A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

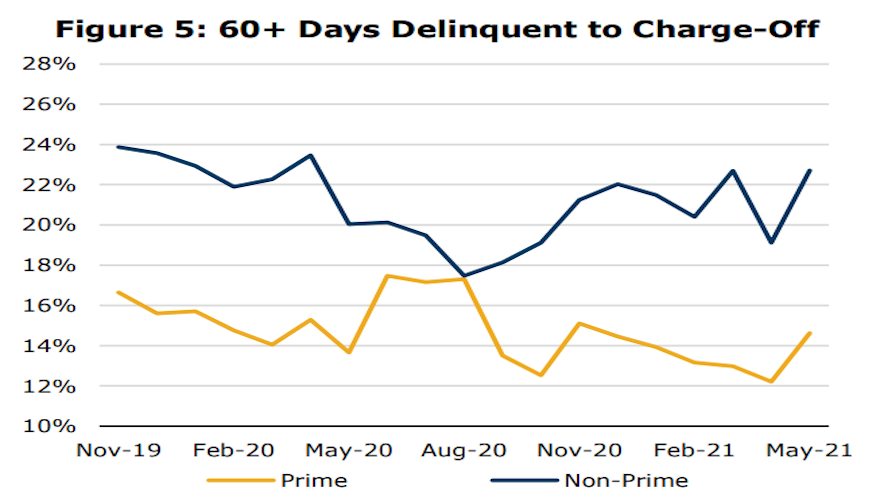

KBRA: Impact of federal stimulus on monthly payments continues to fade

Monday, Jun. 14, 2021, 03:23 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) highlighted how much federal stimulus money provided a positive bounce for maintaining monthly payments. And according to the firm’s newest report, that bounce is losing its momentum, but the overall market still is solid as ... [Read More]

Newest Protective Asset Protection survey highlights nearly 10% growth in F&I sales

Thursday, Jun. 10, 2021, 02:58 PM

SubPrime Auto Finance News Staff

Protective Asset Protection’s latest industry survey focused on how the pandemic impacted the sales of F&I products both online and at the dealership. Protective Asset Protection commissioned the online survey during March and took the pulse of nearly 500 F&I ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Sedgwick expands auto claims division with two strategic acquisitions

Wednesday, Jun. 9, 2021, 03:47 PM

SubPrime Auto Finance News Staff

June is proving to be acquisitions month. Along with transactions involving dealer groups, auctions and digital retailing companies, Sedgwick — a leading global provider of technology-enabled risk, benefits and integrated business solutions — announced on Tuesday that it has acquired ... [Read More]

Loans & ride-sharing involved in latest CFPB settlement

Wednesday, Jun. 9, 2021, 03:36 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau now is taking its regulatory aim at loans connected with workers involved in the gig economy and ride-sharing. The CFPB recently filed a proposed settlement against Driver Loan and chief executive officer Angelo Jose Sarjeant. ... [Read More]

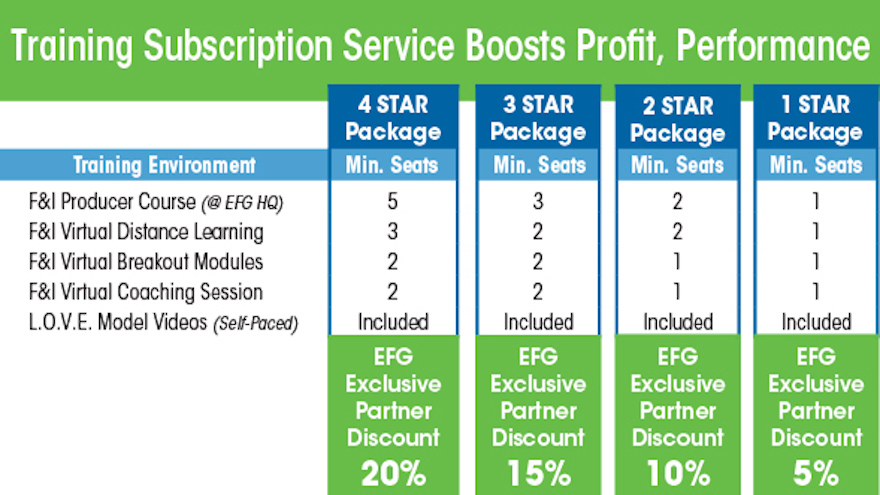

EFG highlights double-digit profit lift after new F&I training

Wednesday, Jun. 9, 2021, 03:33 PM

SubPrime Auto Finance News Staff

EFG Companies is looking to leverage lessons learned through the pandemic to help dealerships get the most out of their F&I activities. This week, EFG announced the debut of its modular training subscription service that when piloted during the pandemic, ... [Read More]

Spireon elevates internal exec to be CTO

Tuesday, Jun. 8, 2021, 02:13 PM

SubPrime Auto Finance News Staff

Spireon, a provider of risk mitigation services and other technologies to subprime auto finance companies and buy-here, pay-here dealers, announced the promotion of one of its executives to be chief technology officer. Previously Spireon’s senior vice president of engineering, the ... [Read More]

Nicholas Financial makes numerous year-over-year performance improvements

Monday, Jun. 7, 2021, 02:44 PM

SubPrime Auto Finance News Staff

Nicholas Financial made quite a year-over-year rebound when detailing its 2021 fiscal year results last week, including vital metrics like net income and delinquency rates. Despite a dip in total revenue, the subprime auto finance company reported that its net ... [Read More]

PAR chooses Hawley to be VP of sales and client relations

Friday, Jun. 4, 2021, 02:14 PM

SubPrime Auto Finance News Staff

PAR North America chose an executive with almost two decades of industry experience to be its vice president of sales and client relations. According to a news release distributed on Thursday, the business unit of KAR Global announced the appointment ... [Read More]

S&P Global Ratings spots significant net-loss improvements in both prime & subprime

Thursday, Jun. 3, 2021, 02:57 PM

SubPrime Auto Finance News Staff

Experian’s Q1 2021 State of the Automotive Finance Market report illuminated many attributes about the contracts originated during the opening quarter of the year, including how outstanding balances now are approaching $1.3 trillion as well as metrics based on geography. ... [Read More]

ARA to host free webinar with Bassford Remele about data privacy

Wednesday, Jun. 2, 2021, 07:26 PM

SubPrime Auto Finance News Staff

The American Recovery Association (ARA) is again leveraging its relationship with Bassford Remele to offer repossession agents a free webinar to discuss an important operational element — data privacy. In an attempt to help repo agents avoid a potential exposure ... [Read More]

X