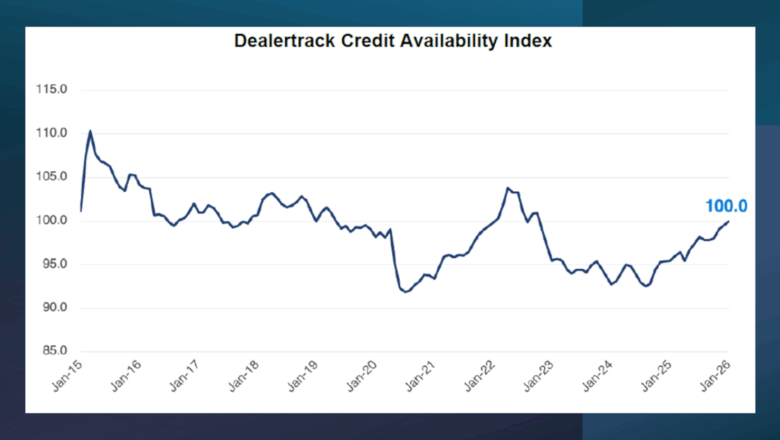

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

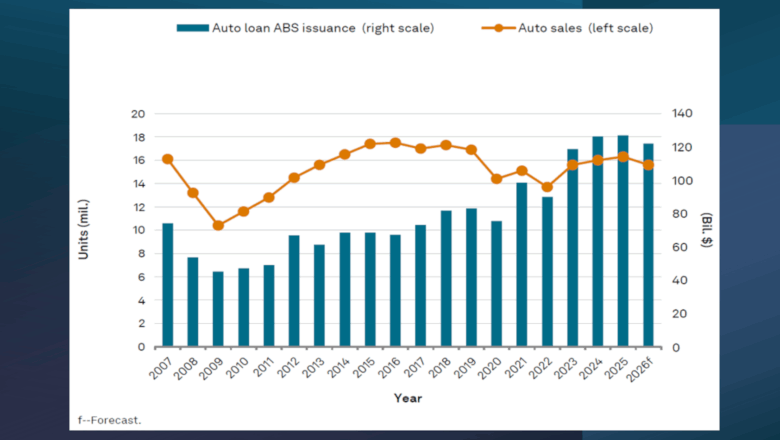

Despite ‘mixed year’ for subprime, S&P Global Ratings watches auto ABS volume generate another record in 2025

Monday, Feb. 16, 2026, 10:59 AM

Debt Awareness Week meant to be ‘wake-up call’

Tuesday, Feb. 17, 2026, 10:21 AM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Cox Automotive on the vanishing divide between wholesale & retail

Used Car Week 2025 extended the ongoing conversation about how the wholesale and retail portions of the used-car market aren’t quite as distinct as they used to be. Cherokee Media Group’s Bill Zadeits hosted a fireside chat about the subject ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

KBRA reports cyclical non-prime auto ABS performance in July

Tuesday, Aug. 13, 2019, 03:46 PM

SubPrime Auto Finance News Staff

If your non-prime portfolio performance is experiencing some cyclical turbulence this summer, it appears you might not be alone. This week, Kroll Bond Rating Agency (KBRA) released its auto loan indices for July, reporting on delinquency roll rates from asset-level ... [Read More]

Nicholas Financial back to profitability after ‘transitional year’

Monday, Aug. 12, 2019, 03:55 PM

SubPrime Auto Finance News Staff

Coming off of what the president and chief executive officer described as a “transitional year,” Nicholas Financial opened its 2020 fiscal year with positive net income after finishing its 2019 fiscal year with a loss. The publicly-traded specialty consumer finance ... [Read More]

Former Arizona dealer employee arrested on fraud charge

Monday, Aug. 12, 2019, 03:54 PM

SubPrime Auto Finance News Staff

Another fraud incident recently surfaced involving two dealerships with the investigation spreading into two states. The Arizona Department of Transportation’s Office of Inspector General made an arrest following an investigation that revealed a Nissan dealership employee stole a customer’s identity ... [Read More]

DOJ secures 10-year prison sentence for orchestrator of luxury-vehicle Ponzi scheme

Friday, Aug. 9, 2019, 02:43 PM

SubPrime Auto Finance News Staff

This week, a judge sentenced a Wisconsin man to more than 10 years in prison after the Justice Department secured an indictment earlier this summer in connection with the orchestration of a Ponzi scheme that included the fraudulent financing and ... [Read More]

SCRA violations cost NMAC nearly $3M

Thursday, Aug. 8, 2019, 08:29 PM

SubPrime Auto Finance News Staff

Repossession of 113 vehicles and violations of vehicle-lease mandates are going to cost Nissan Motor Acceptance Corp. (NMAC) nearly $3 million. The Department of Justice recently announced that NMAC has agreed to pay almost $3 million to resolve allegations that ... [Read More]

SNAAC to wind down operations, liquidate portfolio

Wednesday, Aug. 7, 2019, 08:51 PM

SubPrime Auto Finance News Staff

A little more than three years after announcing an aggressive growth plan based on a strategy to add a significant number of dealership customers throughout the United States, Security National Automotive Acceptance Company (SNAAC) is departing the auto-finance business. A ... [Read More]

Experian and Oliver Wyman roll out tool for CECL forecasting

Wednesday, Aug. 7, 2019, 03:54 PM

SubPrime Auto Finance News Staff

While mandated implementation might be delayed, Experian and Oliver Wyman are still looking to help auto finance companies meet the initial set of deadlines for the Financial Accounting Standards Board’s current expected credit loss (CECL) model via a new solution ... [Read More]

defi SOLUTIONS, Sagent Auto sign merger agreement

Tuesday, Aug. 6, 2019, 06:30 PM

SubPrime Auto Finance News Staff

At the beginning of last year, loan origination system (LOS) provider defi SOLUTIONS announced it has raised $55 million in a Series C investment from Bain Capital Ventures. Then last September, Fiserv Lending Solutions announced the launch of its new ... [Read More]

S&P Global Ratings explains why risk within prime ABS is intensifying

Tuesday, Aug. 6, 2019, 02:36 PM

SubPrime Auto Finance News Staff

Typically, the most risk in auto loan asset-backed securities (ABS) resides in the subprime space stemming from the lower credit tiers connected to that paper. Well, S&P Global Ratings is seeing risk grow within prime ABS, too. Because finance companies are ... [Read More]

DealerPeak unveils Max Desk for soft credit pulls and more

Monday, Aug. 5, 2019, 04:06 PM

SubPrime Auto Finance News Staff

With potential buyers walking into the dealerships with smartphones and the ability to find information, DealerPeak’s Desk Max is looking to equip store personnel with a tablet-driven tool to generate vital data stemming from soft credit pulls, potential monthly payment ... [Read More]

X