consumer Financial Protection Bureau is calling its auto finance data pilot put the onus on nine finance companies. According to a bureau blog post pushed online Thursday, the CFPB said it issued orders ... [Read More]

4 firms dissect current trends that could impact auto financing

Thursday, Feb. 23, 2023, 03:44 PM

Nick Zulovich, Senior Editor

Experts from Cox Automotive, The Conference Board, iLending, S&P Global Ratings recently articulated several ingredients that could create headwinds for the auto finance market during the rest of the year. The ingredients ranged from the bandied about trends connected with ... [Read More]

Auto defaults rise for 9th time in 11 months

Tuesday, Feb. 21, 2023, 03:50 PM

SubPrime Auto Finance News Staff

Interest rates have been rising for more than a year, and auto defaults are on a similar trajectory. S&P Dow Jones Indices and Experian now have seen auto defaults climb nine times in the past 11 months. According to data ... [Read More]

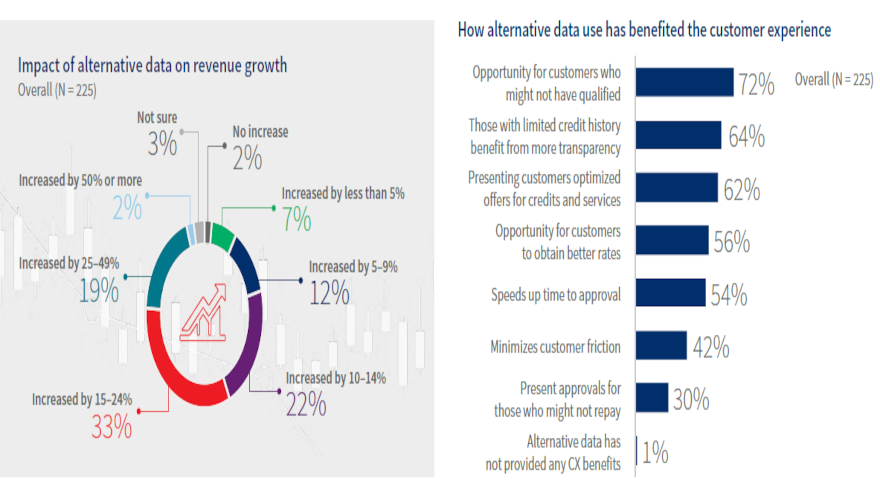

LexisNexis Risk Solutions survey emphasizes alternative data importance in subprime

Monday, Feb. 20, 2023, 04:51 PM

SubPrime Auto Finance News Staff

New research from LexisNexis Risk Solutions reinforced how the use alternative data often focuses on deep subprime, subprime and near-prime consumers Last week, LexisNexis Risk Solutions unveiled the findings of its Alternative Credit Data Impact Report, a nationwide survey assessing ... [Read More]

PODCAST: APCO Holdings CEO Tony Wanderon

Friday, Feb. 17, 2023, 03:00 PM

SubPrime Auto Finance News Staff

Tony Wanderon had a busy start to 2023, highlighted by becoming CEO of APCO Holdings after it acquired National Auto Care (NAC). Wanderon spent some time during NADA Show 2023 in Dallas for this episode of the Auto Remarketing Podcast ... [Read More]

PODCAST: Promoting F&I products before customers are ‘in the box’

Friday, Feb. 17, 2023, 02:55 PM

SubPrime Auto Finance News Staff

Paul McCarthy returned for another episode of the Auto Remarketing Podcast, this time as vice president of sales, key accounts, at Protective Asset Protection. McCarthy took time during NADA Show 2023 in Dallas to share his perspectives on the current ... [Read More]

New CFPB report spots double-digit drop in debt collection tradelines

Thursday, Feb. 16, 2023, 03:28 PM

SubPrime Auto Finance News Staff

Focused on what auto finance underwriters might see daily, the Consumer Financial Protection Bureau (CFPB) released a report this week examining trends in credit reporting of debt in collections from 2018 to 2022. While focused on other parts of the ... [Read More]

X