Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

JM Family installs permanent CFO

Wednesday, Feb. 2, 2022, 04:12 PM

SubPrime Auto Finance News Staff

JM Family Enterprises tapped Eric Gebhard to be the company’s interim chief financial officer last May. On Wednesday, an executive Gebhard helped to recruit became the company’s permanent CFO. Taking on this role as well as holding the title of ... [Read More]

LAUNCHER.SOLUTIONS & VoltSwitch partner to speed funding

Wednesday, Feb. 2, 2022, 04:10 PM

SubPrime Auto Finance News Staff

LAUNCHER.SOLUTIONS said Tuesday that it has completed its integration with VoltSwitch GPS’s Vehicle Tracking platform. The technology provider specializing in originations explained that this integration can provide finance companies with a faster and more seamless funding experience for deals with ... [Read More]

Another Westlake division sets records in 2021

Tuesday, Feb. 1, 2022, 05:33 PM

SubPrime Auto Finance News Staff

As one subsidiary of Westlake Technology Holdings posted records in the vehicle leasing space last year, another of its subsidiaries that specializes in shared cash flow auto lending generated new company records in 2021, too. According to a news release, ... [Read More]

Solera to add Spireon to automotive technology portfolio

Tuesday, Feb. 1, 2022, 05:20 PM

SubPrime Auto Finance News Staff

Spireon is likely familiar to both finance companies as well as fleet operators that use its services to track vehicles. According to a news release, Spireon now is on a path to have new ownership by the end of the ... [Read More]

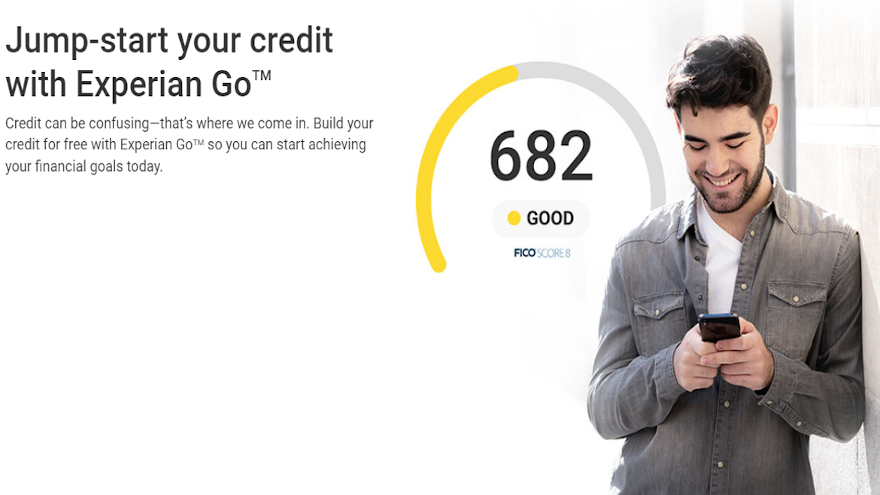

Experian expands credit-building tools for consumers

Monday, Jan. 31, 2022, 04:56 PM

SubPrime Auto Finance News Staff

Another initiative to help finance companies cater to consumers with little or no credit backgrounds recently surfaced; this time from Experian. In what the company said is meant to further financial inclusion across the United States, Experian launched what it ... [Read More]

Florida dealer group involved in credit-building program dubbed ‘Grow & Drive’

Friday, Jan. 28, 2022, 04:31 PM

SubPrime Auto Finance News Staff

A Florida-based group that owns and operates five franchised stores in the Sunshine State as well as Georgia and South Carolina is the first dealer group in the U.S. to work with Grow Credit, which is a financial inclusion platform ... [Read More]

CFPB turns attention to what it calls ‘junk fees’

Thursday, Jan. 27, 2022, 03:50 PM

Nick Zulovich, Senior Editor

The Consumer Financial Protection Bureau (CFPB) launched an initiative on Wednesday in connection with what the federal regulator called “exploitative junk fees” charged by banks and financial companies. The CFPB said through a news release that it’s making this request ... [Read More]

Former DealerSocket exec now COO at VisionMenu

Wednesday, Jan. 26, 2022, 04:42 PM

SubPrime Auto Finance News Staff

VisionMenu welcomed a new chief operating officer this week. Taking on the position for the F&I software provider is Steven Meeker, who arrives as VisionMenu said it’s experiencing rapid growth that prompted the expansion of its executive team to meet ... [Read More]

CreditMiner & TransUnion partner to fight synthetic fraud

Wednesday, Jan. 26, 2022, 04:38 PM

SubPrime Auto Finance News Staff

CreditMiner and TransUnion are working together in an attempt to keep fraud from infecting dealerships. The companies announced a new partnership this week that enables them to offer the automotive industry cutting-edge fraud prevention technologies via their API capabilities. CreditMiner ... [Read More]

ARA looking for unity during ‘another year of turbulence’

Wednesday, Jan. 26, 2022, 04:35 PM

SubPrime Auto Finance News Staff

American Recovery Association president Dave Kennedy directly opened a message to repossession agents, finance companies, forwarders and other service providers by saying: “This year is going to be another year of turbulence in our industry.” While auto defaults have risen ... [Read More]

X