Santander Q4 survey shows ongoing optimism of middle-income Americans who see value of used cars

Charts courtesy of Santander Holdings USA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here’s some positive news to start your week, already filled with industry conferences, courtesy of Santander Holdings USA.

The latest Santander US Paths to Financial Prosperity study showing middle-income Americans’ continued resilience and optimism, even as inflation concerns persist.

Results from the Q4 2025 survey show that consumers’ confidence in achieving financial prosperity remains at a three-year high, with 79% believing they are on the right track.

Santander said this level is further supported by households indicating that they feel secure in their jobs and are better able to manage prices.

The survey also found 9 in 10 households see opportunities for artificial intelligence (AI) to help them achieve financial prosperity and 60% say it will help them within the next year. Specifically, these consumers say AI can help them learn new skills, budget and manage their money more effectively, and make better investment decisions.

The Q4 Santander US study, which builds upon 11 quarters of research, looked at middle-income Americans’ current financial state and outlook for the next 12 months. It examined how economic conditions and other trends are impacting these households and the adjustments they are making in response, including their vehicle, banking, and housing needs.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

And here’s an even brighter view for dealerships and finance companies.

Santander noted consumer demand is being driven by the important role vehicle access plays in enabling mobility, employment, and economic opportunity. As four in five middle-income Americans rely on a vehicle to get to work, Santander said car buying activity remains elevated heading into 2026.

Used vehicles continue to gain traction among cost-conscious shoppers, as Santander mentioned 84% of recent car buyers and 81% of prospective buyers considered or are considering a used vehicle, with two-thirds of prospective buyers saying they are likely to purchase used.

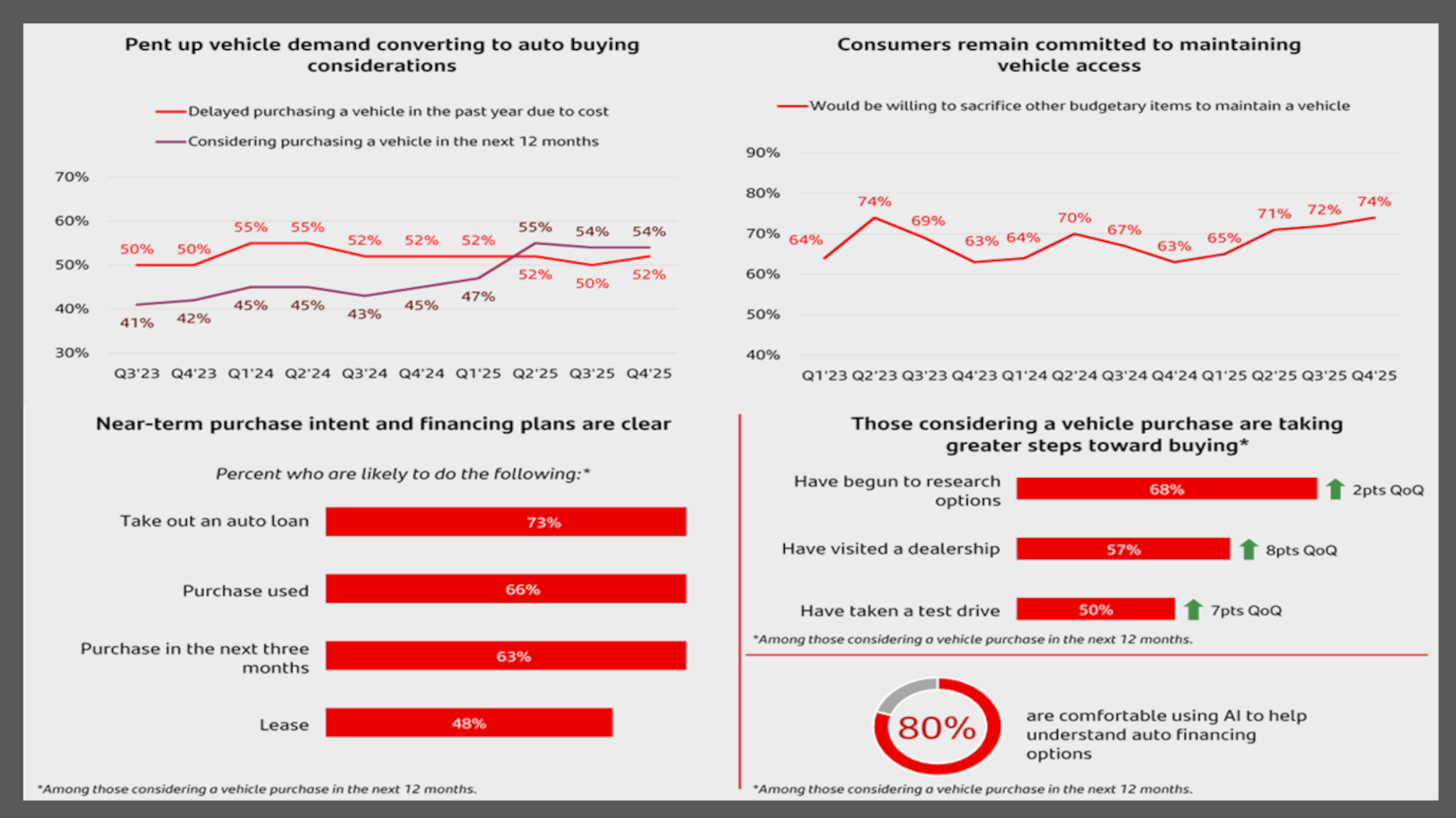

“After several years of pent-up demand, car-buying activity accelerated in 2025,” said Betty Jotanovic, president of auto relationships at Santander Consumer USA, the Auto business of Santander US.

“Momentum continued in Q4, when auto dealership visits rose by 8 percentage points and test drives rose by 7 percentage points. These datapoints underscore how purchase consideration is translating into tangible action,” Jotanovic continued in a news release.

Santander went on to mention AI is increasingly influencing how Americans shop for and finance vehicles.

The new research showed nearly half (49%) of middle-income consumers who shopped for cars online used AI to help understand auto financing options, and four in five prospective buyers say they would be comfortable exploring auto financing with AI assistance.

“From comparing models and pricing to understanding loan terms, AI is emerging as a trusted resource at critical decision points in the car-buying journey, particularly for younger generations who report higher comfort and optimism using AI-enabled tools,” Santander said.

Findings from the latest Santander US Paths to Financial Prosperity study can be found via this website.