A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Portfolio names new VP of sales and marketing

Wednesday, Dec. 1, 2021, 03:52 PM

SubPrime Auto Finance News Staff

An executive who was part of a company that Portfolio acquired last year now is in a crucial management position. Portfolio named Chad Millspaugh as vice president of sales and marketing, effective immediately. The F&I product provider highlighted that Millspaugh’s ... [Read More]

Following sale close, Exeter expands origination program

Wednesday, Dec. 1, 2021, 03:49 PM

SubPrime Auto Finance News Staff

Exeter Finance is closing the year with a pair of notable developments announced on Tuesday. The finance company that specializes in subprime paper said it will extend its underwriting reach into the near-prime credit spectrum, effective immediately. Focused on non-prime ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

PODCAST: Allied Solutions outlines notable goals for 2022

Wednesday, Dec. 1, 2021, 03:46 PM

SubPrime Auto Finance News Staff

Since Used Car Week took place with less than 60 days remaining in the year, two leading executives from Allied Solutions outlined their own professional goals for 2022 and also what the company is looking to accomplish during the next ... [Read More]

PODCAST: Assessing diversity, equity & inclusion with PDP Group’s Deshaun Sheppard

Tuesday, Nov. 30, 2021, 02:51 PM

SubPrime Auto Finance News Staff

Along with being the “excellence of titling execution,” PDP Group account executive Deshaun Sheppard also serves as the diversity, equity and inclusion committee chair for the company that provides title administration solutions for finance companies and other parts of the ... [Read More]

GWC Warranty chooses Wrench as vehicle repair partner

Monday, Nov. 29, 2021, 03:41 PM

SubPrime Auto Finance News Staff

GWC Warranty finalized a relationship on Monday that might make its F&I solutions for used vehicles more appealing for dealership customers, especially ones who prefer at-home or at-work vehicle repairs. GWC Warranty selected Wrench as a new preferred facility repair ... [Read More]

RateGenius: Average refinance rate drops to lowest point of 2021

Monday, Nov. 29, 2021, 03:39 PM

SubPrime Auto Finance News Staff

While consumers with the poor credit profiles didn’t benefit quite as much, RateGenius highlighted through its latest Auto Refinance Rate Report that October contained the lowest average refinancing rate so far this year. [Read More]

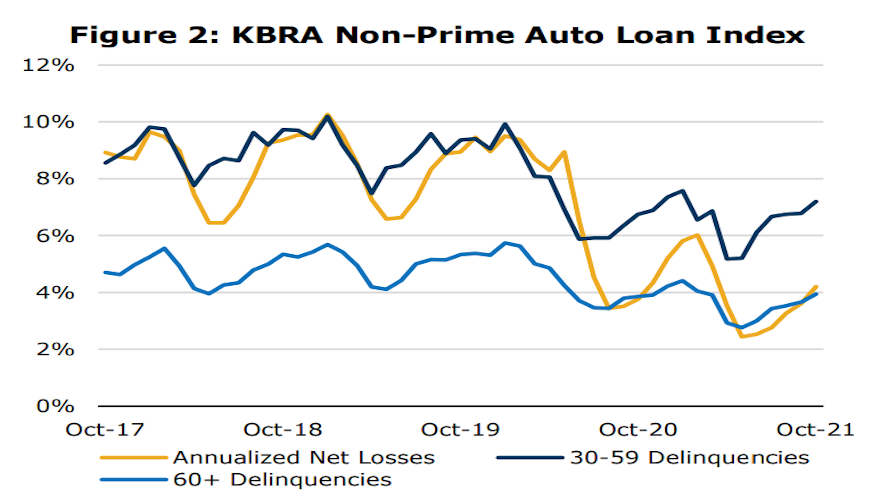

KBRA and S&P Global Ratings review latest payment performances

Tuesday, Nov. 23, 2021, 04:08 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) and S&P Global Ratings each shared their latest observations of contract performance based on metrics collected through the auto ABS market. Analysts at both firms spotted similar patterns. Beginning with S&P Global Ratings, the firm ... [Read More]

IAA & Fastlane partner to streamline total loss claims settlements

Monday, Nov. 22, 2021, 04:37 PM

SubPrime Auto Finance News Staff

IAA and Fastlane now are working together to process financed vehicles that are damaged and declared total losses. The digital marketplace connecting vehicle buyers and sellers and process automation technology company are collaborating to leverage FastLane’s LossExpress solution, a secure ... [Read More]

MLA-driven interest rate cap proposal surfaces again on Capitol Hill

Monday, Nov. 22, 2021, 04:34 PM

SubPrime Auto Finance News Staff

What at least one industry expert cautioned about potentially happening — the proliferation of an Illinois regulation connected with the Military Lending Act (MLA) — is gaining federal momentum again on Capitol Hill. Last week, the American Financial Services Association ... [Read More]

COMMENTARY: How the pandemic altered the F&I product makeup for thousands of dealers

Friday, Nov. 12, 2021, 02:59 PM

Travis Wools, Protective Asset Protection

The industry has seen more than its fair share of changes since the beginning of 2020. With much of the country on lockdown early in the pandemic, dealers were forced to expedite their digital retailing operations, enabling consumers to not ... [Read More]

X