TransUnion projects slight dip in auto originations after robust 2025 volume

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Auto finance often moves counter to other segments of the credit market in positive ways, but not this time, according to TransUnion’s 2026 credit originations forecast released on Thursday.

Among the five credit market segments specified in the forecast, only auto was projected to soften this year. TransUnion predicted personal loan originations would increase by 11.2%, with mortgage loans for purchases and refinancing climbing by 4.0% and 4.2%, respectively, and credit cards expanding by 2.0%.

But auto? TransUnion sees segment originations softening by 1.5% in 2026.

Does that mean the auto-finance market is in trouble? Perhaps not.

TransUnion explained auto loan originations are expected to edge lower, following 2025 gains that were driven largely by consumers who accelerated purchases in advance of anticipated tariffs and the end of the electric vehicle tax credit.

“We expect lending activity to remain measured across most categories as lenders take a disciplined approach to profitable growth, using more data and services to better manage risk and fraud,” said Jason Laky, executive vice president and head of financial services at TransUnion.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“At the same time, consumer demand for credit remains strong across risk tiers and will likely strengthen further if interest rates fall more than expected in the coming quarters,” Laky continued in a news release.

TransUnion released the originations forecast alongside its Q4 2025 Credit Industry Insights Report (CIIR), which pointed to continued expansion in consumer lending at the end of 2025.

Analysts also pointed out that the 2026 originations forecast points to mortgage and unsecured personal loans as the primary drivers of projected expansion. Mortgage originations, both purchase and refinance, are set to extend the rebound of the past two years from near-record low levels, and unsecured personal loans are on pace for a third consecutive year of annual growth.

“These shifts illustrate continued consumer demand for credit in 2026 across most products, though at slower levels of growth than in 2025 as the broader credit landscape continues to normalize,” TransUnion said in the news release.

