Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

ANALYSIS: CFPB suffers first court loss after Seila Law

Thursday, Apr. 8, 2021, 03:05 PM

Ori Lev and James Williams, Mayer Brown

One of the great ironies of the Supreme Court’s decision in Seila Law versus CFPB, in which the Supreme Court held that the Consumer Financial Protection Bureau’s (CFPB) structure was unconstitutional, is that it effectively provided no relief to Seila ... [Read More]

ARA partners with Bassford Remele to enhance compliance offerings

Wednesday, Apr. 7, 2021, 04:17 PM

SubPrime Auto Finance News Staff

Repossession agents and other recovery industry firms certainly do not have a shortage of options for training to remain up to date on compliance and other intricacies of what might be the most complicated segment of auto financing. This week, ... [Read More]

3 parts of Ally’s latest financial education efforts for children

Wednesday, Apr. 7, 2021, 03:59 PM

SubPrime Auto Finance News Staff

Perhaps there might be fewer consumers with soft credit profiles if Ally Financial’s latest initiatives to educate children are successful. In an effort to put the “lit” in Financial Literacy Month this April, Ally announced that it will lean further ... [Read More]

Credit report availability & scrutiny grow

Tuesday, Apr. 6, 2021, 02:02 PM

SubPrime Auto Finance News Staff

The three largest credit bureaus extended free weekly availability of credit reports for another year to help consumers across the country manage their financial health during the ongoing hardship caused by COVID-19. However, the Consumer Financial Protection Bureau also is ... [Read More]

National Auto Care adds experts on fixed ops & profit participation

Monday, Apr. 5, 2021, 03:18 PM

SubPrime Auto Finance News Staff

With at least one store owner praising the actions, National Auto Care (NAC) reinforced its team with experts focused on two areas of great interest to dealerships: profits and training. The F&I product provider announced the addition of two key ... [Read More]

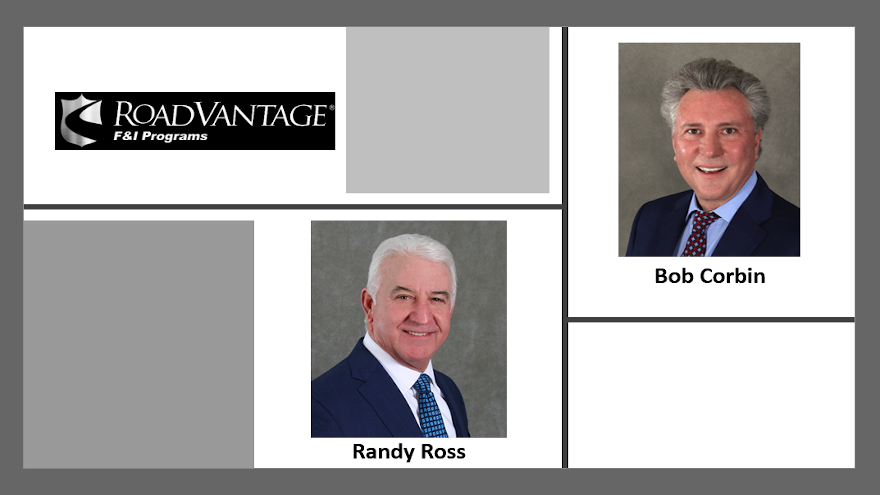

RoadVantage names new president, sales leader

Monday, Apr. 5, 2021, 03:17 PM

SubPrime Auto Finance News Staff

To achieve the flexibility required for what the F&I provider described as its next level of expansion, RoadVantage announced leadership restructuring on Friday with two executives moves. The first move made by RoadVantage was adding industry veteran Bob Corbin as ... [Read More]

PODCAST: Incoming APCO Holdings CEO on job preparation and F&I landscape

Thursday, Apr. 1, 2021, 06:31 PM

SubPrime Auto Finance News Staff

Soon after he was named the incoming chief executive officer of APCO Holdings, Scot Eisenfelder joined the Auto Remarketing Podcast to share how his previous professional stops at places such as AutoNation and Reynolds and Reynolds prepared him for the ... [Read More]

Upcoming free ARA webinar to discuss intricacies of recovery litigation

Thursday, Apr. 1, 2021, 06:26 PM

SubPrime Auto Finance News Staff

The American Recovery Association is hosting a free webinar focused on recovery litigation. Patrick Newman and Tal Bakke of Bassford Remele intend to delve into several topics, including consumer notice and waiver issues as well as contractual provisions to consider ... [Read More]

Edmunds: Q1 down payments & amount financed rise for used & new

Thursday, Apr. 1, 2021, 03:47 PM

SubPrime Auto Finance News Staff

Within hours of it being announced that CarMax was poised to acquire full ownership of the firm, Edmunds shared its first-quarter used-vehicle financing data, highlighting increases in both average down payments and total amount financed. Edmunds reported that the average ... [Read More]

Payix finalizes new payment processing agreement

Wednesday, Mar. 31, 2021, 03:51 PM

SubPrime Auto Finance News Staff

Finance company managers might do a little “happy dance” when they can establish a direct payment pipeline between the company and their contract holders. Payix finalized a payment processing agreement this week that might be worth a rhythmic reaction, too. Payix ... [Read More]

X