A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

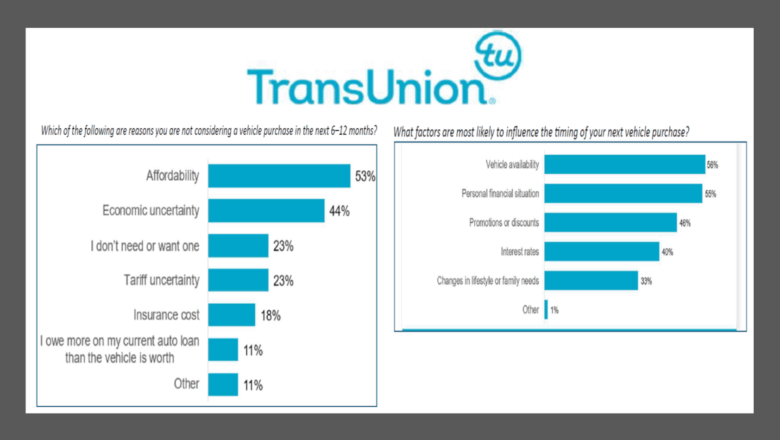

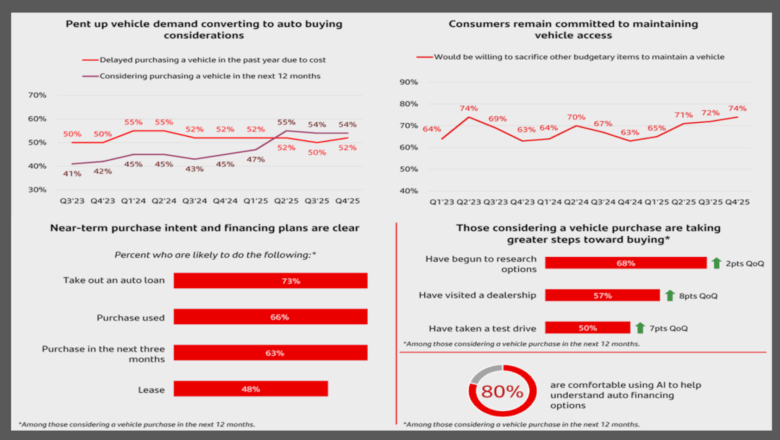

Affordability leads latest TransUnion study & AFSA event dialogue

Tuesday, Feb. 3, 2026, 10:25 AM

Santander Q4 survey shows ongoing optimism of middle-income Americans who see value of used cars

Monday, Feb. 2, 2026, 10:24 AM

Challenge Financial Services hires former UACC exec, acquires $21M portfolio

Monday, Feb. 2, 2026, 10:21 AM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Lenders, forwarders & agents discuss repo bottlenecks

In another of the Used Car Week 2025 panel discussions focused on repossessions and recoveries, AutoSquared.ai co-founder Bahador Rahimi led a conversation that included lenders, forwarders and agents. The group exchanged ideas about how industry firms can smooth the bottlenecks ... Listen Here

Wednesday, Jan. 28, 2026, 07:16 PM

KBRA sees mixed ABS movement in January

Thursday, Feb. 14, 2019, 02:25 PM

SubPrime Auto Finance News Staff

This week, Kroll Bond Rating Agency (KBRA) released its auto loan indices for of January, highlighting that credit performance was mixed across securitized auto loan pools. Analysts noted that annualized net losses in KBRA’s Prime Auto Loan Index for January ... [Read More]

SCUSA and Chrysler Capital give paperless customers a chance to win $10K

Thursday, Feb. 14, 2019, 02:23 PM

SubPrime Auto Finance News Staff

Santander Consumer USA and Chrysler Capital are set to give away some valuable paper in hopes of getting more customers in their portfolios to adopt its paperless billing option. This month, Santander Consumer USA and Chrysler Capital rolled out a ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

ARA partners with Advantage GPS to help repo agents

Wednesday, Feb. 13, 2019, 04:18 PM

SubPrime Auto Finance News Staff

With the auto finance default rate in December rising above 1 percent and new data showing more than 7 million people with a contract 90 days or more delinquent, it might be a busy year for repossessions and recoveries. To ... [Read More]

New York Fed puts 7M auto delinquencies in context

Wednesday, Feb. 13, 2019, 04:15 PM

SubPrime Auto Finance News Staff

A quartet of analysts took a deep look at the auto finance data after the Federal Reserve Bank of New York’s Center for Microeconomic Data released its Quarterly Report on household debt and credit on Tuesday. At first blush, it ... [Read More]

Prospects for 2019 tax season: ‘I don’t think we really know’

Tuesday, Feb. 12, 2019, 03:13 PM

Nick Zulovich, Senior Editor

Whether it’s during company conference calls or coffee-shop chatter, many individuals with an interest in auto financing are keeping a close watch on this tax season, especially in light of the longest government shutdown already unfolding to begin 2019 and elected ... [Read More]

Westlake closes record-breaking year with portfolio surpassing $8B

Monday, Feb. 11, 2019, 04:36 PM

SubPrime Auto Finance News Staff

All of the metrics Westlake Technology Holdings shared about its 2018 performance headed in directions that would please just about any executive team or board of directors. And the company already is aiming for double-digit improvement this year. The company ... [Read More]

Ruszkowski now president and COO of Carleton

Monday, Feb. 11, 2019, 04:34 PM

SubPrime Auto Finance News Staff

Effective immediately, Matt Ruszkowski has been named president and chief operating officer of Carleton, a provider of compliant consumer loan calculations and lending document generation software. A company news release indicated Ruszkowski will lead Carleton’s experienced executive leadership team toward ... [Read More]

AUL names Frank as manager of operations

Monday, Feb. 11, 2019, 04:32 PM

SubPrime Auto Finance News Staff

AUL Corp. recently promoted one of its managers who has been with the vehicle service contracts administrator for more than a dozen years. According to a news release, AUL president and chief executive officer Jimmy Atkinson has elevated Deonna Frank ... [Read More]

Revenue, people and compliance highlight Credit Acceptance year-end report

Friday, Feb. 8, 2019, 02:53 PM

Nick Zulovich, Senior Editor

Along with sharing an update involving investigations by state-level authorities in two locations, Credit Acceptance went through a series of year-end figures to detail its 2018 performance. And to go with data about income and originations, the subprime auto finance ... [Read More]

BB&T and SunTrust to merge in $66B stock deal

Thursday, Feb. 7, 2019, 04:07 PM

SubPrime Auto Finance News Staff

Dealerships, especially ones located in the Southeast that have business relationships with SunTrust Banks and BB&T Corp., soon will be working with just one financial institution. The banks announced on Thursday that both companies’ boards of directors have unanimously approved ... [Read More]

X