TransUnion spots continued softening of subprime originations as delinquencies jump

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The subprime space is continuing to lose momentum as 2023 reaches the short rows of potential originations for dealerships and finance companies.

What is gaining steam, however, are delinquencies.

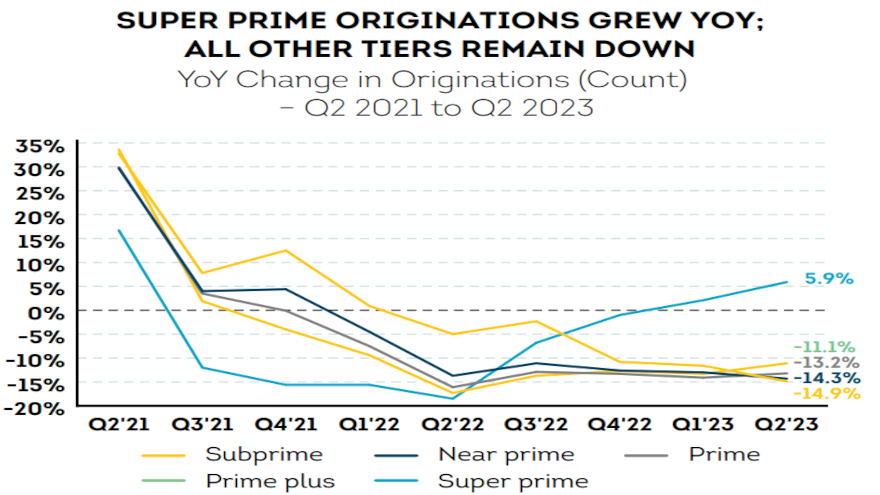

For the second consecutive quarter, originations softened across most risk tiers, according to Q3 2023 Quarterly Credit Industry Insights Report (CIIR) from TransUnion.

Viewed one quarter in arrears to account for reporting lag, TransUnion indicated auto finance originations in Q2 declined 9% year-over-year to 6.3 million while at the same time experiencing a slight seasonal uptick of 4.6% compared to the previous quarter.

When examining the data by credit tier, analysts noticed only super prime paper generated a year-over-year gain, climbing 5.8%.

Meanwhile, TransUnion indicated subprime and near-prime originations continue to be the most suppressed, sliding by 15.2% year-over-year.

But what might have been the minds most of Used Car Week attendees last week in Scottsdale, Ariz., TransUnion reported through a news release that accounts 60 days or more past due increased to 1.35% in Q3, up from 1.19% in Q3 of last year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts explained vintages continue to show performance similar to 2021 cohorts. They added early 2022 cohorts looked “materially worse,” but an early look at the performance of Q1 2023 originations shows “slight” improvement over a year earlier.

Turning back to paper coming into portfolios, TransUnion said the new-versus-used financing split continues to trend back toward pre-pandemic norms, with new models making up 43% of all units financed in Q3, up from 39% of all units a year earlier.

TransUnion noticed the average amounts financed and monthly payments moving in opposite directions.

The report showed the average amounts financed for new vehicles dipped 2.6% year-over-year, while the average amounts financed for used vehicles declined 4.8% year-over-year.

Meanwhile on a year-over-year comparison, monthly payments for recently originated used-car paper is up 1.3%. And for new-model contracts, the monthly payments are up 4.2%.

When looking at those payment metrics on a sequential basis, they’re relatively flat for used vehicles and modestly lower for new models, according to TransUnion.

Analysts determined the leasing market share currently stands at 21% of new vehicle registrations, up from its 2022 low of 17% but still below its pre-pandemic level of approximately 30%.

“The new vehicle market has improved; however, recent events, including the United Auto Workers strike, could impact continued growth due to consumer perception and inventory of certain vehicle models,” said Satyan Merchant, senior vice president and automotive business leader at TransUnion. “High interest rates continue to help drive up monthly payments for both used and new vehicles.

“As interest rates and cross-wallet inflation are likely to remain relatively high for at least a while longer, affordability will continue to be challenging, particularly among below-prime consumers,” Merchant continued in the news release. “Lenders’ close eye on portfolio delinquency and macroeconomic indicators will likely determine if/when underwriters expand their buy boxes to riskier borrowers.”

Q3 2023 Auto Loan Trends

| Auto Lending Metric | Q3 2023 | Q3 2022 | Q3 2021 | Q3 2020 |

| Total Auto Loan Accounts | 80.4 million | 80.2 million | 82.0 million | 82.6 million |

| Prior Quarter Originations1,3 | 6.3 million | 6.9 million | 8.2 million | 6.4 million |

| Average Monthly Payment NEW2 | $737 | $707 | $630 | $575 |

| Average Monthly Payment USED2 | $537 | $529 | $476 | $401 |

| Average Balance per Consumer3 | $23,809 | $22,642 | $20,997 | $19,699 |

| Average Amount Financed on New Auto Loans2 | $40,792 | $41,872 | $38,686 | $35,474 |

| Average Amount Financed on Used Auto Loans2 | $27,036 | $28,405 | $26,265 | $21,446 |

| Consumer-Level Delinquency Rate (60+ DPD)3 | 1.53% | 1.29% | 0.86% | 0.99% |

1Note: Originations are viewed one quarter in arrears to account for reporting lag.

