Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

ANALYSIS: Police arrest Florida shop owner who refused to surrender vehicle

Tuesday, Feb. 2, 2021, 04:18 PM

Dennis LeVine, Kelley Kronenberg

Despite recent changes in the lien sale laws, fraud by repair shops in south Florida continues. Some repair shops ignore the law with impunity. We believe involving the police and moving more aggressively toward fraudulent shop owners will send a ... [Read More]

Subprime notes: CPS securitization & Credit Acceptance financing, credit facility

Sunday, Jan. 31, 2021, 08:44 PM

SubPrime Auto Finance News Staff

Two long-standing subprime auto finance companies each made moves last week to give themselves the financial horsepower they need to continue originations and other business activities. After Consumer Portfolio Services launched its first securitization of 2021, Credit Acceptance announced the ... [Read More]

Interim CFPB director spells out immediate priorities

Sunday, Jan. 31, 2021, 08:37 PM

SubPrime Auto Finance News Staff

While he might be serving as director of the Consumer Financial Protection Bureau only in an interim capacity, Dave Uejio doesn’t appear to be just sitting idle as lawmakers eventually consider President Joe Biden’s nominee to be the permanent fixture ... [Read More]

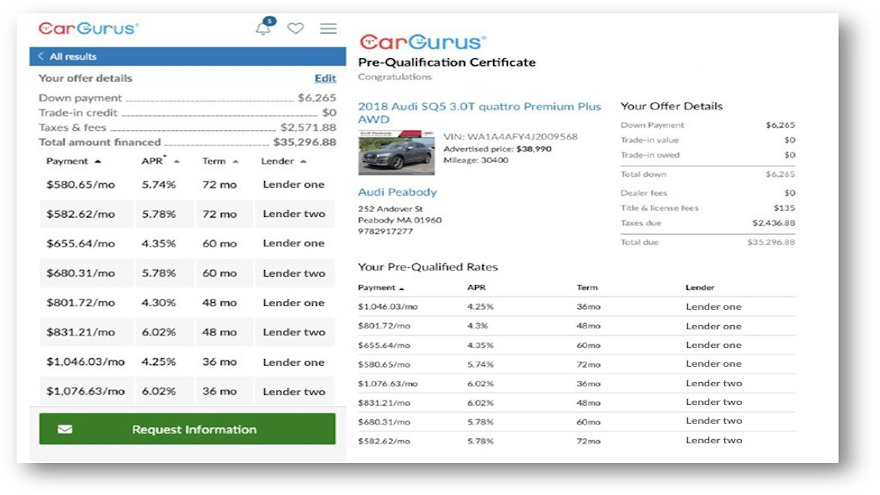

CarGurus unveils pre-qualify program through Capital One, Westlake & GLS

Friday, Jan. 29, 2021, 03:53 PM

SubPrime Auto Finance News Staff

The next development in the working relationship involving CarGurus, Capital One, Westlake Financial and Global Lending Services (GLS) surfaced on Friday. CarGurus announced a new feature that can enable shoppers to pre-qualify for financing as they search on CarGurus for ... [Read More]

Exeter begins 15th anniversary celebration with gift to 1-millionth customer

Friday, Jan. 29, 2021, 03:48 PM

SubPrime Auto Finance News Staff

Exeter Finance is in a celebratory mood and rightfully so. The non-prime auto finance company now has originated contracts with 1 million customers since it was founded in 2006. To commemorate this milestone, Exeter identified its 1-millionth customer as Raul ... [Read More]

TransUnion: Financial accommodations for struggling contract holders remain elevated

Thursday, Jan. 28, 2021, 04:03 PM

SubPrime Auto Finance News Staff

While the number of accounts TransUnion classifies as being in some form of financial hardship status closed the year below a peak registered soon after the onset of the pandemic, the level remains notably elevated and isn’t softening at the ... [Read More]

PODCAST: Skip-tracing during the COVID-19 era

Wednesday, Jan. 27, 2021, 05:17 PM

SubPrime Auto Finance News Staff

Alex “SkipGuru” Price returned to the Auto Remarketing podcast to discuss one of the subjects he knows best: skip-tracing. Now the director of training and development for LocateSmarter, a data and analytics company, Price described how the pandemic has impacted ... [Read More]

Line 5 integrates with TecAssured to aid with dealer management & marketing

Wednesday, Jan. 27, 2021, 05:15 PM

SubPrime Auto Finance News Staff

Line 5, which partners with dealers to fund vehicle protection plans at all points along the credit spectrum, recently announced an integration with the technology solutions experts at TecAssured. TecAssured is a leading provider of innovative technology solutions for the ... [Read More]

Subprime ABS shows some deterioration, reflecting seasonality & COVID-19

Wednesday, Jan. 27, 2021, 05:12 PM

SubPrime Auto Finance News Staff

Looking through the prism of the public asset-backed securities market (ABS), both S&P Global Ratings and Kroll Bond Rating Agency (KBRA) spotted deterioration when analysts examined subprime auto financing. However, the softening didn’t trigger an extreme reaction from experts, with ... [Read More]

Experian: The drop in subprime is not a cause for concern

Tuesday, Jan. 26, 2021, 02:57 PM

Melinda Zabritski, Experian

At the onset of the pandemic, many industry pundits made comparisons to the Great Recession; though we quickly learned that the similarities were few and far between. The underlying causes and economic impact of COVID-19 are vastly different from those ... [Read More]

X