TurboPass now offers 90-day banking report option for users

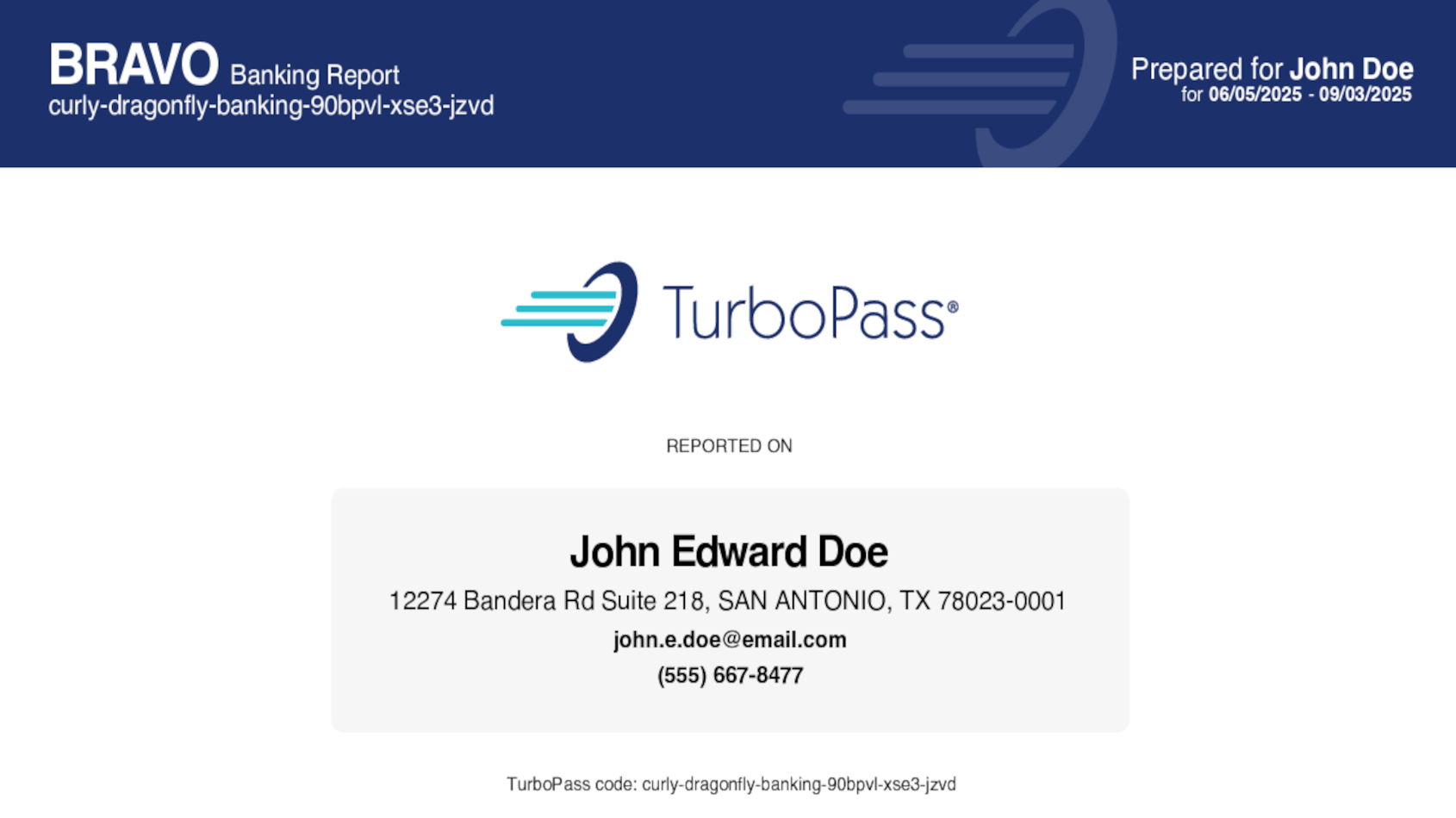

Screenshot courtesy of TurboPass.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TurboPass acknowledged some dealerships and auto-finance companies prefer to examine stipulations and other underwriting documents through the prism of a 90-day window.

So this week, the financial technology software company that provides automation, SaaS, and cloud-based solutions for automotive dealerships, banks, property managers, and finance companies across North America, released a 90-day banking reports option for its Bravo report.

The company highlighted this enhancement to TurboPass’s banking verification gives users the flexibility to choose between 90-day and 120-day banking data reports, providing greater customization to meet their specific income verification requirements.

TurboPass explained this new option comes as users seek tailored solutions for streamlined income verification processes. Since launching banking reports in 2018, TurboPass has processed more than a million banking verification requests, helping dealerships and apartment complexes access direct-from-source income data while reducing fraud and improving customer experience.

The company pointed out the 90-day option provides the same comprehensive income verification that TurboPass banking reports are known for with a focused 90-day banking data window. This change comes in light of feedback from lenders and other partners.

TurboPass users can now select the timeframe that best fits their preference, whether that’s the original comprehensive view of 120 days or the new focused view of only 90 days.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Once the banking report is generated, users can rebuild the report from a 90-day report to a 120-day report and vice versa, according to the company.

For users who link their account to TurboPass, the process remains unchanged.

Users send a secure TurboPass link via text or email, recipients safely connect their bank account through TurboPass’ secure platform and within seconds, the TurboPass user receives a banking report complete with verified income data sourced directly from the bank, credit union, or financial institution.

TurboPass said its banking reports are requested more than 80,000 times a month helping thousands of businesses understand their buyer or applicant without reviewing paper documents.

TurboPass co-founder and CEO Mike Jarman said data points like proof of phone number and residence are bonuses built into every report where applicable.

“We’re always listening to our users and constantly evolving our platform to meet their needs,” Jarman said in a news release. “By offering both 90-day and 120-day banking report options, we’re giving our users the flexibility to choose what works best for their business while maintaining the same level of accuracy and fraud protection they’ve come to expect from TurboPass.”

For more information, visit https://www.turbopassusa.com/.