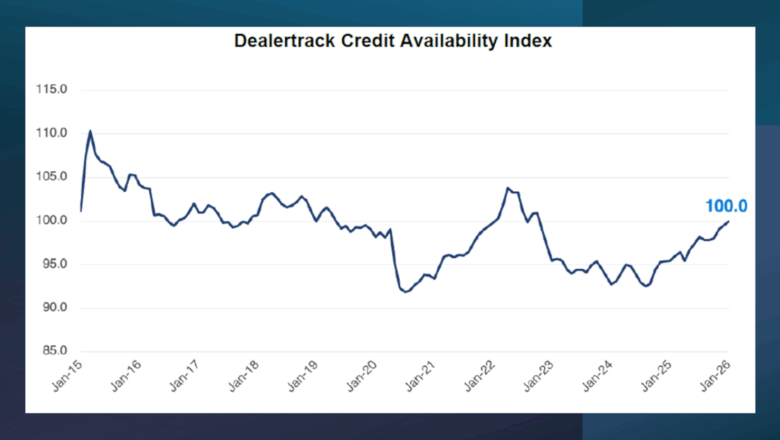

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

Voting closes on President’s Day for 10 industry awards to be given at NARS 2026

Wednesday, Feb. 11, 2026, 01:00 PM

Labor scene still murky, creating potential headwind for automotive

Wednesday, Feb. 11, 2026, 10:38 AM

Alistair Weaver on Edmunds Top Rated Awards

Edmunds editor-in-chief Alistair Weaver joins the Auto Remarketing Podcast from the NADA Show 2026 expo hall, where he talks with Cherokee Media Group senior editor Joe Overby about the Edmunds Top Rated finalists at the convention, how dealers can use ... Listen Here

Thursday, Feb. 12, 2026, 05:41 PM

2025 Used Car Week Hall of Fame induction ceremony

This episode of the Auto Remarketing Podcast takes listeners back to the 2025 Used Car Week Hall of Fame induction ceremony. Hear Jerry Kroshus, Becky Igo and Kathy Ruble share their reaction to being the next three executives who were ... Listen Here

Monday, Feb. 9, 2026, 09:42 PM

Perspectives from 2025 Women in Auto Finance honorees

Episodes of the Auto Remarketing Podcast originating from Used Car Week 2025 continue with this panel discussion of Women in Auto Finance honorees, presented by Primeritus Financial Services. The honorees discussed their career trajectories, the current state of the industry ... Listen Here

Monday, Feb. 9, 2026, 03:08 PM

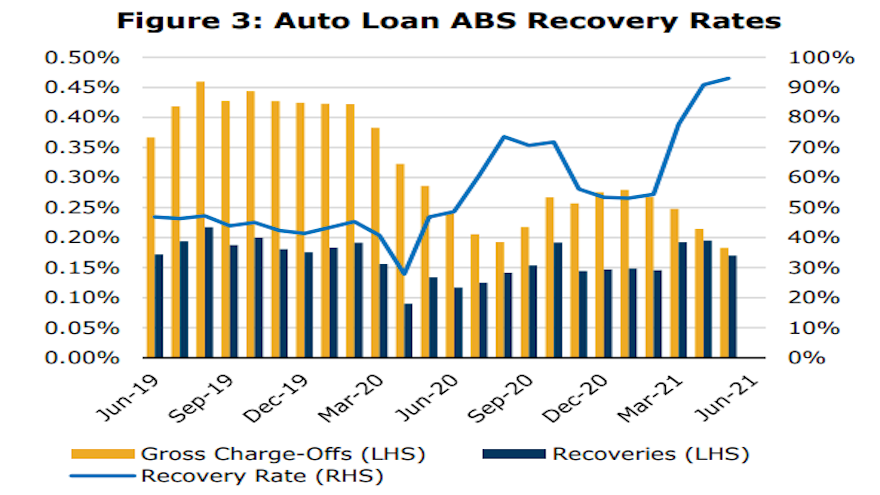

KBRA forecasts softening recovery rates as used-vehicle prices dip

Wednesday, Aug. 11, 2021, 03:56 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) released new research on Tuesday that analyzed the impacts of “skyrocketing” used-vehicle prices on auto finance credit performance metrics, as well as discusses future implications as the economy marches toward a return to pre-pandemic norms. [Read More]

