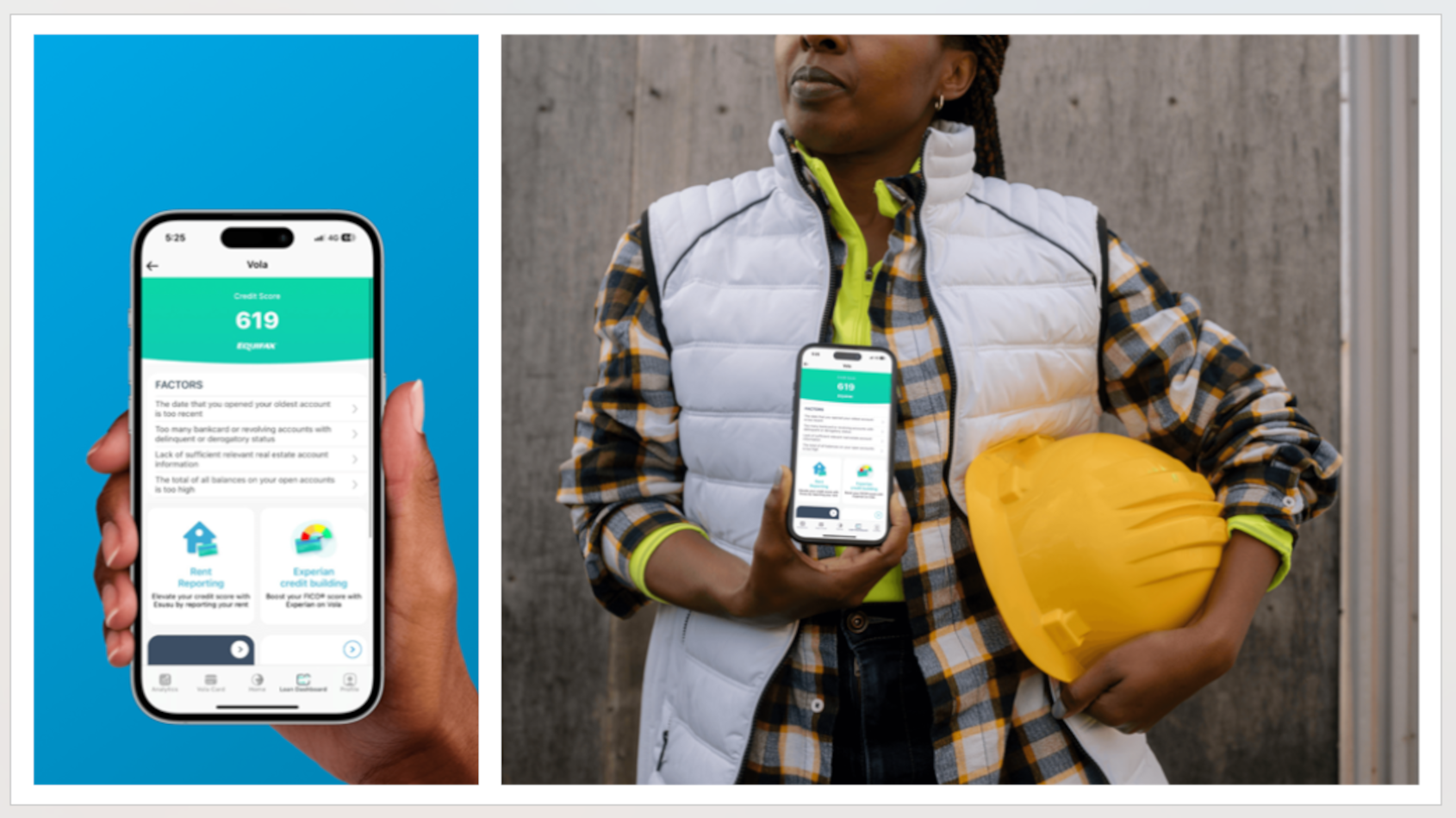

Vola CreditMap aimed at helping consumers handle debt & increase credit scores

Images courtesy of Vola Finance.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Coinciding with the Federal Reserve Bank of New York tabulating that total consumer debt surpassed $18 trillion during the second quarter, personal financial management platform Vola Finance rolled out a new loan management dashboard designed to help consumers take control of personal debt and increase their credit scores.

According to a news release, the Vola CreditMap can provide a centralized, intuitive platform to manage everything from credit cards and student loans to rent and utility reporting.

Key features of Vola CreditMap include:

—Centralized view of all active loans, including student, auto, credit card, and more

—Real-time alerts for upcoming payments and opportunities to boost credit

—Custom insights based on payment behavior and evolving credit bureau policies

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Rent and utility tracking for inclusion in credit scoring, where eligible

The company highlighted that more than 30,000 users have been using CreditMap in beta to gain deeper insight into their finances and credit health, and on average, users are managing five active loans.

To date, the company supports more than 6,000 banks and credit unions, and partners with banks and fintech solutions like Mastercard and FIS to help power Vola’s platform.

CreditMap can aggregate verified loan data directly from credit bureaus and financial institutions via Method Financial and can optimize repayment schedules to lower users’ total cost of debt.

Through its partnership with Esusu, Vola also can provide credit-building features like alerts and rent reporting that can count toward users’ credit scores.

“We believe that building strong credit shouldn’t feel like a mystery. Vola CreditMap goes beyond simply showing users their credit score, we break down the specific factors influencing it and provide personalized guidance based on where they are in their financial journey,” Vola Finance CEO Tushar Bagamane said.

“Whether it’s understanding credit utilization or identifying opportunities to improve their score, we’re giving users real, actionable insights. With our growing library of financial literacy tools built directly into the dashboard, we’re equipping them with the knowledge to make smarter decisions every step of the way,” Bagamane went on to say.

The tool can be found on Vola Finance website or via its app from the Apple App Store or Google Play for Android users.