TransUnion spots ‘pre-pandemic norms’ in newest auto-finance analysis

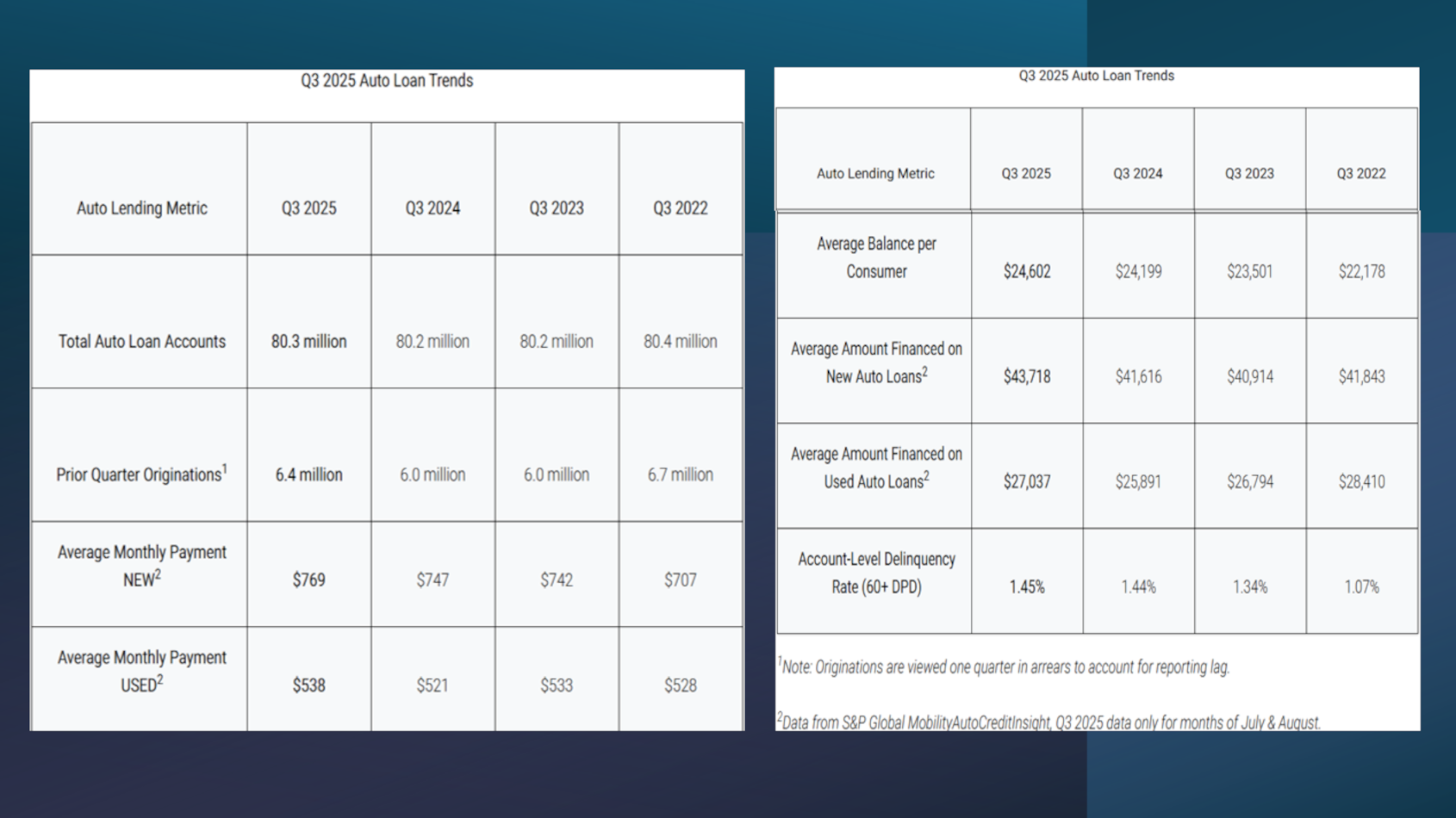

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experts are seeing auto financing “trending back toward pre-pandemic norms” based data contained in TransUnion’s Q3 2025 Credit Industry Insights Report (CIIR).

TransUnion reported on Monday that originations rose 5.2% year-over-year to 6.7 million, supported by Federal Reserve rate cuts and stable inventories.

Analysts noticed growth was led by super prime (up 8.4%) and subprime (up 8.8%), with expansion in these risk tiers contributing to overall market gains.

“Affordability challenges, tariffs, and rising ownership costs remain headwinds,” TransUnion said.

Following a period of stabilization in 2023 and 2024, TransUnion indicated average monthly payments for new vehicles rose 3.0% year-over to $769 in Q3, while used-vehicle payments increased 3.3% to $538.

