Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Top 10 states where rates on auto financing are rising most

Thursday, Oct. 9, 2025, 11:46 AM

SubPrime Auto Finance News Staff

For individuals residing in Wyoming, they’re having to “cowboy up” for their auto financing, according to new research shared on Thursday by WalletHub. WalletHub recently reported average interest rates on auto loans aren’t rising evenly across the country. To identify ... [Read More]

Bell & Williams taps RISC for compliance monitoring

Wednesday, Oct. 8, 2025, 01:27 PM

SubPrime Auto Finance News Staff

According to a post on social media, Bell & Williams Associates has selected Recovery Industry Services Co. (RISC) as its exclusive partner for third-party recovery agent compliance monitoring. In a move that was effective Oct. 1, RISC will manage all ... [Read More]

Carputty launches Flexloan in partnership with Westlake to reach more non-prime consumers

Wednesday, Oct. 8, 2025, 11:28 AM

SubPrime Auto Finance News Staff

On Tuesday, Carputty announced the launch of Flexloan, a new product that the fintech company said “significantly expands” the namesake’s addressable market. In partnership with Westlake Direct, a division of Westlake Financial, Carputty has introduced Flexloan, which is a product ... [Read More]

Experts from Davis+Gilbert and McDonald Hopkins offer more analysis of Tricolor bankruptcy impact

Wednesday, Oct. 8, 2025, 11:27 AM

Nick Zulovich, Senior Editor

Experts are still trying to project how the dramatic bankruptcy filing by Tricolor Holdings is going to impact subprime auto finance for the remainder of the year and beyond. Legal practitioners from Davis+Gilbert and McDonald Hopkins each recently offered perspectives, ... [Read More]

AFSA urges CFPB to rescind larger participants rule for vehicle finance

Monday, Oct. 6, 2025, 11:58 AM

SubPrime Auto Finance News Staff

American Financial Services Association general counsel Philip Bohi recently submitted a comment letter in response to the Consumer Financial Protection Bureau’s advance notice of proposed rulemaking (ANPR) on supervision of vehicle finance companies. AFSA recapped that the CFPB is allowed ... [Read More]

PODCAST: Cox Automotive’s Andy Mayers on opportunity in subprime & elsewhere in auto finance

Friday, Oct. 3, 2025, 10:52 AM

SubPrime Auto Finance News Staff

Andy Mayers sees opportunity in subprime and other parts of auto finance. The associate vice president of business operations for retail solutions with Cox Automotive explained his reasons during this episode of the Auto Remarketing Podcast. Mayers also mentioned another ... [Read More]

4 components of Protective Asset Protection’s revamped appearance coverage

Friday, Oct. 3, 2025, 10:51 AM

SubPrime Auto Finance News Staff

Sometimes a vehicle’s paint needs a touchup. That’s what Protective Asset Protection did with one of its F&I offerings. This week, Protection Asset Protection refreshed its paint and fabric product, which is now called Appearance Protection The company highlighted this ... [Read More]

Arra Finance moves into next stage of business growth with new credit from Goldman Sachs

Friday, Oct. 3, 2025, 10:50 AM

SubPrime Auto Finance News Staff

While reiterating that it has finalized its acquisition of the auto finance division of Crescent Bank, Arra Finance also announced this week that it has increased its funding capital sources. With the completion of these key business developments, Arra Finance ... [Read More]

