VantageScore spots notable auto-delinquency jump in July

Screenshot courtesy of VantageScore.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The July edition of CreditGauge published this week by VantageScore showed that auto is one of the credit segments showing the most performance deterioration.

VantageScore reported mortgage and auto loan credit delinquencies saw the largest year-over-year uptick in the early-stage category, which covers 30 to 59 days past due. They’re up 0.11 and 0.05 points, respectively.

Analysts said auto loan and mortgage balances also increased on a month-over-month basis, while originations decreased for auto loans and held steady for mortgages.

And there’s other turbulence in the credit market.

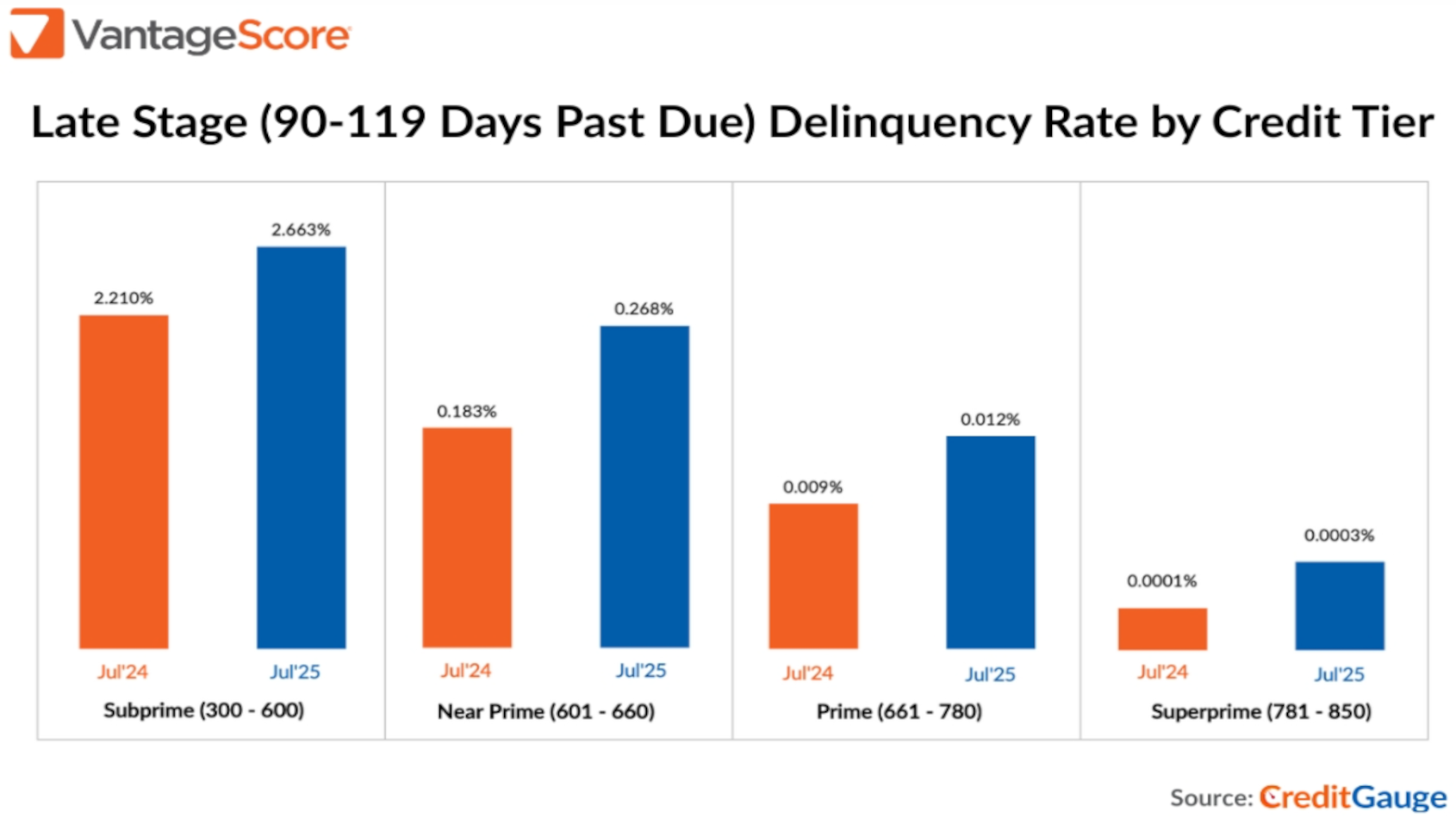

VantageScore indicated credit delinquencies more than 90 days late were up 109% year-over-year in the VantageScore super-prime segment, while prime saw a 47% increase year-over-year.

Furthermore, the average VantageScore 4.0 credit score dropped by one point to 701 reflecting the decrease in creditworthiness for the average consumer.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

VantageScore’s subprime tier grew by 0.6 points from 18.1% to 18.7% between July 2023 and July of this year, swelling the ranks of consumers more likely to face repayment challenges.

Conversely, analysts added the VantageScore prime tier shrunk by 1.4% over the same period.

“Consumers in the highest VantageScore credit tiers are showing increased signs of credit stress on a year-over-year basis,” said Susan Fahy, executive vice president and chief digital officer at VantageScore.

“We’re also seeing a marked divergence in secured versus unsecured lending. Balances are increasing for auto loans and mortgages, while new credit originations are down,” Fahy continued in a news release. “Sustained inflation for car and house prices is driving higher balances in these credit categories.”

Analysts added more insight via the video available below.