Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Vanguard Dealer Services promotes 2 veteran executives

Friday, Jan. 15, 2021, 03:25 PM

SubPrime Auto Finance News Staff

Vanguard Dealer Services chief executive officer James Polley announced two promotions this week of long-time executive within the company, a firm that has provided automotive consulting, dealership training and F&I products and services since 1999. Through a news release, the ... [Read More]

Payix highlights 3 accomplishments during record-breaking year

Friday, Jan. 15, 2021, 03:23 PM

SubPrime Auto Finance News Staff

The pandemic and industry challenges created by COVID-19 didn’t slow Payix. This week, the provider of white-labeled collection tools and payment processing services to finance companies and loan servicers announced record-breaking achievements in 2020 in spite of those significant, well-known macro-economic headwinds. ... [Read More]

EFG Companies looks to future with new EVP of dealer services

Thursday, Jan. 14, 2021, 04:26 PM

SubPrime Auto Finance News Staff

With an eye toward current F&I business as well as where that segment could go after the pandemic, EFG Companies welcomed a former senior executive at Cox Automotive to its leadership team on Thursday. Scott Kaskocsak, who previously was the senior ... [Read More]

Cox Automotive predicts ‘significant’ climb in repo volume

Wednesday, Jan. 13, 2021, 04:11 PM

Nick Zulovich, Senior Editor

Cox Automotive estimates that repossession volume will make a “significant” rise in 2021 compared to last year. According to data shared during Friday’s Cox Automotive Industry Insights 2021 presentation, repossession volume in 2020 softened to the lowest level in five ... [Read More]

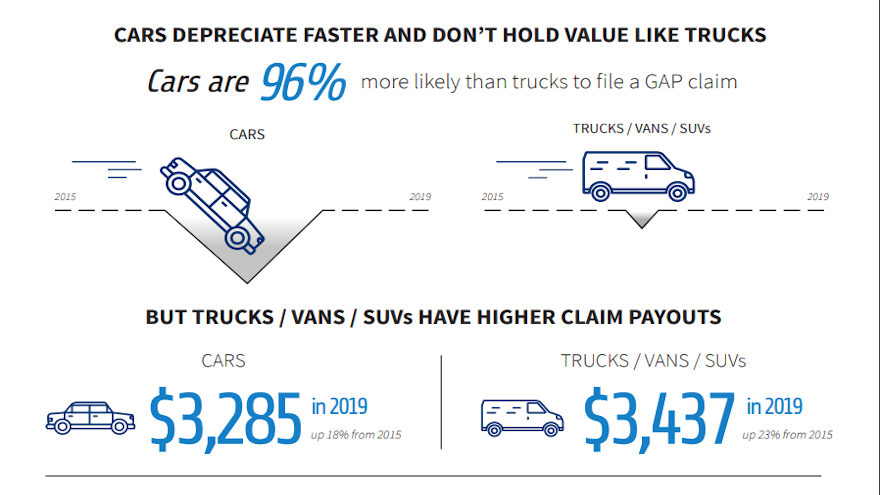

Report: Value consumers get for GAP coverage continues to rise

Wednesday, Jan. 13, 2021, 03:59 PM

SubPrime Auto Finance News Staff

A report compiled by AmTrust Financial Services showed how much value consumers are getting from F&I products, especially guaranteed asset protection (GAP) coverage as well as owners who operate their vehicles where weather and road conditions are poor. The AmTrust ... [Read More]

Remitter USA now has new CEO & VP of sales

Tuesday, Jan. 12, 2021, 04:21 PM

SubPrime Auto Finance News Staff

Remitter USA is beginning its journey through 2021 with revamped leadership, including a new chief executive officer and vice president of sales. Now overseeing the white-labeled digital communications platform powered by artificial intelligence that can help finance companies maximize revenue ... [Read More]

PPP restarts this week by SBA & Treasury

Monday, Jan. 11, 2021, 03:57 PM

SubPrime Auto Finance News Staff

This week’s restart of the Paycheck Protection Program (PPP) could benefit dealerships and finance companies directly if they choose to apply for and are granted loans through this federal program. Or PPP could provide a trickle-down effect for stores and ... [Read More]

Protective Asset Protection finalizes acquisition of Revolos to enhance F&I portfolio

Friday, Jan. 8, 2021, 02:37 PM

SubPrime Auto Finance News Staff

Here’s another update to start 2021 from our busy mergers and acquisitions desk. Protective Life Corp., overseer of Protective Asset Protection and a wholly owned U.S. subsidiary of Dai-ichi Life Holdings, announced this week it completed the transaction to acquire ... [Read More]

DriveItAway joins effort to end ‘Poverty of the Carless’

Thursday, Jan. 7, 2021, 07:29 PM

SubPrime Auto Finance News Staff

A 2019 study published in the Journal of Planning Education and Research examined how vehicle ownership and income are directly related to poverty, coining the term, “Poverty of the Carless.” During the past 60 years, the study indicated all advances ... [Read More]

Edmunds data shows widening gap between new and used financing metrics

Thursday, Jan. 7, 2021, 04:40 PM

SubPrime Auto Finance News Staff

The financing metrics Edmunds compiled and shared this week might have reinforced why more budget-limited consumers likely made a used-vehicle purchase rather than going for a new model. According to Edmunds data, December financed new-car purchases represented the highest average ... [Read More]

X