AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Automotive Intelligence Award Honoree: Patrick Manzi of NADA

Our conversations with the 2026 Automotive Intelligence Award winners continue with Patrick Manzi, who is the chief economist at the National Automobile Dealers Association. Manzi , who got his first subscription to Car and Driver in his early teens, talks ... Listen Here

Friday, Mar. 6, 2026, 07:55 PM

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

NCM & WOCAN Spotlight Emerging Dealership Leader

Ashley Cavazos, who is president of the Women of Color Automotive Network and a consultant, instructor and 20 group moderator at NCM Associates, joins the show, along with Colby Sturdivant, new-car manager at Freedom Honda Sumter in South Carolina. WOCAN ... Listen Here

Wednesday, Mar. 4, 2026, 07:35 PM

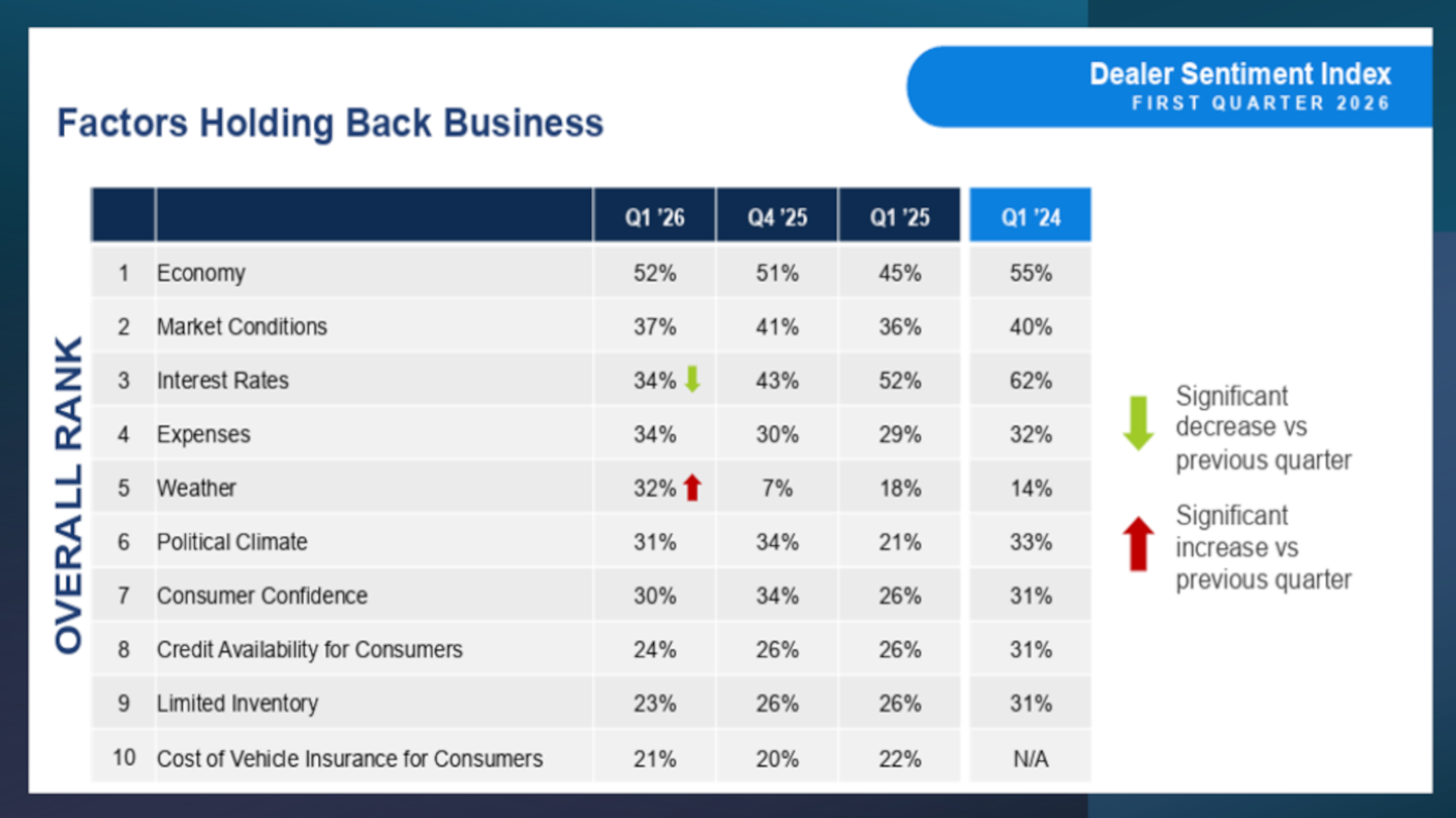

Already the top factor holding back dealership business, potential economic headwinds build

Monday, Mar. 9, 2026, 10:53 AM

Nick Zulovich, Senior Editor

The survey generating findings for the Q1 2026 Cox Automotive Dealer Sentiment Index was conducted from Jan. 28 to Feb. 10. Responses from 1,031 participants, including 532 franchised and 499 independent dealers, showed the economy remained the top factor holding ... [Read More]

Assurant adds another location offering training on Reynolds docuPAD eContracting system

Wednesday, Mar. 4, 2026, 11:33 AM

SubPrime Auto Finance News Staff

F&I managers looking to polish their skills using the Reynolds and Reynolds docuPAD eContracting system can take advantage of an exclusive program now offered at the Automotive Training Academy by Assurant in Atlanta. Assurant expanded access for automotive professionals beyond ... [Read More]

