Ripe repossession market prompts Automotive Ventures to invest in Loanbridge

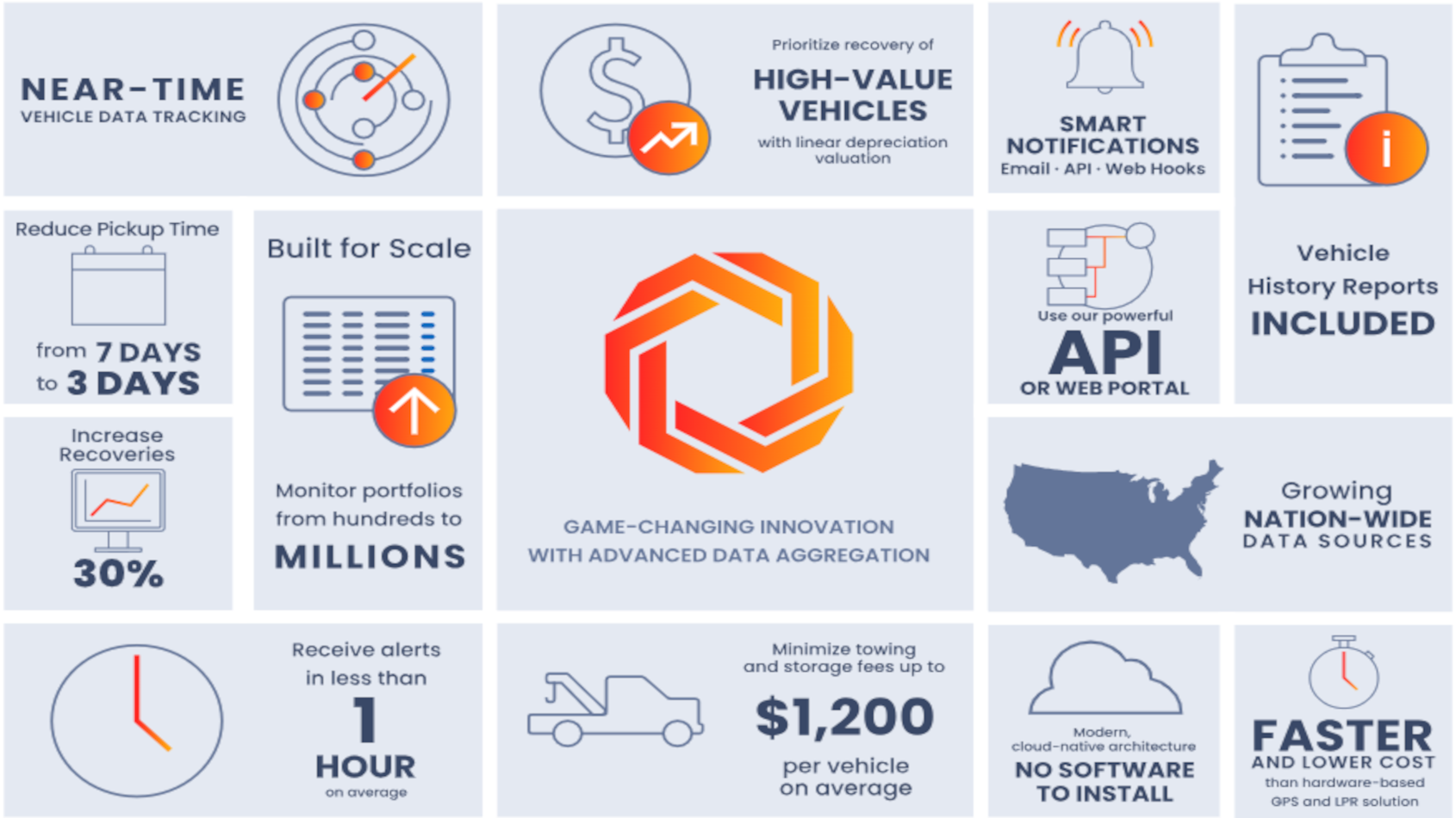

Screenshot courtesy of Loanbridge.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Equifax reported earlier this year that consumer debt in auto loans and leases has surpassed $1.7 trillion, exceeding credit card and student loan debt. Equifax also said delinquencies have increased by 7% year-over-year, reaching a three-year high.

It’s trends like those that are part of the reason why Automotive Ventures invested in Loanbridge, which offers a platform that delivers VIN-only vehicle monitoring that connects police impounds, private lot data, and retail listing platforms into a single, actionable view without GPS devices or integrations.

“The need for better tracking and recovery tools has never been more acute,” Steve Greenfield wrote on Automotive Ventures’ blog. “Loanbridge is operating in a $10 billion+ annual repossession market with a clear opportunity to expand into origination analytics, insurance, and fleet management.

“Loanbridge is already tracking over 5 million VINs and has delivered measurable impact for major lenders, car rental, and fleet customers. In one pilot, the platform reduced repo times from seven days to three hours and uncovered millions in potential savings for lenders,” the general partner of Automotive Ventures continued.

Greenfield also highlighted Loanbridge’s leadership team, which includes founder and CEO Alex Wilhelm who “brings deep fintech and operational experience,” along with chief operating officer Nat Parker (former CEO of Moovel North America) and chief technology officer Rick Ross (a former executive at Cubic).

“At Automotive Ventures, we invest in the future of auto commerce — particularly in companies that are modernizing legacy infrastructure with data, automation, and software. Loanbridge checks all those boxes,” Greenfield said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Their traction in the subprime and mid-prime lending markets is just the beginning. With a compelling GTM strategy and a strong pipeline of enterprise customers, Loanbridge is poised to become a foundational piece of the auto finance stack,” he went on to say.

In its own blog post, Loanbridge stated its enthusiasm for being associated with Automotive Ventures.

“With Automotive Ventures’ backing, we’re not just validating our model — we’re joining a portfolio of companies shaping the future of automotive commerce. It’s a space filled with businesses solving complex problems with smart, scalable solutions. We’re proud to be part of that group,” Loanbridge said.