Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Vervent reiterates that it’s servicing Tricolor loans

Friday, Oct. 17, 2025, 10:15 AM

SubPrime Auto Finance News Staff

Social media memes and motivational merchandise are everywhere nowadays in business, sports and beyond with the simple phrase: Do your job. Vervent reiterated this week that the payment servicing company is doing that as it’s been roughly three weeks after ... [Read More]

REPAY & Emotive partner for improved automotive loan payment acceptance & management

Friday, Oct. 17, 2025, 10:15 AM

Nick Zulovich

With collecting payments in the headlines nowadays, REPAY announced a new integration with Emotive Software this week. The companies highlighted auto finance companies can now take advantage of the combined functionality of REPAY’s convenient, automation-enabling payment technology and Emotive’s comprehensive ... [Read More]

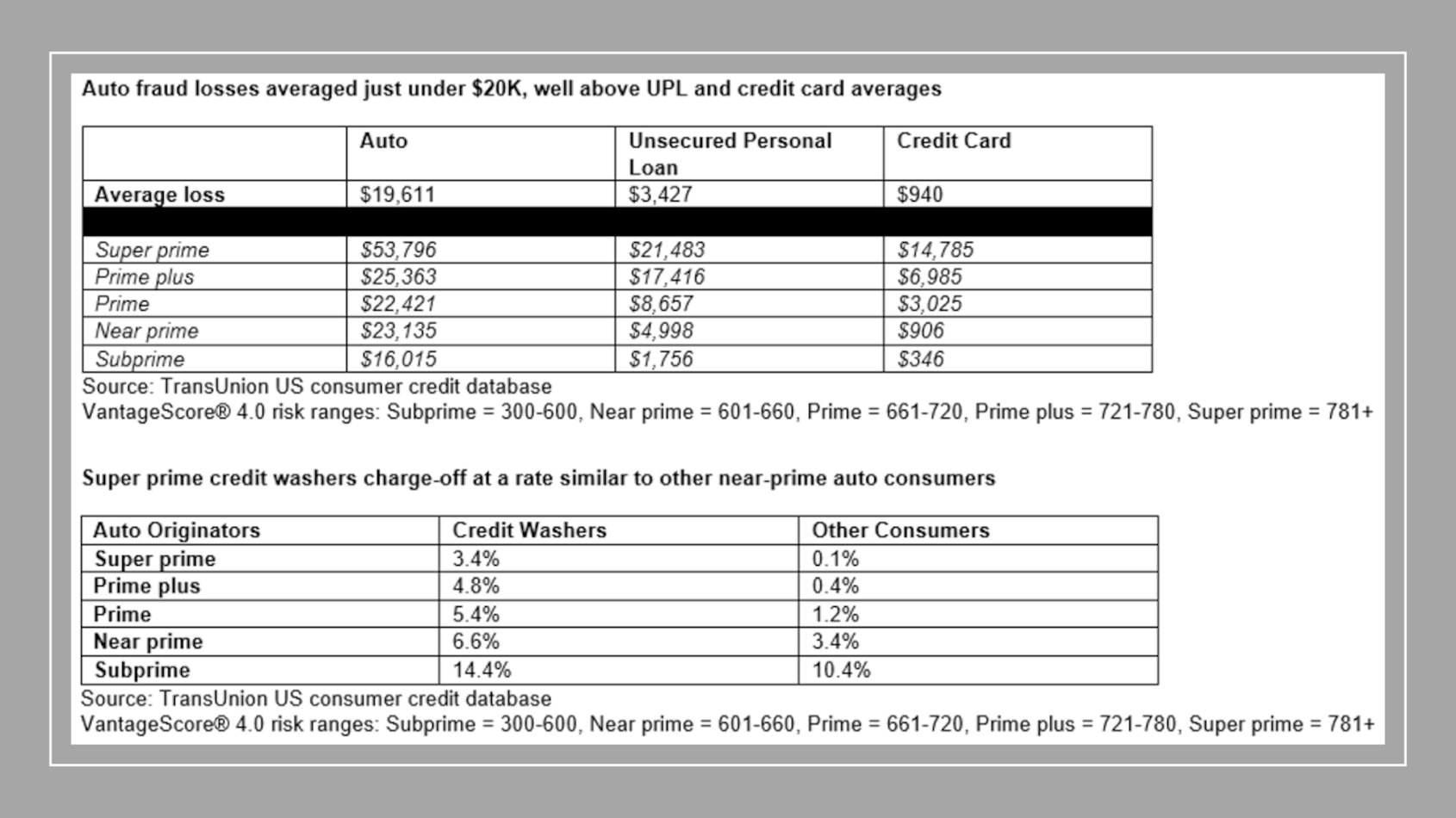

TransUnion: ‘Credit washing is a silent disruptor’

Thursday, Oct. 16, 2025, 11:18 AM

Nick Zulovich

Washing your car, your dishes, even yourself, seems like a positive and prudent experience. However, credit washing — especially in auto finance — is making quite a mess for lenders, according to new analysis from TransUnion on Thursday. TransUnion said ... [Read More]

Sixth Street to acquire Global Lending Services

Wednesday, Oct. 15, 2025, 04:15 PM

SubPrime Auto Finance News Staff

Evidently the investment world isn’t completely sour on subprime auto financing despite what’s transpired in the industry segment recently. On Wednesday afternoon, Global Lending Services (GLS) announced it has entered into a definitive agreement to be acquired by Sixth Street, ... [Read More]

DRN, MVTRAC & SCM make multiple moves to improve positions with lenders & repo agents

Wednesday, Oct. 15, 2025, 03:15 PM

SubPrime Auto Finance News Staff

DRN, MVTRAC and Secure Collateral Management (SCM) made multiple moves recently to enhance their services to auto-finance companies and their relationships with repossession agents. First, DRN and Loanbridge formed a partnership, as Loanbridge data is now integrated into DRN’s monitoring, ... [Read More]

Agora Data and DealerCenter to deploy nationwide integration

Wednesday, Oct. 15, 2025, 12:07 PM

SubPrime Auto Finance News Staff

On Tuesday, Agora Data teamed up with DealerCenter to form a strategic partnership designed to empower dealers with enhanced tools and resources to obtain capital, streamline operations, and grow their businesses. According to a news release, more than 20,000 dealers ... [Read More]

