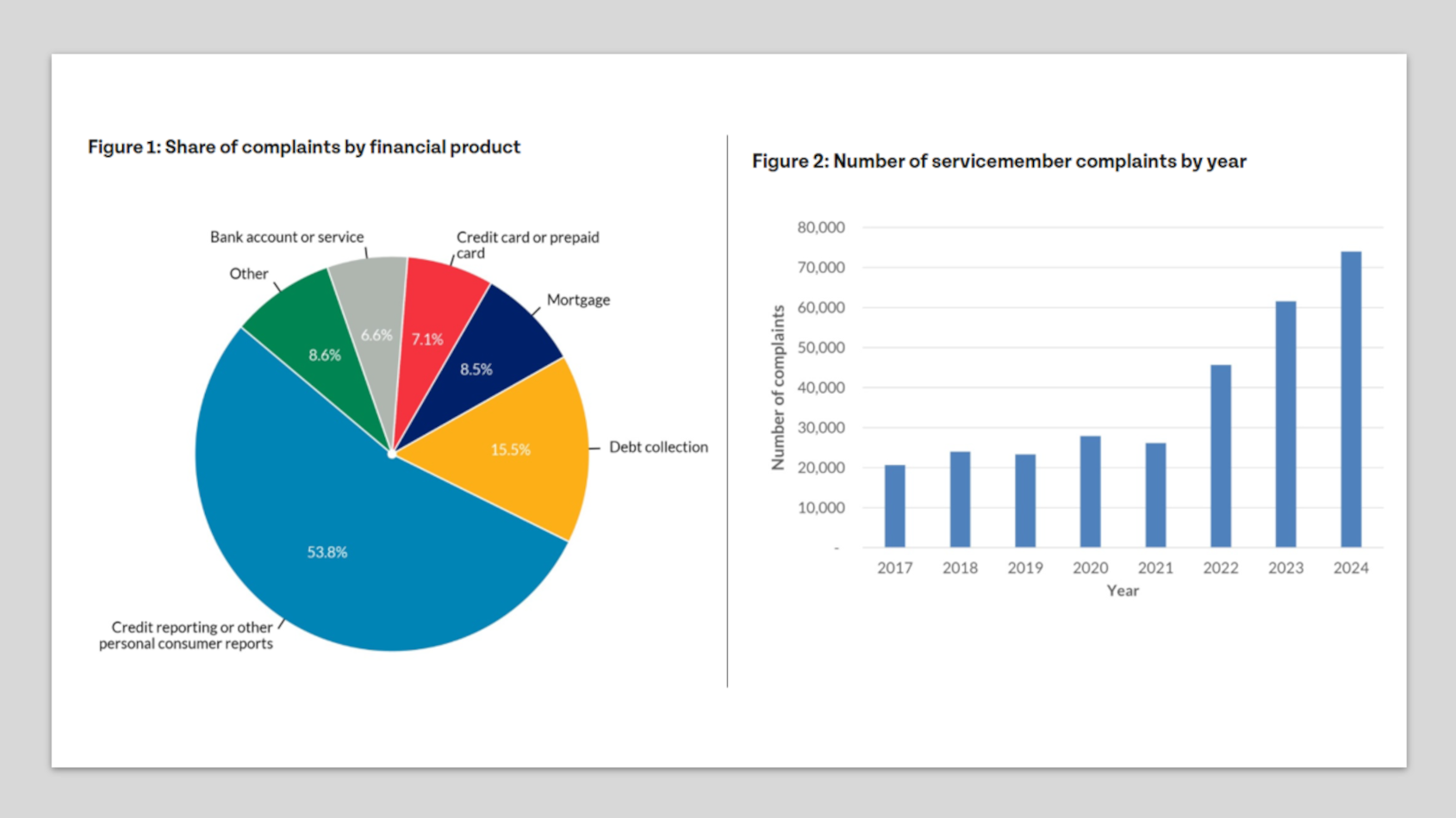

Report shows 165% increase in complaints to CFPB by servicemembers during a 4-year span

Charts courtesy of the U.S. PIRG Education Fund and Frontier Group.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Advocates are encouraged and concerned following the release of a new report on Tuesday from the U.S. PIRG Education Fund and Frontier Group that analyzed a portion of complaints published by the Consumer Financial Protection Bureau (CFPB).

While not specifically mentioning auto finance, researchers discovered complaints from servicemembers, veterans and their families about problems with financial companies rose by 165% between 2020 and 2024.

“The men and women who have served in the military deserve to have their finances defended,” said Douglas Phelps, chairman of U.S. PIRG Education Fund. “The CFPB’s public complaints database delivers for servicemembers, veterans and their families and is just one of the many ways the bureau has protected their financial security.”

Highlights from the report included:

—98.5% of servicemember complaints to the CFPB received a timely response from the financial institution in question.

—84,017 complaints — 23.5% — resulted in monetary or non-monetary relief.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—53.8% of the 357,065 published complaints were about credit reporting issues including incorrect information, misuse of credit reports and inadequate investigations.

—Complaints are most concentrated in areas near military bases or with large veteran populations, particularly the Atlanta area and several cities in Texas.

Veterans organizations joined U.S. PIRG Education Fund in calling attention to the critical role the CFPB plays in protecting servicemembers and veterans from financial harm.

“Many of our IAVA members have relied on the Consumer Financial Protection Bureau to have their backs when others did not. They’ve recovered millions of dollars lost to predatory lenders, helped troops navigate complex financial systems, and held bad actors accountable,” said Kaitlynne Yancy, director of membership programs for Iraq and Afghanistan Veterans of America (IAVA).

“Disabling the bureau would no doubt threaten military readiness and the stability of those who serve, in addition to sending a message to those who’ve relied on the CFPB that their concerns didn’t matter,” Yancy continued.

Tammy Barlet is vice president of government affairs for Student Veterans of America.

“For years, the CFPB has been committed to protecting servicemembers, veterans, and their families. We have seen firsthand the CFPB’s Office of Servicemember Affairs champion our military-connected community, working tirelessly to protect them from some of the most harmful and predatory financial practices,” Barlet said.

“Those who have served our country deserve protection and thanks to the CFPB, they have a dedicated champion ensuring their rights and financial well-being are defended,” Barlet went on to say.

Advocates pointed out that the CFPB recently withdrew its decade-plus-old internal guidance for publishing consumer complaints — a move they said that could be the first step toward eliminating public access to the complaints database altogether.

“Public access to the complaint database is worth fighting for. Without it, servicemembers, veterans, and all consumers are less likely to get their problems resolved when they are wronged,” said Quentin Good, Frontier Group policy analyst and report co-author.

Mike Litt, consumer campaign director at U.S. PIRG Education Fund and report co-author, added, “To fulfill the CFPB’s mission, the bureau’s leadership should not dismantle it from within.

“Acting director Russell Vought should use all available tools and resources to protect our servicemembers, veterans and all consumers,” Litt went on to say.