A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Oliver returns to VSC space as RoadVantage senior VP of operations

Monday, May. 21, 2018, 02:45 PM

SubPrime Auto Finance News Staff

Don Oliver went into retirement for about a year until he was recently lured back into the vehicle service contract administration business. RoadVantage, one the fastest-growing providers of F&I programs for the automotive industry, announced the addition of Oliver as ... [Read More]

Consulting firm chooses Kennedy as part of finance expansion

Monday, May. 21, 2018, 02:42 PM

SubPrime Auto Finance News Staff

National Automotive Finance Association board member Joel Kennedy leveraged his experience and expertise into a position with a consulting firm broadening its scope into consumer finance. Spinnaker Consulting Group, a national boutique professional services consultancy based in Richmond, Va., will ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Cherokee Media Group unveils launch of Auto Fin Journal

Friday, May. 18, 2018, 06:19 PM

SubPrime Auto Finance News Staff

Cherokee Media Group (CMG), publishers of Auto Remarketing and SubPrime Auto Finance News, and producers of Used Car Week, the Automotive Intelligence Summit and Auto Remarketing Canada — as well as additional leading auto industry events and media — has ... [Read More]

PointPredictive unveils Fraud Data Exchange for consortium members

Friday, May. 18, 2018, 03:27 PM

SubPrime Auto Finance News Staff

PointPredictive wants to help auto finance companies to work together to combat fraud, so the firm is deploying an extension of its collaboration endeavors. This week, PointPredictive announced the launch of Fraud Data Exchange, a new cooperative service that can ... [Read More]

TransUnion acquires iovation to boost fraud-prevention portfolio

Friday, May. 18, 2018, 03:25 PM

SubPrime Auto Finance News Staff

TransUnion is putting more resources into fraud prevention. On Friday, TransUnion said it has agreed to acquire iovation, one of the most advanced providers of device-based information in the world, strengthening its position in fraud and identity management. While financial ... [Read More]

Seasonal impact lifts March ABS performance and recoveries

Thursday, May. 17, 2018, 03:53 PM

SubPrime Auto Finance News Staff

Along with some noteworthy developments about how finance companies are striving to improve the quality of paper flowing into their portfolios, the latest monthly U.S. Auto Loan ABS tracker from S&P Global Ratings contains other elements that should delight industry ... [Read More]

Nationwide Skip Experts watches accounts and resolutions jump by using masterQueue

Wednesday, May. 16, 2018, 04:54 PM

SubPrime Auto Finance News Staff

When it comes to recoveries, double-digit improvements in certain metrics certainly are attention getters. That’s what Nationwide Skip Experts (NSE) has experienced recently. NSE deployed masterQueue, an enterprise level skip tracing software, across its organization. Since deployment of the software, ... [Read More]

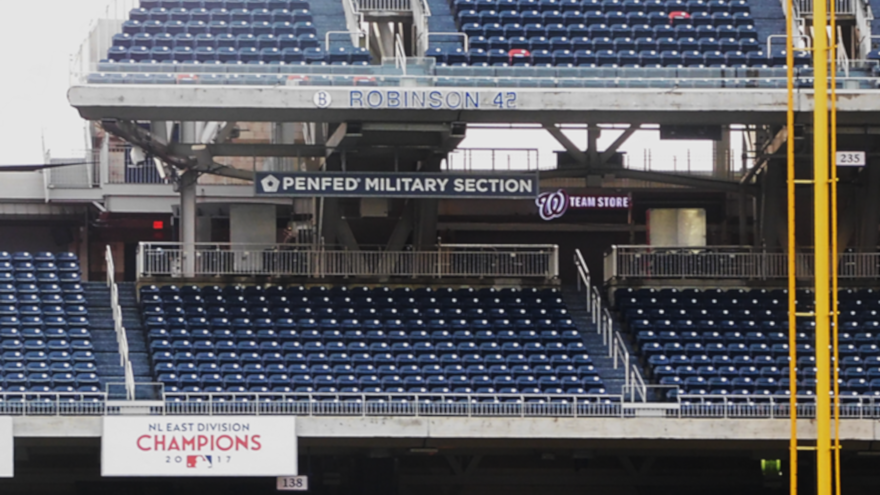

PenFed Credit Union ramps up Nationals sponsorship to salute the military

Wednesday, May. 16, 2018, 04:20 PM

SubPrime Auto Finance News Staff

The nation’s second largest federal credit union is taking servicemembers out to the ballgame. This week, PenFed Credit Union announced it has signed a unique and expansive sponsorship deal with the Washington Nationals Major League Baseball team. The new three-year ... [Read More]

Former top Exeter, AmeriCredit leaders reunite again with FinTech firm

Wednesday, May. 16, 2018, 04:14 PM

SubPrime Auto Finance News Staff

After collaborating previously at Exeter Finance and AmeriCredit, auto finance industry veterans Mark Floyd and Kenneth Wardle are teaming up again; this time to leverage what’s happening online when consumers search for financing. According to a news release sent to ... [Read More]

Credit Acceptance sees increased activity for originations and compliance

Monday, May. 14, 2018, 06:49 PM

Nick Zulovich, Senior Editor

As the subprime auto finance company’s field representatives are generating more business from their active dealer network, state and federal regulators are keeping the compliance team at Credit Acceptance busy, too. The latest filing to the Securities and Exchange Commission ... [Read More]

X