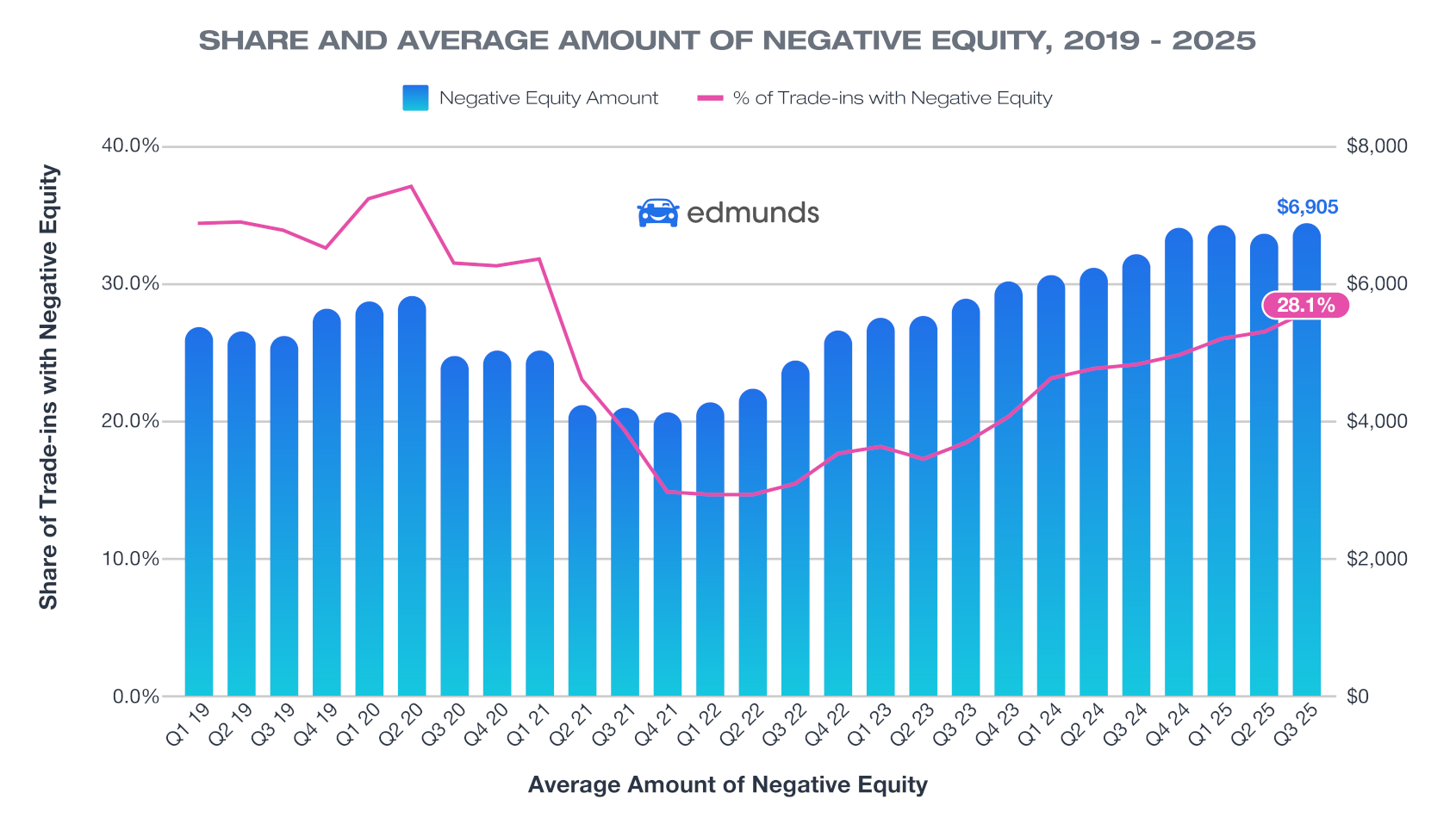

Edmunds spots 3 new records connected to negative equity in Q3

Wednesday, Oct. 15, 2025, 12:06 PM

SubPrime Auto Finance News Staff

The newest auto-finance data Edmunds released on Wednesday focused specifically on new-vehicle purchases and excluded used. But it still showed the conundrum lenders are facing nowadays associated with average negative equity, which climbed to an all-time high in the third ... [Read More]

As delinquency continues to rise, consumers’ view on buying vehicles deteriorates, too

Tuesday, Oct. 14, 2025, 10:21 AM

Nick Zulovich, Senior Editor

Signals about what happens before and after a vehicle is delivered and financed aren’t so rosy. Cox Automotive chief economist Jonathan Smoke pointed out that the initial October reading of consumer sentiment from the University of Michigan showed, “Consumers’ views ... [Read More]

