TransUnion: ‘Credit washing is a silent disruptor’

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Washing your car, your dishes, even yourself, seems like a positive and prudent experience.

However, credit washing — especially in auto finance — is making quite a mess for lenders, according to new analysis from TransUnion on Thursday.

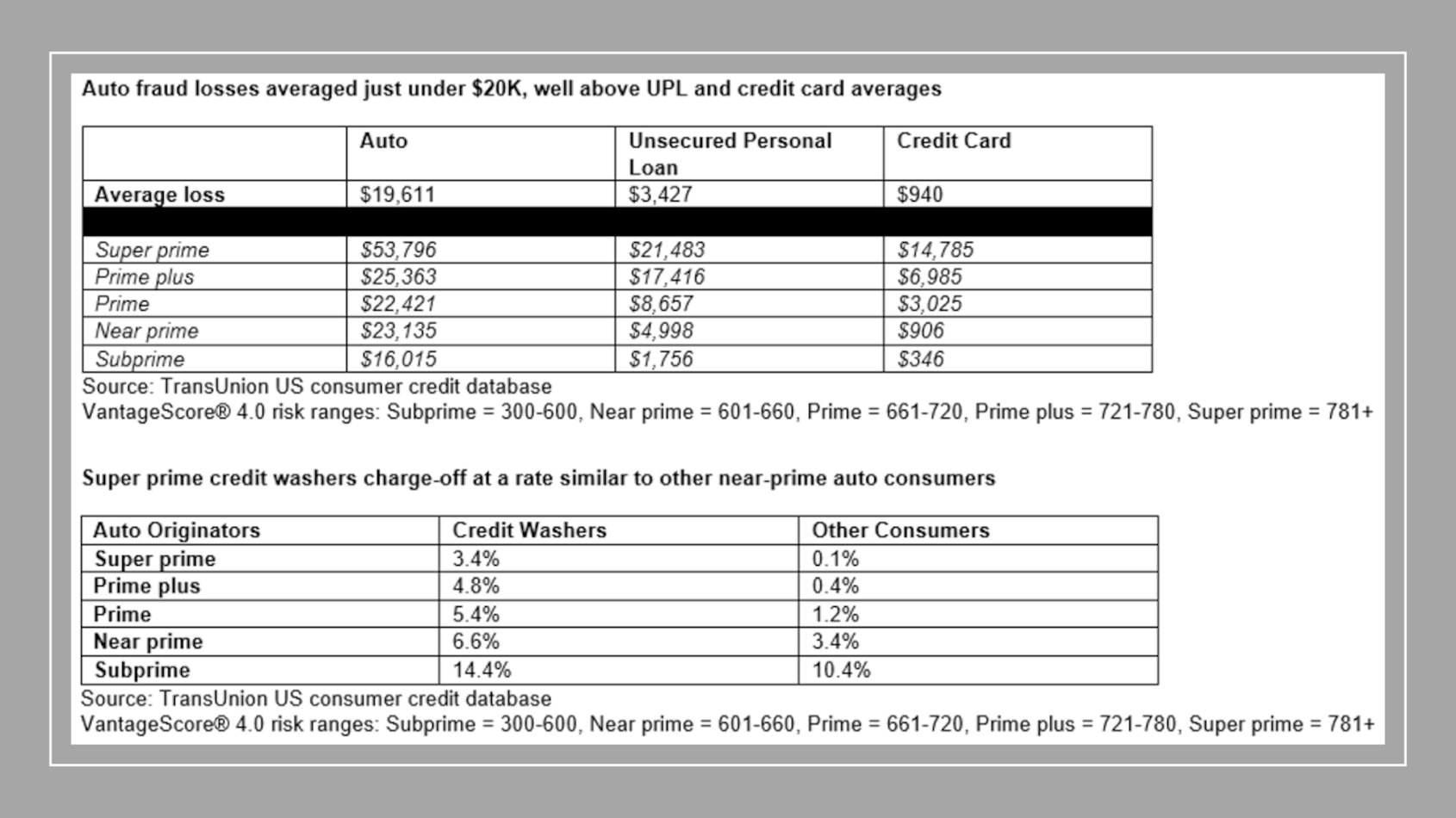

TransUnion said fraud-related charge-off losses in auto lending are not only significant, but they are also dramatically higher than those seen in other consumer credit product types like unsecured personal loans and credit cards.