TransUnion pinpoints how high credit scores could jump if rent payments are integrated

Tuesday, Aug. 10, 2021, 02:16 PM

SubPrime Auto Finance News Staff

TransUnion sees consumers who rent where they live as constituting as much as half of the individuals who possess non-prime or lower credit profiles; if they even have a credit score at all. Credit bureau analysts see that if rent ... [Read More]

House members consider new resources to help FTC

Monday, Aug. 9, 2021, 02:24 PM

SubPrime Auto Finance News Staff

The Subcommittee on Consumer Protection and Commerce of the U.S. House Committee on Energy and Commerce recently conducted a hearing on how best to modernize the Federal Trade Commission. With all five current commissioners participating, the subcommittee deliberated 16 proposals ... [Read More]

US adds 943K jobs in July, triggering ‘large’ drop in unemployment rate

Friday, Aug. 6, 2021, 03:30 PM

SubPrime Auto Finance News Staff

No doubt a key component to having a healthy auto-finance portfolio is the contract holders being gainfully employed. The U.S. Bureau of Labor Statistics shared some positive news on that front on Friday. The Labor Department reported that nonfarm payroll ... [Read More]

Nicholas Financial watches momentum build in Q1 of 2022 fiscal year

Thursday, Aug. 5, 2021, 03:21 PM

SubPrime Auto Finance News Staff

While the pandemic has hindered face-to-face contact in many ways, Nicholas Financial reiterated that its branch-model system and how the subprime finance company interacts with dealers and consumers again helped its quarterly performance. Nicholas reported figures from the first quarter ... [Read More]

CFPB pushes forward with November effective date for debt collection rules

Wednesday, Aug. 4, 2021, 07:19 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) decided debt collection firms are ready to abide by new rules. Last week, the bureau announced that two final rules issued under the Fair Debt Collection Practices Act (FDCPA) will take effect as planned ... [Read More]

PODCAST: Cindy Allen of StoneEagle F&I on dealers’ journey to improved profits

Wednesday, Aug. 4, 2021, 03:49 PM

SubPrime Auto Finance News Staff

StoneEagle F&I chief executive officer Cindy Allen made her first appearance on the Auto Remarketing Podcast to recap the journey dealerships have made through the pandemic to generate notable profits via their finance offices. Allen also touched on how dealers ... [Read More]

Credit Acceptance keeping underwriting strategy intact despite softer Q2 originations

Tuesday, Aug. 3, 2021, 02:22 PM

Nick Zulovich, Senior Editor

Even though Credit Acceptance watched its second-quarter origination volume drop by 28.7%, leadership of the subprime auto finance company is committed to maintaining its underwriting strategy, which played a role in it generating healthy income gains. Last week, Credit Acceptance ... [Read More]

AUL uses dealer & consumer feedback to compile 5 tips to help make F&I better

Monday, Aug. 2, 2021, 01:00 AM

SubPrime Auto Finance News Staff

With seven months of 2021 already completed, AUL Corp. senior vice president of strategic product development Jason Garner identified five key F&I tips to help dealerships and finance companies be even more successful during the remainder of the year. Garner ... [Read More]

Credit Acceptance, Wise F&I honored for great workplaces

Monday, Aug. 2, 2021, 12:58 AM

SubPrime Auto Finance News Staff

Credit Acceptance Corp. and Wise F&I each have received accolades for how great their workplaces are. For Credit Acceptance, the finance company that specializes in subprime auto financing now has claimed six accolades so far this year, with the most ... [Read More]

X