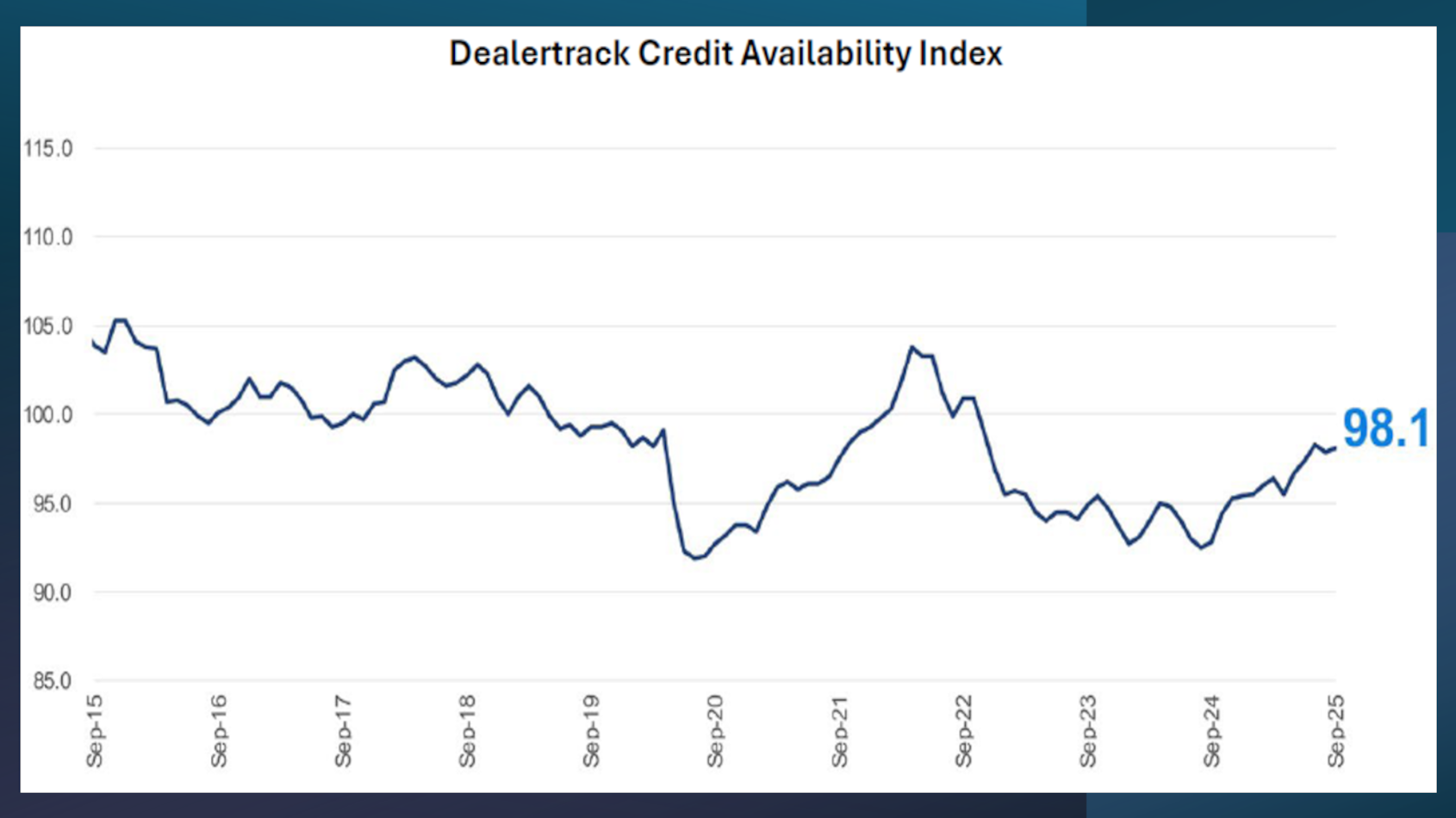

Auto credit availability improves slightly again in September

Monday, Oct. 13, 2025, 11:52 AM

SubPrime Auto Finance News Staff

Perhaps because of automotive market and general economic turbulence, there might be some tightening of underwriting by finance companies. The Dealertrack Credit Availability Index showed that development has yet to come based on Cox Automotive data gathered in September. The ... [Read More]

More than 6 investors push $50M Series B funding into Yendo to grow beyond vehicle-secured credit card

Friday, Oct. 10, 2025, 10:04 AM

SubPrime Auto Finance News Staff

Loans connected with vehicle titles aren’t new. But Yendo announced a $50 million Series B funding round on Thursday to fuel its efforts to grow as a company that claims to be behind the first-ever vehicle-secured credit card. According to ... [Read More]

X