Auto lending ticks up as borrowers take on higher payments and larger loans

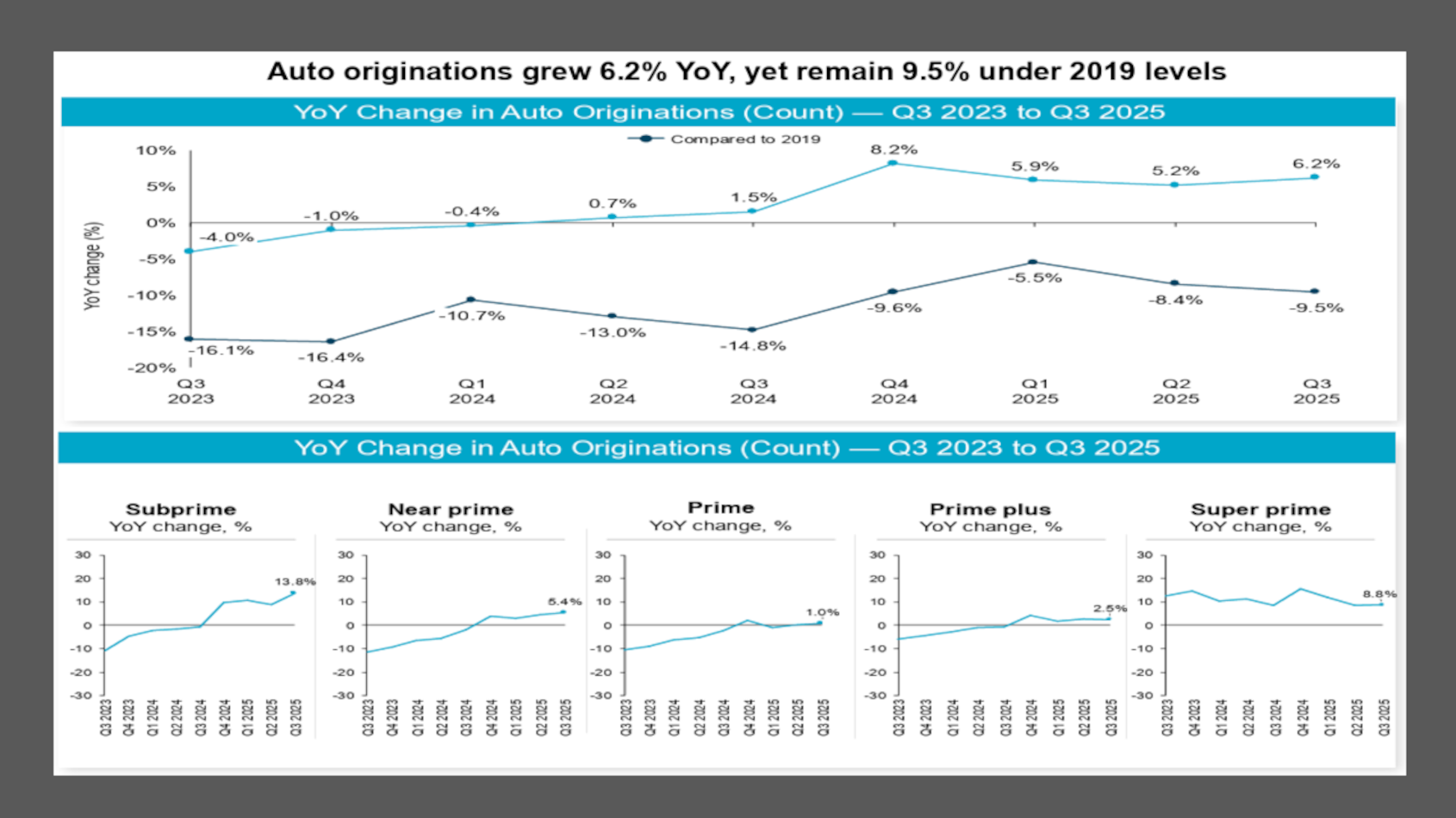

Looking at the data one quarter in arrears because of the reporting lag, TransUnion indicated auto loan originations rose 6.2% year-over-year to 6.7 million in Q3 2025.

Despite ongoing affordability challenges and tariff concerns impacting consumer vehicle demand, analysts determined every risk tier posted year-over-year gains, with subprime leading the way at 13.8% followed by super prime at 8.8%.

Prime auto volume edged up 1.0% year-over-year, according to TransUnion.

Continuing the affordability conversation, analysts determined average monthly payments continued to climb.

TransUnion reported new-vehicle payments rose 3.4% year-over-year to $782, while used-vehicle payments increased 3.1% year-over-year to $538.

Analysts noted that the amounts financed also grew. For new cars, they rose 4.9% year-over-year to $44,495. For used cars, they increased 4.3% year-over-year to $27,278.

Meanwhile, TransUnion’s delinquency data contained activity from the fourth quarter.

Analysts found that accounts 60 days or more past due ticked up 3 basis points year-over-year to 1.50%.

While delinquency continued to rise, TransUnion explained that increases were driven more by used vehicles, with delinquencies up 10 basis points year-over-year compared to an increase of 4 basis points for new vehicles, signaling a slower pace of overall deterioration.

“Rising vehicle prices continue to push loan sizes and monthly payments higher, shifting a greater share of new loan originations to super prime consumers, who are better positioned to absorb these increases,” said Satyan Merchant, senior vice president, automotive and mortgage business leader at TransUnion

“These trends underscore persistent affordability pressures that make it harder for many consumers to manage the total cost of ownership. While tariffs add to these challenges, broader pricing dynamics suggest affordability constraints are likely to persist if current patterns continue,” Merchant continued in a news release.

Unsecured personal loan demand sets a new high as lenders navigate shifting risk

Again, based on data one quarter in arrears because of the reporting lag, TransUnion said unsecured personal loan originations reached a record 7.2 million in Q3 2025, the second consecutive quarter of new highs.

Analysts indicated subprime drove growth with a 32.5% increase in originations year-over-year, while near prime and super prime segments each rose 21.5%.

Fintech lenders held a 42% share of originations, up from roughly one third a year earlier, according to TransUnion tracking.

TransUnion also tabulated that total unsecured personal loan balances climbed to a record $276 billion in Q4 2025, with 26.4 million consumers carrying a balance.

Analysts said subprime borrowers again led expansion with a 17% increase year-over-year.

Despite record totals, TransUnion pointed out average balances per consumer and per account remained flat year-over-year.

And perhaps not surprisingly, analysts acknowledged the delinquency rate for accounts 60 days or more past due also climbed, rising to 3.99% in Q4 2025 from 3.57% a year earlier

“More Americans are turning to unsecured personal loans, and lenders are meeting that demand with stronger risk management,” said Josh Turnbull, senior vice president, consumer lending business leader at TransUnion. “Fintechs remain the most active issuers, and even at elevated growth levels, especially among non-prime borrowers, performance reflects disciplined underwriting and recalibrated risk strategies

“Although account and consumer level delinquency increased year-over-year, balance level performance held steady,” Turnbull continued in a news release. “Recent vintages also show newer subprime loans outperforming older cohorts, while super prime performance has deteriorated slightly.”

Additional observations about overall credit market

Turning back to its predictions, TransUnion said early signs of its forecasted originations growth can be seen when looking back to late 2025, when year-over-year increases emerged across credit cards, unsecured personal loans and auto.

At the same time, analysts explained more consumers continued to drift away from the mid-level risk tiers and toward the highest and lowest risk tiers, reshaping portfolio dynamics for lenders.

After remaining unchanged for the past several years, the median VantageScore posted a year-over-year decline in Q4 2025, down 2 points to 711, “signaling a subtle, but meaningful change in overall consumer credit health,” according to TransUnion.

“After several years marked by credit behaviors influenced by stubbornly high inflation and elevated interest rates, we may be seeing signs of a return to more traditional growth,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion.

“As these more typical patterns return, it’s more important than ever for lenders to leverage advanced tools, including trended data, to more accurately assess evolving risk profiles,” Raneri added.