Researchers indicated synthetic identity fraud, which occurs when real and fake information are combined to create a new, fictitious identity with dishonest or criminal intent, continues to drive significant financial losses.

At the same time, TransUnion noticed credit washing is emerging as a complementary threat.

“Both tactics obscure actual consumer risk, leading to elevated losses even among credit tiers traditionally associated with lower risk,” TransUnion said in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Getting into some numbers

For contracts originated from March through September 2023, TransUnion noticed average dollar losses observed two years later due to fraud in auto loans were significantly higher than in other loan types.

In fact, researchers said fraud losses in auto loans were 21 times greater than those in credit cards, and six times greater than those in unsecured personal loans originated during the same period.

At the same time, TransUnion said the charge-off percentage from fraud was actually higher among those in credit score risk tiers traditionally considered lower risk.

Researchers explained that the elevated loss rates in auto lending are driven by a combination of factors, including the larger loan amounts typical of auto financing and the evolving tactics used by suspected fraudsters to exploit vulnerabilities in the lending process.

“Interestingly, fraud incidence rates in auto lending actually lag behind those for credit card and unsecured personal loans for third-party and synthetic fraud,” researchers said. “However, dollars lost are significantly higher across all credit risk tiers.”

“Auto fraud losses are also unique in that they are heavily driven by prime and better risk tiers — consumers generally considered to be lower risk,” they added.

Among that set of consumers, TransUnion noticed those individuals flagged by its fraud prevention solutions as more likely to be synthetic, exhibited a bad rate 12.5 times higher than other consumers, with average balance losses exceeding $22,000 per consumer and well over $50,000 among super prime consumers.

In contrast, synthetic fraud losses in the unsecured personal loans and card segments were significantly lower, both in terms of frequency and financial impact, according to TransUnion’s data and solution performance.

“As the auto lending landscape becomes more digital and interconnected, the risk of fraud is no longer isolated to fringe cases — it’s becoming a systemic challenge that requires proactive, data-driven and innovative solutions,” said Satyan Merchant, senior vice president, auto and mortgage business leader at TransUnion. “Our synthetic fraud scoring models reveal that high-risk behavior can be masked behind seemingly strong credit profiles. This makes it harder to ensure that each person is reliably represented in the auto lending marketplace.

“Lenders must be equipped with tools that go beyond traditional credit risk indicators to uncover hidden fraud signals before they result in costly losses,” Merchant added in the news release.

More about credit washing

In addition to exploring dynamics in synthetic fraud, TransUnion’s analysis highlighted the rise of credit washing.

Experts explained credit washing typically involves consumers fraudulently disputing legitimate, accurate data — often delinquent or charged-off accounts — to temporarily improve their credit profiles. One example of this can be seen when consumers falsely claim they are victims of identity fraud.

TransUnion pointed out this behavior is particularly concerning because it can create a false impression of borrower credit quality, leading lenders to make lending decisions based on inaccurate perceptions of risk.

Researchers noticed charge-off rates for credit washers with super prime risk scores were comparable to those for non-credit washers in the near prime tier, revealing a troubling disconnect between perceived and actual risk.

TransUnion said these consumers may appear highly creditworthy at origination, but their subsequent performance data tells a different story —one that poses significant risk to lenders relying solely on traditional scoring methods.

“Credit washing is a silent disruptor in the lending space,” Merchant said. “It makes it harder than ever for lenders to distinguish between genuine and manipulated profiles. What’s most concerning is that this behavior is increasingly prevalent among consumers in lower-risk credit tiers, where lenders typically expect better credit performance.

“To stay ahead, lenders must integrate fraud-specific attributes and verification tools that can detect these anomalies before they impact portfolio performance,” he went on to say.

To learn more about how TransUnion fraud prevention solutions can help auto lenders detect synthetic identities and instances of credit washing to help avoid fraud and prevent fraud losses, go to this website.