2Data from S&P Global MobilityAutoCreditInsight, Q3 2023 data only for months of July & August.

3TU discovered irregularities from a data contributor, and that data has been removed from our market reporting until resolution.

Source: TransUnion

Personal loan summary

Looking at another part of financial services often relevant to subprime participants, TransUnion discovered total unsecured loan balances set a new record for the eighth consecutive quarter, growing to $241 billion in Q3 2023, representing year-over-year growth of nearly 15%.

Analysts determined super prime experienced the most significant YoY balance growth of 38.6%, followed by subprime and prime plus at 15% and 14%, respectively.

TransUnion tabulated the average balance per consumer grew nearly 9% year-over-year to $11,692, another record high, and the number of consumers with a balance grew to 23 million in Q3, a 5% increase year-over-year.

However, that personal loan paper is performing, as TransUnion noticed 60-day delinquencies ticked down to 3.8% in Q3 from 3.9% a year earlier.

On a vintage basis, analysts explained delinquencies for below prime vintages for Q3 2022 originations after 12 months have stabilized compared to 12-month performance for the Q3 2021 origination cohorts, while delinquencies for prime and above vintages originated in Q3 2022 are elevated over the prior year.

“Although originations continue to fall from 2022’s record levels, total unsecured loan balances and consumer-level balances still reached records, driven primarily by super prime consumers, representing a continued shift by lenders towards less risky borrowers,” said Liz Pagel, senior vice president of consumer lending at TransUnion. “While originations in Q2 2023 were down 14.5% from last year, they remain elevated compared to the pre-pandemic period, demonstrating continued demand in this market.”

Pagel continued by noting “60-day delinquencies saw their first year-over-year decline in borrower-level delinquency in over a year, led by improvement in the performance of originations by below prime borrowers. This is something worth watching in the months to come as we look for potential impacts of the restarting of student loan payments for millions of borrowers.

“Lenders should continue to find opportunities given strong employment rates and a continued desire by consumers to refinance higher interest card debt,” Pagel went on to say.

Q3 2023 Unsecured Personal Loan Trends

| Personal Loan Metric | Q3 2023 | Q3 2022 | Q3 2021 | Q3 2020 |

| Total Balances | $241 billion | $210 billion | $156 billion | $148 billion |

| Number of Unsecured Personal Loans | 27.8 million | 26.4 million | 21.6 million | 21.4 million |

| Number of Consumers with Unsecured Personal Loans | 23.2 million | 22.0 million | 19.2 million | 19.5 million |

| Borrower-Level Delinquency Rate (60+ DPD) | 3.75% | 3.89% | 2.52% | 2.55% |

| Average Debt Per Borrower | $11,692 | $10,749 | $9,387 | $8,864 |

| Prior Quarter Originations* | 5.1 million | 6.0 million | 4.4 million | 2.6 million |

*Note: Originations are viewed one quarter in arrears to account for reporting lag.

Source: TransUnion

Overall credit observations

TransUnion’s report also highlighted affordability challenges for homes and automobiles, as well as growing concerns over rising debt service costs, have resulted in consumers opening fewer new credit accounts.

While balances across many credit products are higher year-over-year, TransUnion indicated originations for those same credit products lagged behind the levels that they were at one year ago.

Analysts noted mortgage originations lead the decline, down nearly 37% year-over-year, as potential home buyers continued to hold off in the face of high interest rates and home prices, which show no sign of dropping in the near future.

TransUnion mentioned the refinance market in the housing space remains on the sidelines for now, too.

Furthermore, TransUnion added unsecured personal loan originations were also down significantly year-over-year from the record levels in 2022, down nearly 15%, as lenders have increasingly focused on less risky credit tiers when considering new unsecured personal loan originations.

“Inflation has abated to a large extent in recent months, but its elevated levels in 2021 – 2022 have left overall prices sharply higher across a wide range of products and services — not just discretionary spend categories, but everyday items that consumers rely on,” said Charlie Wise, senior vice president of global research and consulting at TransUnion.

“As a result, consumers have increasingly turned to their existing available credit lines. It will be worth watching how those balances are further impacted as some consumers begin feeling the pinch of the resumption of student loan payments,” added Wise, who also mentioned TransUnion elaborated more about its report via a webinar.

Balances Were Up While Originations Were Down Across Credit Products YoY

| Key Metrics | Q3 2023 | Q3 2022 | YoY% Change |

| Total Credit Card Balances (Bankcard) | $995 billion | $866 billion | 15.0% |

| Total Mortgage Balances | $11.8 trillion | $11.5 trillion | 3.2% |

| Total Auto Balances | $1.6 trillion | $1.5 trillion | 5.2% |

| Total Unsecured Personal Loan Balances | $241 billion | $210 billion | 14.8% |

| Q2 2023 | Q2 2022 | YoY% Change | |

| Total Credit Card Originations1 (Bankcard) | 20.5 million | 21.3 million | -3.8% |

| Total Mortgage Originations1 | 1.2 million | 1.9 million | -36.5% |

| Total Auto Originations1,2 | 6.3 million | 6.9 million | -8.7% |

| Total Unsecured Personal Loan Originations1 | 5.1 million | 6.0 million | -14.5% |

1Note: Originations are viewed one quarter in arrears to account for reporting lag.

2TU discovered irregularities from a data contributor, and that data has been removed from our market reporting until resolution.

Source: TransUnion.