VantageScore pinpoints how much subprime credit market is growing

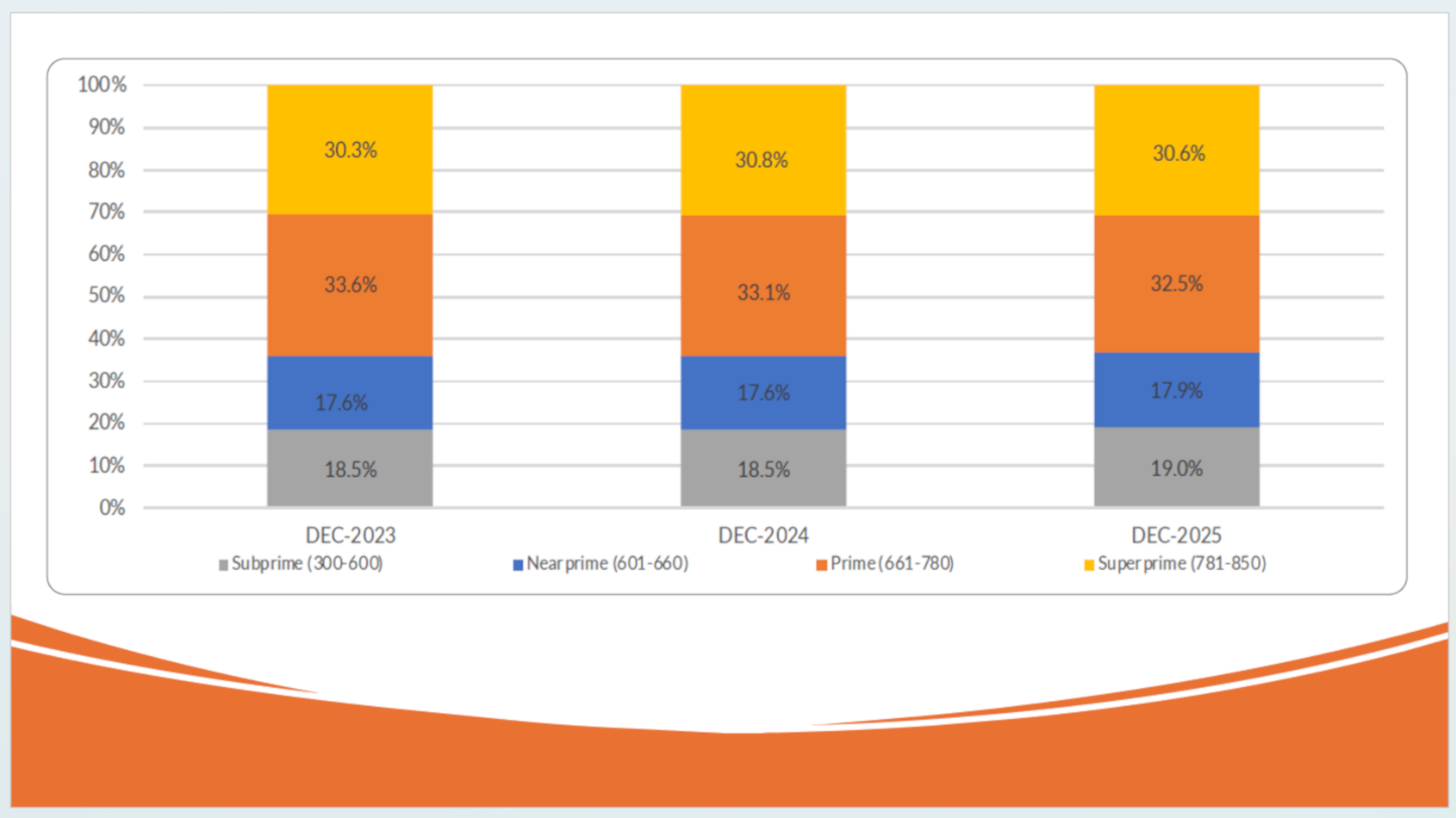

Chart courtesy of VantageScore.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps lenders that specialize in subprime auto finance can find a positive way to view the latest edition of CreditGauge from VantageScore.

The data showed the pool of subprime consumers is getting noticeably deeper.

From December 2023 to December of last year, analysts reported the share of consumers in the VantageScore subprime credit tier increased from 18.5% to 19.0%, while the VantageScore near-prime segment edged up from 17.6% to 17.9%.

Over the same period, analysts noticed the VantageScore prime tier declined by 1.1%, indicating a gradual migration of consumers to lower credit tiers, reflecting pressure from ongoing affordability constraints, according to Susan Fahy, executive vice president and chief digital, data and technology officer at VantageScore.

“Higher mortgage and auto loan delinquencies reflect the effects of elevated interest rates and prices in today’s housing and auto markets,” Fahy said in a news release.

In an online video posted by VantageScore, Fahy added, “What this trend shows us is that it indicates there’s a gradual migration of consumers to lower credit score tiers, and this is reflective of the ongoing affordability pressures that consumers are facing currently.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average VantageScore 4.0 credit score declined by 1 point to 700 in December.

In that online video, VantageScore president and CEO Silvio Tavares elaborated about the complex credit situation the December data illuminated.

“The reality is there are a lot of mixed signals,” Tavares said. “On the one hand, you have affluent Americans really spending with wild abandon. It is very much a tale of two cities where wealthy Americans are spending and borrowing and everyday Americans are feeling much more challenged by the economy. It is, in fact, the proverbial K-shape. And if you look at the averages across the entire population, sometimes it sends a false signal.

“And so the key for lenders today is they really have to recognize that they have two distinct sets of customers with two distinct needs. Affluent consumers are looking for larger lending. They increasingly are very credit worthy,” he continued.

“The average consumer is more challenged, and many of those are becoming a much more marginal, risky consumer,” Tavares went on to say. “And so this is a time to know both audiences, but also to invest in the best data analytics so you can discern between those two and make the right decisions when it comes to lending.”

What about the decisions finance companies already made?

In December, VantageScore reported overall delinquency rates edged up on both a month-over-month and year-over-year basis across all categories.

Analysts indicated late-stage delinquencies saw the highest month-over-month and year-over-year increases, rising to 0.27% from 0.24% and 0.19%, respectively. Early- and mid-stage delinquencies also ticked up on both a monthly and an annual basis, according to the latest edition of CreditGauge

“These trends suggest emerging repayment strain among a subset of borrowers at year-end amid persistently elevated borrowing costs,” VantageScore said in the news release.