PODCAST: PayNearMe on evolving consumer preferences when making payments

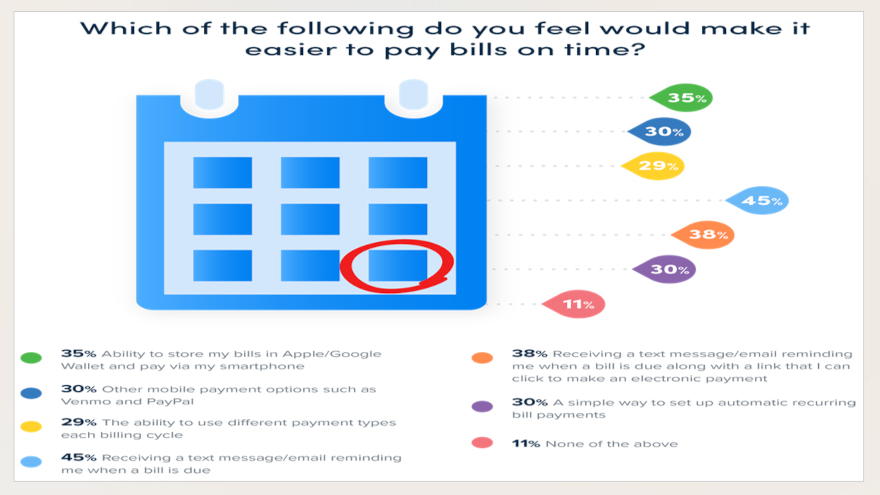

Graphic courtesy of PayNearMe.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

There’s a growing preference toward alternative payment methods, as well as increased demand for hyper-personalized interactions.

Those are two of the top findings from the study titled “Consumer Trends Driving the Future of Loan Payments,” recently released by PayNearMe, which added consumers’ expectations for convenience are leading to more dissatisfaction with traditional loan repayment processes.

PayNearMe said its study also revealed other challenges in the repayment process that can create poor payment experiences and jeopardize customer loyalty and potential future revenue.

The study, based on a March online survey of 1,574 U.S. consumers aged 18 and older, showed:

—42% of respondents say they feel disorganized when repaying loans; up 75% from a previous report published three years ago, indicating a critical area for improvement in the repayment process. PayNearMe noted this metric stood at 24% in 2021.

—76% more respondents report experiencing stress and anxiety when managing and making loan repayments compared to three years ago, as it came in at 51% in 2024 and 29% in 2021.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—61% of those surveyed say they wish managing and repaying loans was easier, reflecting a strong desire for user-friendly payment experiences (a 39% increase).

—Preference for digital wallets as available loan repayment options is growing for survey respondents. For instance, 54% prefer PayPal as an option compared to 43% in 2021 (a 26% increase), and Cash App has jumped 95% in preference, from 22% to 43%.

—69% of respondents appreciate a personalized payment experience and 80% would like their payment screen dynamically populated with their contract details.

—82% of those surveyed say a poor repayment experience, such as limited payment options, would influence their decision to work with a different finance company for future financing.

“The industry has reached a tipping point, as evidenced by the overwhelming responses that indicate the critical importance of payment experiences in shaping customer satisfaction,” PayNearMe executive vice president and chief marketing officer Anne Hay said in a news release.

“The gap between consumer payment preferences and the payment experience that lenders currently provide continues to widen,” Hay continued. “It’s clear that the personalization of payment experiences could alleviate the current stress and dissatisfaction associated with traditional loan repayment processes, and choice of payment options is key to personalization.”

The study also showed payment preferences continue to increase for alternative payment methods, specifically digital wallets, as evidenced by survey respondents reporting the following options as being important or very important:

—54% say PayPal (up from 43% in 2021 – a 26% increase)

—44% say Venmo (up from 27% in 2021 – a 63% increase)

—43% say Cash App Pay (up from 22% in 2021 – a 95% increase)

Additionally, 38% of survey respondents noted that having the ability to use a stored balance on a digital wallet such as PayPal, Venmo or Cash App Pay would make paying loans easier.

According to the study, one in four survey respondents said not having their preferred payment types available makes loan repayment difficult.

“Expanding payment types and channels is no longer optional for lenders. The data underscores a clear trend toward the increasing importance of digital wallets for loan repayment,” Hay said. “If lenders want to create the customer experience consumers desire, payment choice and convenience are critical factors,” she continued.”

Hay also mentioned the study sheds light on consumer preferences and frustrations with the repayment process and sets the stage for finance companies to innovate and adapt in ways that can lower the overall cost of accepting payments.

Nearly one in five survey respondents (19%) regularly call customer service to pay their contract, which can lead to overburdened agents and higher costs for finance companies.

“When lenders drive their customers to personalized, self-service channels, they ultimately lower their operational costs while freeing up their staffs’ time to focus on other tasks,” Hay said.

“Consumers expect loan repayment to be as effortless as placing an order on Amazon,” she continued. “With reminders that include a personalized payment link, PayNearMe is enabling lenders to deliver what consumers ultimately want—an easy, click-and-pay self-service experience.

“The industry has reached a tipping point, as evidenced by the overwhelming responses that indicate the critical importance of payment experiences in shaping customer satisfaction,” she went on to say. “With nearly eight in 10 respondents (79%) expressing a likelihood to stick with the same lender in the future following an exceptional payment experience, it’s clear that a quality experience has become an important factor in consumer decision-making. For the borrower, the payment experience is the customer experience.”

Hay elaborated about the study findings even more during an episode of the Auto Remarketing Podcast. Hay also addressed a question she said she gets regularly about whether traditional cash payments will ever go away.

Listen to the conversation in the window below.