Vervent expands relationship with Quanta Credit Services to handle Tricolor portfolio

Wednesday, Mar. 4, 2026, 11:32 AM

SubPrime Auto Finance News Staff

Vervent got some help with its successor servicing responsibilities for the majority of Tricolor Holdings’ approximately 100,000 subprime auto loans by announcing an expanded partnership with Quanta Credit Services on Tuesday. Vervent began taking on successor servicing chores last fall ... [Read More]

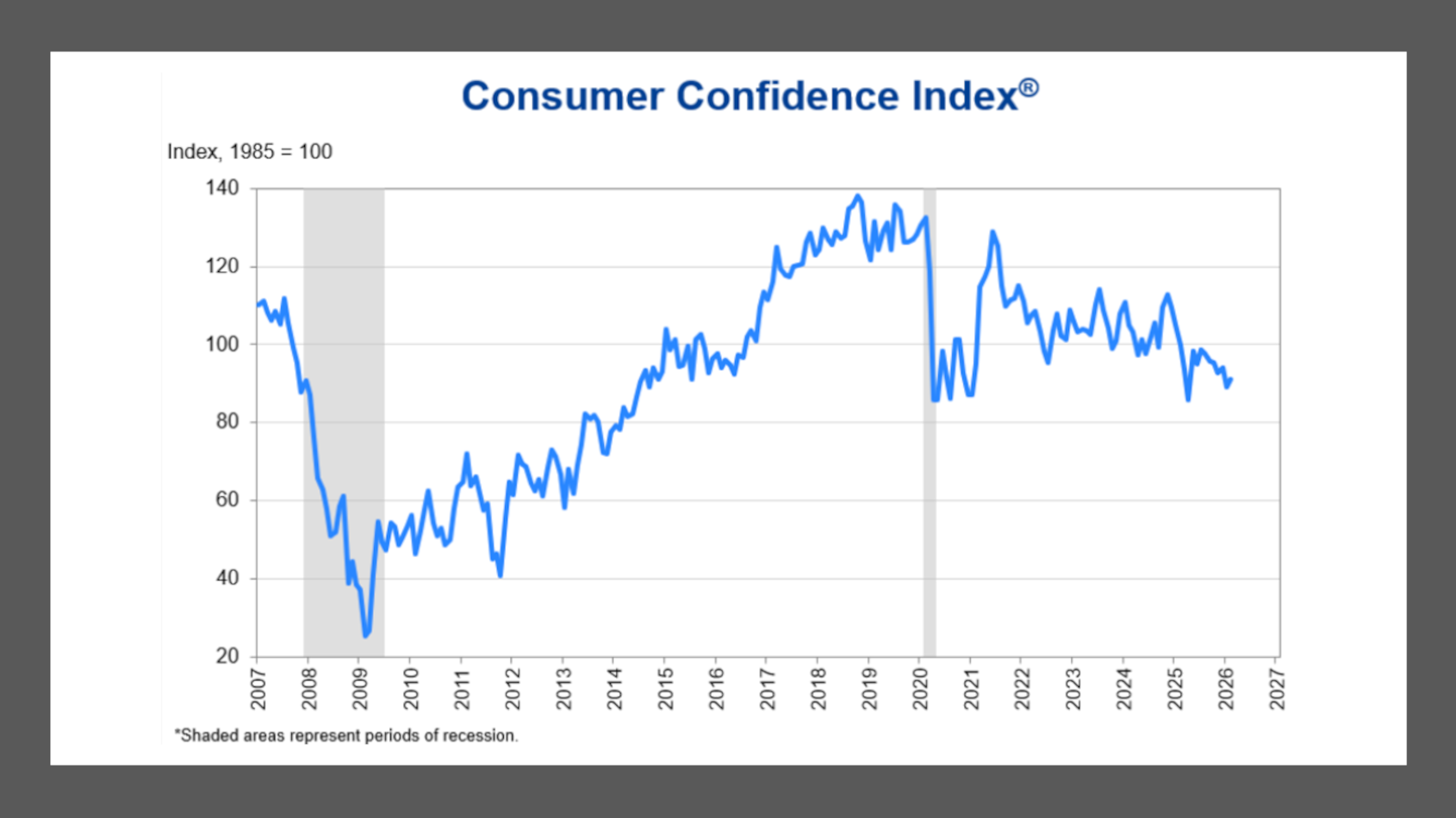

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

SubPrime Auto Finance News Staff

How consumers are really doing and feeling nowadays varies significantly depending on which measurement you are viewing. Confidence is up, but so is stress. While the Conference Board’s Consumer Confidence Index increased in February, the LegalShield Consumer Stress Legal Index ... [Read More]

Startup gives 7-step plan using tax refunds to help consumers with thin credit histories

Monday, Mar. 2, 2026, 10:33 AM

SubPrime Auto Finance News Staff

A startup dedicated to building a more inclusive credit system recently released new financial guidance tailored for consumers with no or thin credit histories on what to do with their federal tax refunds. According to the third update for this ... [Read More]

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Nick Zulovich

A recently formed partnership is bringing blockchain technology to the non-prime auto finance industry, with dealerships being among the intended beneficiaries. Agora Data and Figure Technology Solutions are collaborating to launch what they claim is the first blockchain-enabled platform, bringing ... [Read More]

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

SubPrime Auto Finance News Staff

Michelle Bowman, who serves as vice chair for supervision at the Federal Reserve, testified on Thursday during a hearing in Washington, D.C., hosted by the Senate Banking Committee. How Bowman said the Federal Reserve approaches supervisory and regulatory activities of ... [Read More]

X