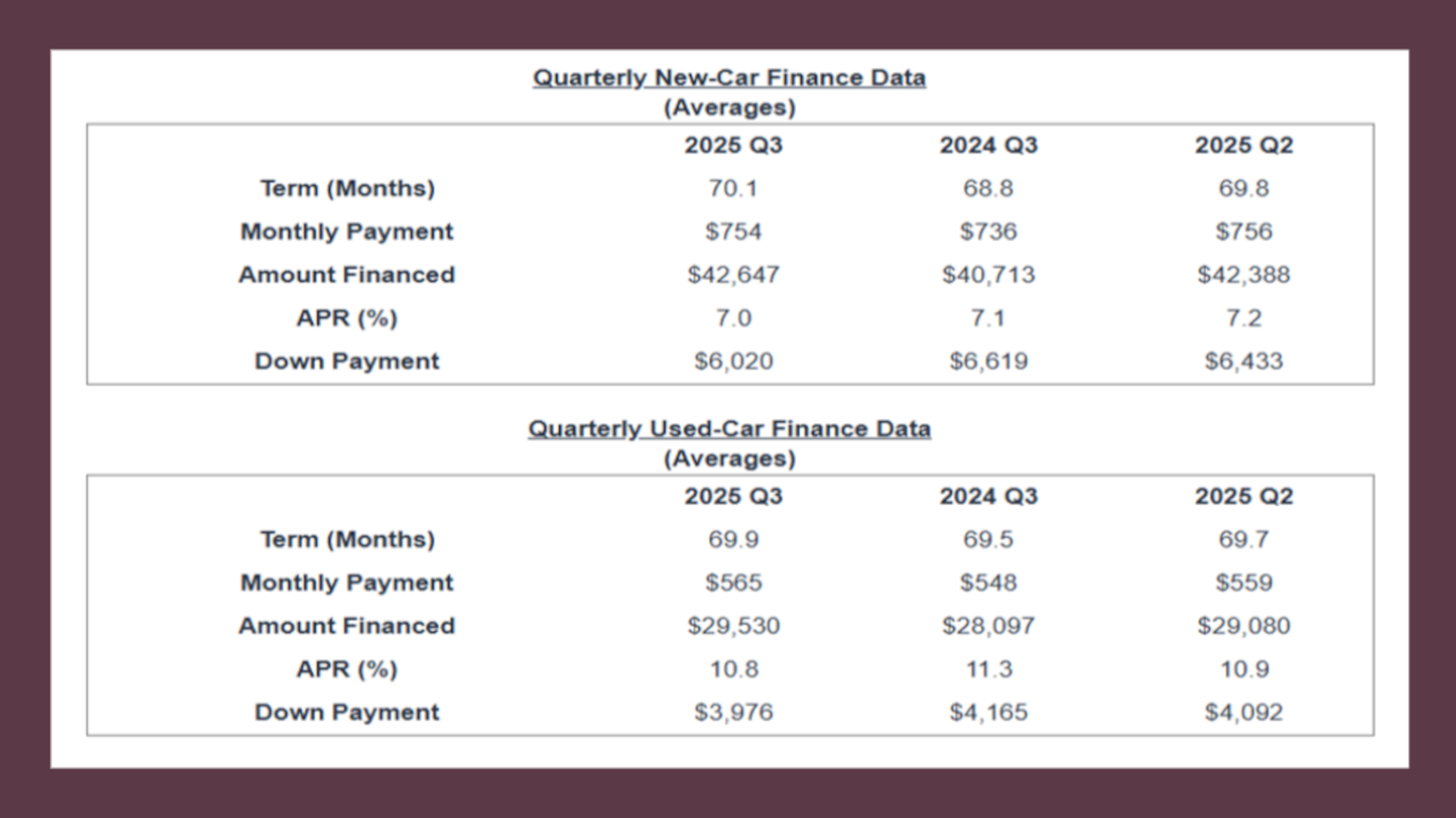

Edmunds: Used-car buyers committing to $1,000 monthly payments at new record

Thursday, Oct. 2, 2025, 10:07 AM

SubPrime Auto Finance News Staff

Edmunds reported the number of consumers who committed to a monthly payment of $1,000 or more when financing a used or new vehicle during the third quarter continues to be high, with a new record surfacing among used vehicles. According ... [Read More]

Cornerstone Advisors research on what subprime & near-prime consumers want from banks & credit unions

Wednesday, Oct. 1, 2025, 11:41 AM

SubPrime Auto Finance News Staff

New research from Cornerstone Advisors showed a path that could benefit banks and credit unions and consumers with subprime or near-prime credit scores. The provider of business and technology consulting services for banks, credit unions, and fintech firms estimated that ... [Read More]

X