Despite rising costs, analysts said the mix of vehicles financed in Q2 — 43% new and 57% used — closely mirrors pre-pandemic 2019 levels. TransUnion reiterated originations are viewed one quarter in arrears to account for reporting lag.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion went on to mention the percentage of accounts more than 60 days past due rose to 1.45% in Q3, up 4 basis points year-over-year, although the pace of growth has slowed.

Analysts pointed out delinquency rates among 2024 vintages remain elevated compared to 2019, especially within prime and below-prime risk tiers, signaling continued pressure on credit performance.

“Auto lending continued to expand in Q3 2025, supported by rate cuts and stable inventories, even as affordability and ownership costs remain key challenges,” said Satyan Merchant, senior vice president, automotive and mortgage business leader at TransUnion.

Consumer financing behavior is trending back toward pre-pandemic norms, with a balanced mix of new- and used-vehicle loans despite rising monthly payments,” Merchant continued in a news release. “With the expiration of the EV tax credit in September 2025, we’ll be closely watching for a potential uptick in EV registrations in the prior months leading up to it, while also monitoring elevated delinquency rates among newer vintages for signs of credit performance pressure.”

Update on unsecured personal loans

In related activity, TransUnion analysis of unsecured personal loan revealed record balances and resilient credit performance

The report indicated unsecured personal loan originations reached 6.9 million in Q2, marking a 26% year-over-year increase.

Analysts noticed growth was strongest among traditionally riskier tiers, with subprime originations up 35% and near prime up 26%. Fintechs accounted for over 40% of these new loans, rebounding after a dip in the previous quarter, according to TransUnion.

TransUnion also found that balances continued their steady climb, hitting a record $269 billion in Q3. That’s an 8% increase year-over-year and the largest since Q1 2024.

Analysts determined all risk tiers saw growth, led by super prime at 11%.

TransUnion uncovered that fintechs now hold more than half of total balances, followed by banks at 21%.

Analysts pointed out delinquency rates remained relatively stable year-over-year in Q3, with the 60-day delinquency rate inching up to 3.52%, compared to 3.50% in Q3 of last year.

Of note was the subprime segment, where delinquency declined to 11.4% from 11.9% a year earlier, while other risk tiers held steady.

Josh Turnbull, senior vice president and consumer lending business leader at TransUnion, explained this modest shift in subprime suggests some early signs of improvement in credit performance among higher-risk borrowers.

“Sustained growth in the unsecured personal loan saw 26% year-over-year originations growth and balances reaching a record $269 billion. This growth was led by fintechs, as they continued gaining share in the super prime segment, and as growth picked up significantly in non-prime credit tiers,” Turnbull said in the news release.

“More precise risk strategies have enabled this confidence, as evidenced by serious delinquency growing only two basis points year-over-year as lending volumes grow and buy boxes open,” Turnbull added.

Diverging trends developing in overall credit risk

When looking at the entire credit market, TransUnion explained that recent patterns in consumer credit risk suggest a growing divide among U.S. consumers, as some demonstrate heightened financial resilience while others face mounting challenges.

Analysts spotted a steady increase in the percentage of individuals classified in the lowest risk super prime credit risk tier, rising from 37.1% in Q3 2019 to 40.9% in Q3 2025. TransUnion said this increase in the share of super prime borrowers occurred as the overall credit market expanded, with the total number of super prime borrowers now approximately 16 million higher than in 2019.

“This upward movement reflects continued financial stability among top-tier consumers,” analysts said.

At the same time, TransUnion noticed the subprime segment has gradually returned to pre-pandemic levels after notable declines in 2020 and 2021, when many consumers were able to pay down debt and reduce credit account delinquencies during a period of reduced expenses and pandemic-related relief programs.

“We are seeing a divergence in consumer credit risk, with more individuals moving toward either end of the credit risk spectrum,” said Jason Laky, executive vice president and head of financial services at TransUnion.

“While super prime has steadily grown since the pandemic, subprime has returned to pre-pandemic levels, leaving the middle tiers increasingly thinner. This shift suggests that while many consumers are navigating the current economic climate well, others may be facing financial strain,” Laky continued

TransUnion explained that the movement toward super prime and subprime tiers is clearly reflected in recent activity across the credit card and auto lending markets.

Analysts said year-over-year growth in new account originations and total balances was strongest in these two tiers, far outpacing all others.

Michele Raneri, vice president and head of U.S. research and consulting at TransUnion, explained this divergence in credit behavior highlights evolving consumer dynamics and underscores the importance of tailored risk strategies across the credit spectrum.

“As consumers increasingly shift toward the extremes of the credit risk spectrum, it’s no surprise we’re seeing the sharpest growth in credit card and auto activity within those tiers,” Raneri said. “To navigate these changes effectively, lenders should leverage advanced tools — like access to trended data — to better assess evolving risk profiles.”

TransUnion plans to elaborate about the Q3 findings during a webinar scheduled for 2 p.m. (ET) on Thursday. Registration for the session can be completed via this website.