A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

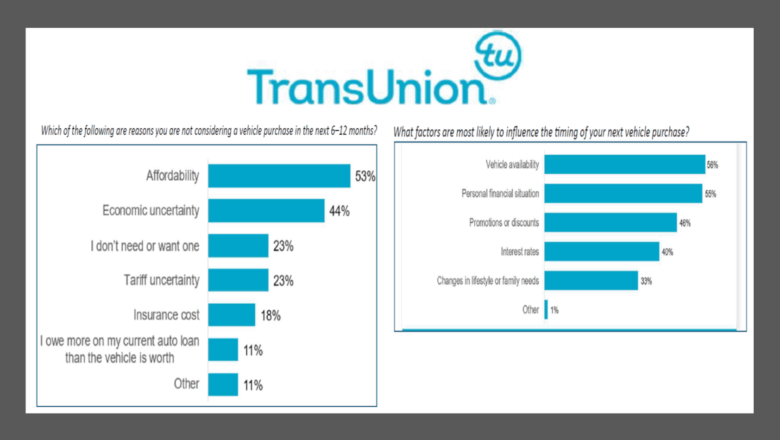

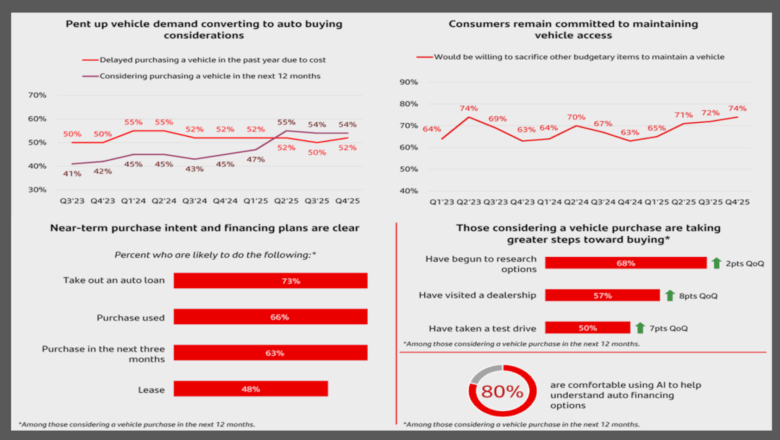

Affordability leads latest TransUnion study & AFSA event dialogue

Tuesday, Feb. 3, 2026, 10:25 AM

Santander Q4 survey shows ongoing optimism of middle-income Americans who see value of used cars

Monday, Feb. 2, 2026, 10:24 AM

Challenge Financial Services hires former UACC exec, acquires $21M portfolio

Monday, Feb. 2, 2026, 10:21 AM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Innovate Auto Finance secures $50M deal with asset management firm

Friday, Jan. 26, 2018, 03:40 PM

SubPrime Auto Finance News Staff

Investment firms continue to push funds into the auto finance space. Not long after defi SOLUTIONS landed $55 million, Innovate Auto Finance — a purchaser and servicer of automobile loan portfolios and provider of line-of-credit financing — said it has ... [Read More]

Ally pledges $750M to buy contracts from DriveTime

Wednesday, Jan. 24, 2018, 05:03 PM

SubPrime Auto Finance News Staff

DriveTime might be still searching for a new chief executive officer, but the retailer that specializes in working with consumers with soft credit now has more resources for originations. Ally Financial on Wednesday announced that it has entered into an ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

As DRN’s hotlist hits new high, recoveries top record $2B

Wednesday, Jan. 24, 2018, 02:57 PM

SubPrime Auto Finance News Staff

Digital Recognition Network (DRN) is finding plenty of work for repossession agents to do, and it’s resulting in record recoveries for auto finance companies. DRN highlighted on Tuesday that its active hotlist hit an all-time high of 360,000 license plate ... [Read More]

Enhanced workforce pushes CRIF Select to nearly $4B in originated volume

Wednesday, Jan. 24, 2018, 02:56 PM

SubPrime Auto Finance News Staff

Boosting its workforce worked out nicely for CRIF Select. CRIF Select, a division of CRIF Lending Solutions and provider of indirect auto finance partner programs, announced on Wednesday that the company surpassed $3.7 billion in funded paper volume for 2017. ... [Read More]

Darwin Automotive updates platform based on latest Military Lending Act interpretation

Tuesday, Jan. 23, 2018, 06:10 PM

SubPrime Auto Finance News Staff

F&I software provider Darwin Automotive announced on Tuesday that it has integrated smart disqualify technology into its F&I platform that can disqualify products based on Military Lending Act (MLA) qualifications. The company said this technology is incorporated into the platform ... [Read More]

FTC Act civil penalties rise based on inflation

Tuesday, Jan. 23, 2018, 04:27 PM

SubPrime Auto Finance News Staff

In combing through the Federal Register this week, the National Automobile Dealers Association found that the Federal Trade Commission recently announced increases to various civil penalties amounts within its jurisdiction to adjust for inflation. In particular, that could be associated ... [Read More]

Top 10 used brands that financed buyers stretch most to afford

Tuesday, Jan. 23, 2018, 03:37 PM

SubPrime Auto Finance News Staff

LendingTree released findings of its study on which brands buyers who secure financing are stretching the most to afford. The company acknowledged financing a vehicle is one of the more significant financial decisions Americans make, and even those who try ... [Read More]

2 newest F&I Express executives each possess 20 years of experience

Monday, Jan. 22, 2018, 03:58 PM

SubPrime Auto Finance News Staff

F&I Express recently added two executives to its company team who each possess more than 20 years professional experience. First, the company announced Gary Peek has joined the business team as chief information officer. Management highlighted that Peek will be ... [Read More]

CPS finalizes first securitization of 2018, totaling $190M

Monday, Jan. 22, 2018, 03:49 PM

SubPrime Auto Finance News Staff

Last week, Consumer Portfolio Services announced the closing of its first term securitization of 2018. Officials highlighted the transaction is CPS’ 27th senior subordinate securitization since the beginning of 2011 and the 10th consecutive securitization to receive a triple “A” ... [Read More]

defi SOLUTIONS lands $55M investment from Bain Capital Ventures

Friday, Jan. 19, 2018, 04:22 PM

SubPrime Auto Finance News Staff

The management team at defi SOLUTIONS now has a sizeable amount of resources to deploy an aggressive growth plan. On Friday, defi SOLUTIONS announced it has raised $55 million in a Series C investment from Bain Capital Ventures. Executives highlighted the ... [Read More]

X