A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

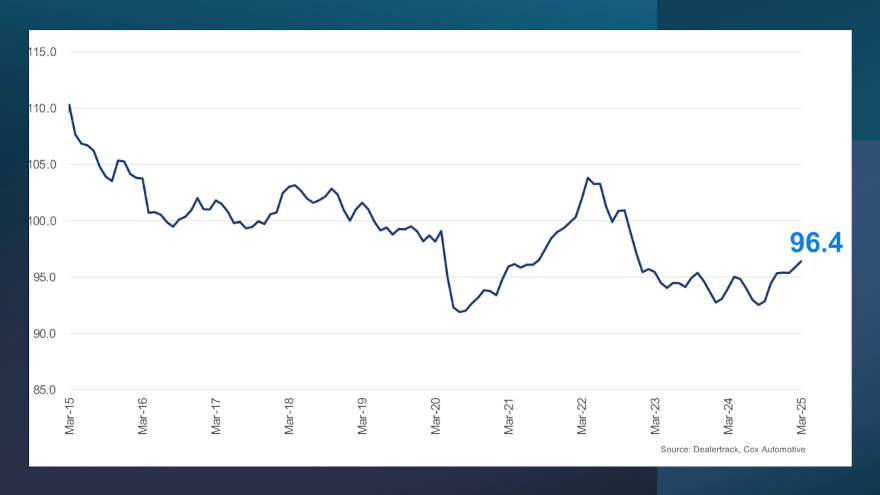

Why credit access reached highest level in 28 months

Monday, Apr. 14, 2025, 11:19 AM

SubPrime Auto Finance News Staff

Anecdotal conversations that Cherokee Media Group shared with Auto Intel Summit attendees last week generally indicated that dealers and lenders are not having too much trouble getting potential vehicle buyers the financing they need to take delivery. The newest Dealertrack ... [Read More]

Awards roundup: Accolades for Credit Acceptance, EFG & Western Funding

Friday, Apr. 11, 2025, 11:23 AM

SubPrime Auto Finance News Staff

Credit Acceptance, EFG Companies and Western Funding all announced in recent days that they received awards associated with their operations connected to auto financing. Beginning Credit Acceptance, the company specializing in subprime auto financing said it has been named one ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Veros Credit gains strategic investment from ITOCHU International

Monday, Apr. 7, 2025, 09:26 AM

SubPrime Auto Finance News Staff

With an eye toward national expansion among other growth objectives, Veros Credit on Monday announced a strategic investment from ITOCHU International, a global leader in trading and investment. According to a news release, the investment may result in ITOCHU acquiring ... [Read More]

Insight LPR joins industry conversation about contracts & more

Friday, Apr. 4, 2025, 10:33 AM

Nick Zulovich, Senior Editor

On Thursday, Insight LPR joined the recent conversation about license plate recognition technology in the repossession industry public square started by the American Recovery Association and DRN. In a letter signed by president John Nethery and sent to Cherokee Media ... [Read More]

PODCAST: More from DRN’s Jeremiah Wheeler about state of LPR

Friday, Apr. 4, 2025, 10:30 AM

SubPrime Auto Finance News Staff

DRN president Jeremiah Wheeler appeared on the Auto Remarketing Podcast this week to continue the intensifying dialogue about license plate recognition technology. Wheeler elaborated about the company’s response to assertions made by the American Recovery Association and what he hopes ... [Read More]

Edmunds: While used-financing trends remain stable, 2 records set involving new cars in Q1

Thursday, Apr. 3, 2025, 11:04 AM

SubPrime Auto Finance News Staff

If it took some extra finagling to get your contracts bought during the first quarter — especially in connection with new vehicles — the latest financing data from Edmunds might support the reasons why. While the metrics for used-car financing ... [Read More]

MBSi bolsters toolbox again with new agent invoice solution

Wednesday, Apr. 2, 2025, 01:42 PM

SubPrime Auto Finance News Staff

Within a month of rolling out a tool designed to automatically verify lienholder changes, MBSi introduced another solution aimed at improving processes associated with vehicle repossessions. MBSi highlighted that this new tool — Smart Invoicing — was designed in collaboration ... [Read More]

CalAmp relocates headquarters to streamline operations & strengthen technical hub

Wednesday, Apr. 2, 2025, 10:22 AM

SubPrime Auto Finance News Staff

Last week, CalAmp announced the relocation of its corporate headquarters from one California city to another, shifting from Irvine to Carlsbad. The technology and asset tracking company said this strategic move is designed to streamline operations and further align the ... [Read More]

VantageScore spots intensifying auto delinquency & impact from student loans

Wednesday, Apr. 2, 2025, 10:21 AM

SubPrime Auto Finance News Staff

Evidently keeping up with monthly car payments isn’t the highest priority nowadays. And experts from VantageScore see the delinquency landscape for auto finance potentially deteriorating further when some consumers again must navigate payments of student loans. Auto-loan delinquencies increased across ... [Read More]

ARA & DRN work toward smoothing concerns over LPR

Tuesday, Apr. 1, 2025, 10:57 AM

Nick Zulovich, Senior Editor

What perhaps could have festered into a messy situation involving organizations that have worked together so closely in the repossession world has smoothed over in recent days. The American Recovery Association used a white paper to explain notable operational and ... [Read More]

X